.

Buy 3 Dow Jones dividend stocks within 5% of the 52-week high.

Whether you've been investing for a while or you're just starting out, you've probably heard the advice to "buy low and sell high." After all, everyone likes a good deal. But making a decision is rarely that easy.

It can be difficult to buy stocks against the trend when the price is falling and when the red light is flashing on your screen.

Similarly, it may seem counterintuitive to buy a stock at a time when its price is at an all-time high. However, if a company is able to grow its earnings in the future, buying a good company at a high price can be a winning strategy.

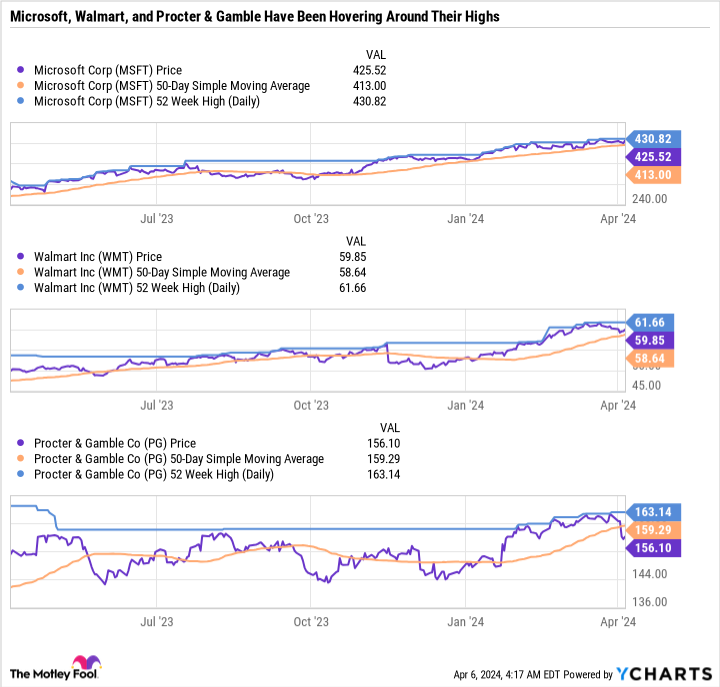

Microsoft (NASDAQ resonance code: MSFT),Wal-Mart (New York Stock Exchange: WMT)(math.) andProcter & Gamble (NYSE: PG)Shares of these companies are trading within 5% of their 52-week highs. None of these stocks are as cheap as they used to be, but there's still a lot to like about these companies as long-term investments. Here's what makes each dividend stock stand out.

This growth stock is hiding in plain sight.

For a while, some investors were skeptical that a $1 trillion U.S. company would ever emerge. But in August 2018, theApple Inc.The company has crossed this coveted threshold. And almost exactly five years ago, at the end of April 2019, Microsoft crossed the $1 trillion mark. Today, Microsoft's market capitalization is $3.16 trillion, while Apple's is $2.62 trillion. The gap in market capitalization is more thanNikola Tesla (1856-1943), Serbian inventor and engineerThe full value of the

At first glance, Microsoft's modest size compared to other companies, and the rapid rise in its stock price in recent years, might make you think it's overvalued. After all, it's a familiar, staid tech company that's been around for decades. But it's fair to say that Microsoft is a very different business than at any other time in its history.

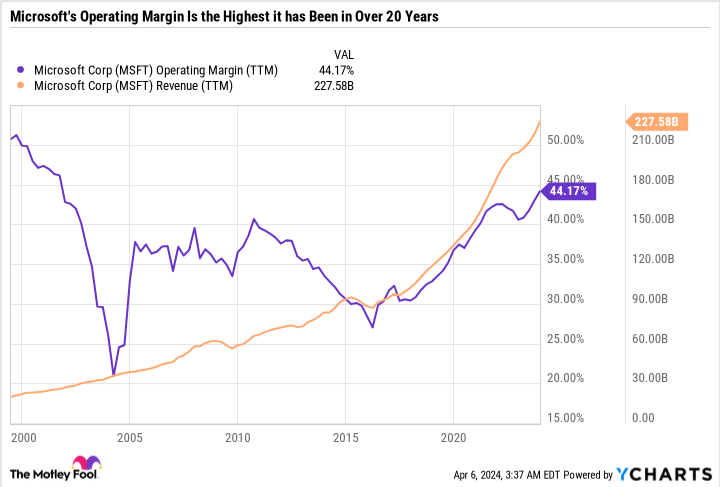

Microsoft is applying artificial intelligence (AI) to new and traditional solutions. Its cloud infrastructure business remains a juggernaut. But at the end of the day, what really matters is Microsoft's margins in relation to its sales growth. And now that Microsoft's sales and margins are both growing, it's a golden opportunity to improve its efficiency and attract Wall Street's attention.

