.

Bank of Montreal shares 4 charts that illustrate why stock investors shouldn't be concerned about long-term interest rate hikes

-

According to Brian Belski of Bank of Montreal (BMO), investors need not worry about interest rates going higher for a long time.

-

He pointed out that stocks had historically performed well during periods of rising and higher interest rates.

-

These four charts confirm Belsky's bullish stance, even though the Fed has not signaled an imminent rate cut.

Investors are beginning to realize that the Fed may not cut rates in 2024 after Fed chief Jerome Powell's hawkish comments on Tuesday.

This contrasts sharply with expectations at the beginning of the year, when the Fed was expected to cut rates as many as seven times as deflation continued.

But a string of fiery inflation reports since January has caused Powell to pause in his pledge to cut rates this year, leading to a surge in stock market volatility.

However, Brian Belski, an investment strategist at Montreal Bank, believes the stock market should do well in a period of rising and rising interest rates.

"Our research suggests that, despite current conventional wisdom to the contrary, investors should not be concerned about rising interest rates. In fact, we have found that some of the strongest periods of S&P 500 performance over the past few decades have coincided with rising or higher interest rates," Belsky said in a note Tuesday.

Belski argues that investors have become accustomed to near-zero interest rate levels after the Great Financial Crisis of 2008, which is "absolutely not normal" and that while there will be some discomfort for investors in adjusting to higher rates, in aggregate this should be a positive backdrop for the stock market.

"Whilst we agree with the statement that 'interest rates are higher over the long term', we are less worried than investors about recent interest rate levels and trends. Current conventional wisdom seems to suggest that any kind of rise in yields is automatically bad for stocks. However, our research suggests the opposite.

According to Belsky, the economy is the reason stocks do better when interest rates are rising than when they are falling.

"Lower interest rates can reflect weaker economic growth and vice versa," Belski said.

These four charts demonstrate Belsky's point of view.

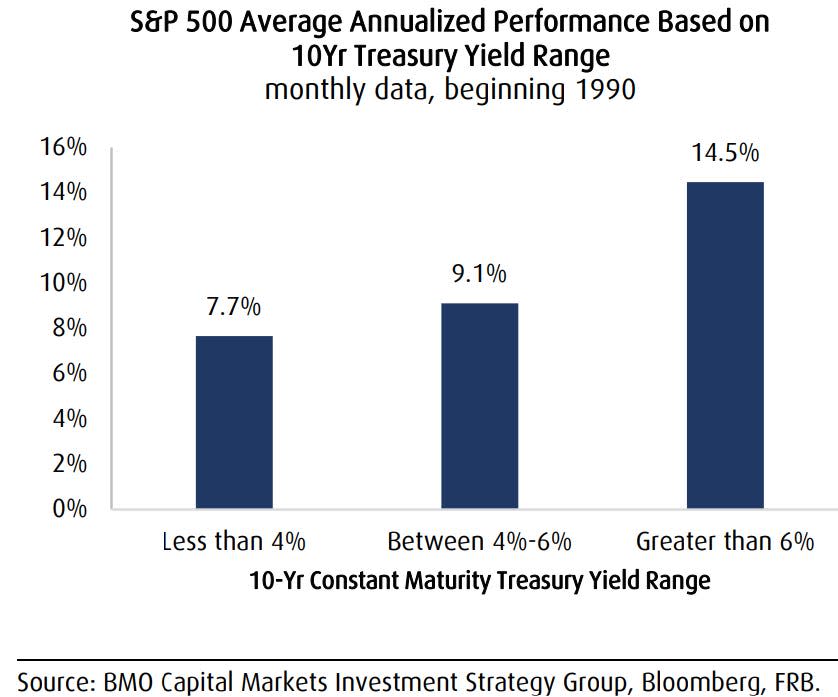

1. Historically, higher interest rates have not impacted equities

Belski emphasized that since 1990, the S&P 500 has performed higher on an annualized basis where the 10-year Treasury yield is above 6%.

Currently, the 10-year Treasury is yielding about 4.60%, while the S&P 500 is yielding 9.1%, which is much higher than the stock market's annualized yield of 7.7%, which was 7.7% when interest rates were below 4%.

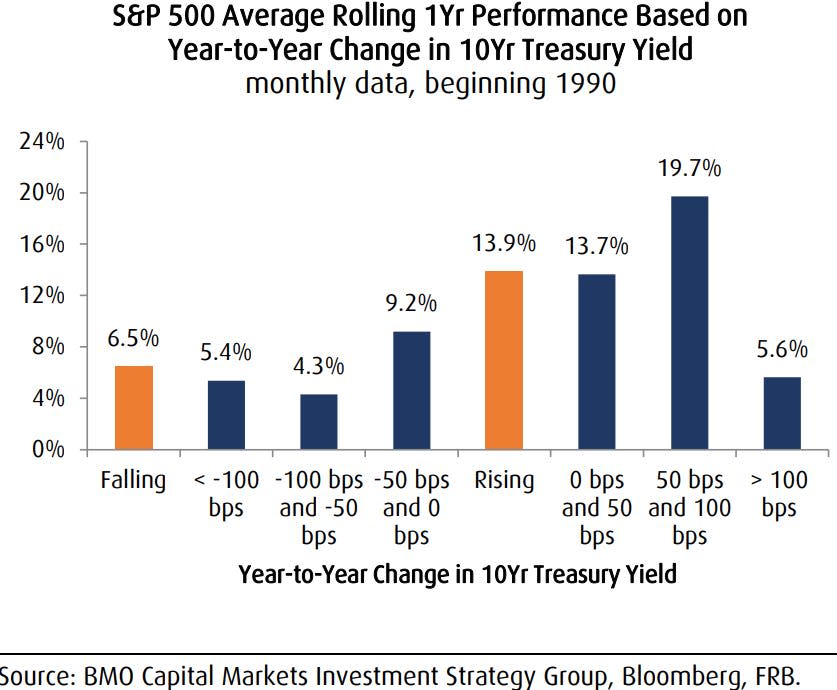

2. The S&P 500 Index performs better when interest rates are rising.

Belski analyzed the data and found that since 1990, the S&P 500 has outperformed when interest rates have risen than when rates have fallen. In fact, where rates have risen, the average rolling one-year performance of the S&P 500 has been more than double that of when rates have fallen.

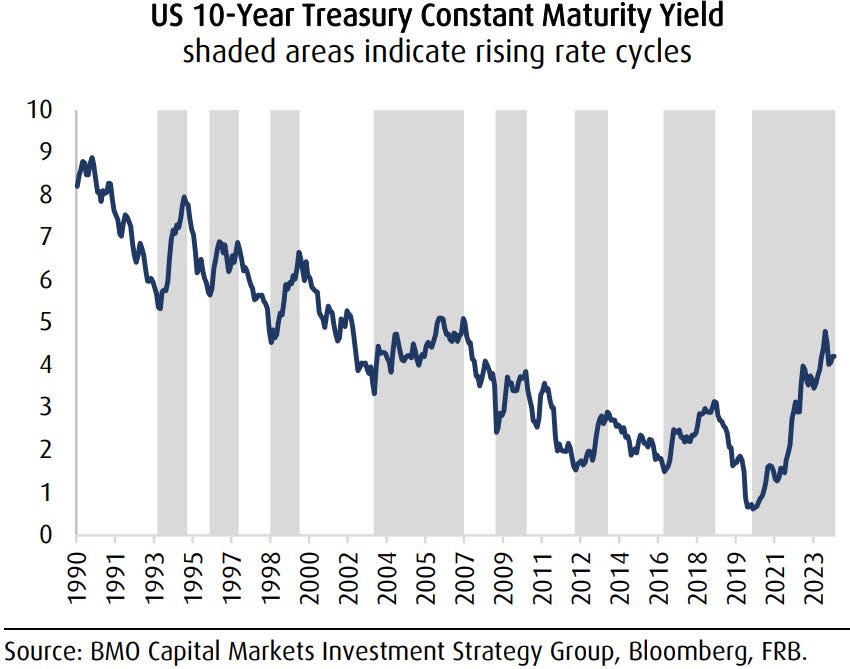

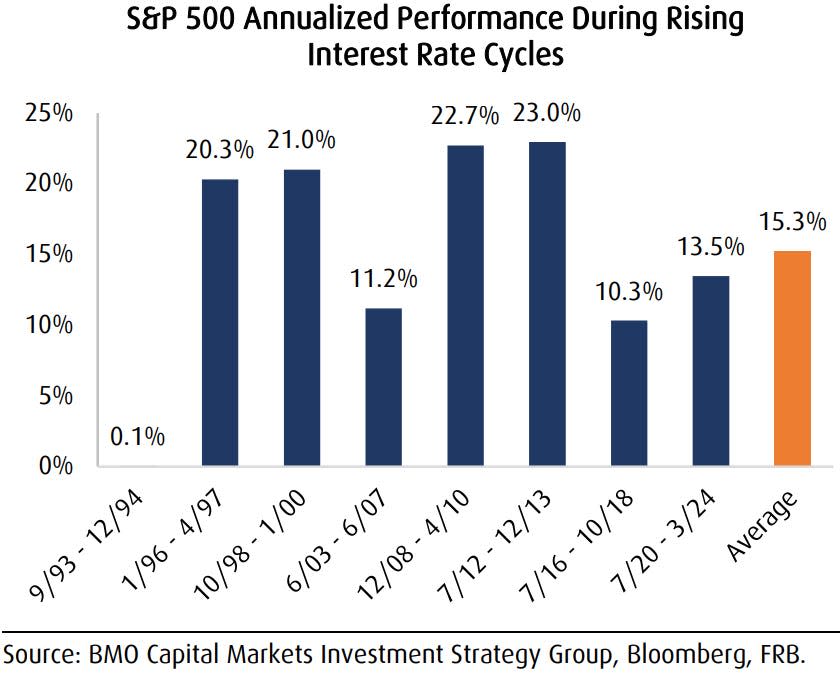

3. Since 1990, there have been eight occasions when interest rates have risen.

Since 1990, there have been eight periods of interest rate rises, and in each of these periods, stocks have performed positively.

4. Since 1990, stocks have risen every time interest rates have risen.

Belski emphasized that the S&P 500 has performed positively in all eight periods since 1990 when interest rates have risen.

Read the original article on Business Insider