As you can see from the chart, Microsoft's operating margins fell off a cliff during the dot-com bubble burst, and it took a few years for them to recover, surpassing 40% in the early 2010s (Microsoft Office 365 was launched in June 2011). But then Microsoft entered a period of declining margins, which rebounded largely due to the growth of Microsoft Azure.

Microsoft's Intelligent Cloud division, led by Azure, continues to grow. But here's the kicker: Microsoft is also using artificial intelligence to unlock its growth potential. Microsoft is realizing massive sales growth through a number of high-margin divisions. This growth looks sustainable - making the investment case stronger than ever.

Microsoft also purchases stock and pays out more dividends than any other U.S. company. Therefore, even with a P/E ratio as high as 38.5, Microsoft is still a good buy.

Wal-Mart stock isn't as expensive as it looks.

Wal-Mart looks like a safe, low growth, dividend paying company. With a price-to-earnings ratio of 31.3, it also looks expensive. But it doesn't matter where Wal-Mart is right now, it matters where it's going.

The analyst consensus estimates are for earnings per share (EPS) of $2.35 in fiscal 2025, $2.59 in fiscal 2026, and $1.91 in fiscal 2024. However, the company's adjusted EPS for fiscal 2024 is $2.21. Adjustments include currency exchange rates, restructuring charges, opioid legal fees and other unusual costs. As a result, the jump from FY2024 to the analysts' forecast is not significant.

Based on the FY2025 forecast, Walmart's P/E ratio is 25.5, which is much more reasonable. Coincidentally, this forward-looking forecast is the same as Wal-Mart's 10-year median P/E ratio.

Walmart is buying near its all-time highs because of its valuation. The company is also making improvements through store noodle remodels, a new design philosophy, and accelerated growth in Walmart+ delivery service.

Wal-Mart made its biggest dividend hike in over a decade, increasing by a whopping 91 TP3T to $0.83 per share per year. Although the yield is only 1.41 TP3T, Wal-Mart is the "Dividend King" of dividend increases for over 50 consecutive years. If future dividend increases are even greater, Walmart stock could become an even more meaningful source of passive income.

No matter what the market does, you can always count on this dividend king!

Procter & Gamble (P&G) has declined the most from its 52-week high and is the only stock on this list where the previous price was below its 50-day moving average.

As you can see from the chart, the 50-day moving averages of all three stocks are relatively close to their 52-week highs, suggesting that they have been hovering around their 52-week highs for some time.

Indicators such as 50-day moving averages and 200-day moving averages are good indicators of market sentiment towards a company within a specific window. For P&G, a drop below the 50-day moving average could simply be a natural correction after a big rally.

Procter & Gamble's annual gain of nearly 11% in March outpaced the Consumer Staples industry,Standard & Poor's 500 The index, evenNasdaq ResonanceIndex. The company has shown strong pricing power and growth, but not enough to justify the uptick. Even after the correction, P&G's P/E is still 26.2, but its forward P/E is 24.3.

P&G's business model is recession-proof, so its earnings have grown steadily regardless of the market cycle. It has re-purchased stock, thereby reducing its share count and increasing its earnings per share, and it enjoys high profit margins that are well above those of many of its peers. P&G has increased its dividend for 67 consecutive years, making it one of the oldest "Dividend Kings". But dividends are only one facet of its capital-recycling program, as it also spends a lot of money on buybacks and has reduced its stock count by more than 13% in the last decade.

P&G isn't cheap, but it's not worth being cheap either.

Value for money quality

Microsoft, Wal-Mart and P&G are all worth buying near all-time highs, but for different reasons.

Microsoft is a high-quality company that is accelerating its high profit growth while continuing to reward its shareholders through buybacks and dividends.

Walmart is more valuable than it looks at first glance and just increased its dividend significantly.

P&G has a high profit margin and a stable business, and has been rewarding its shareholders in a variety of ways.

All three companies are good examples of why it's worth paying for quality in the stock market, rather than trying to buy a weaker business just because the valuation is cheap.

Invest $1,000 now

It's good to listen to our analyst team when they have stock tips. After all, they've been running a newsletter for 20 years called "The New York Times".Motley Fool Stock AdvisorIt has more than tripled the market*.

They have just announced what they think investors are currently doing.-est (superlative suffix)Worth Buying10Only ...... Microsoft made the list, but there are 9 other stocks you may have overlooked.

View these 10 stocks

*Stock Advisor's Report as of April 8, 2024

Daniel Foelber does not own any of the stocks listed above. the Motley Fool holds recommendations on Apple, Microsoft, Tesla, and Wal-Mart. the Motley Fool recommends the following options: long Microsoft Jan 2026 $395 calls and short Microsoft Jan 2026 $405 calls. the Motley Fool has a disclosure policy. The Motley Fool has a disclosure policy.

Buy Now 3 Dow Jones Dividend Stocks Inside 52-Week High 5% was originally published by The Motley Fool.