.

2 Super Growth Tech Stocks to Buy in 2024 and Beyond

Last year, technology stocks were on a roll.Nasdaq Resonance 100The tech sector index has risen 48% since last April. companies across the sector have benefited from the artificial intelligence (AI) boom, which has boosted countless tech stocks.

Artificial Intelligence has the potential to boost the development of consumer products, cloud computing, 鈥眡戯, self-driving cars, machine learning and other technology industries. Last year, the AI market was close to $200 billion and is expected to grow at a compound annual growth rate of 37% by 2030.

As such, now is an excellent time to spend a larger portion of your investment portfolio on technology, with the potential for significant gains in the coming years as AI expands and touches more areas of the industry.

Here are two ultra-high-growth tech stocks to buy for 2024 and beyond.

1. Intel

Intel (NASDAQ: INTC)Since its founding over 55 years ago, the company has been a major player in the tech world. As a leading chipmaker, the company provides hardware for all areas of the industry, including customized gaming PCs,MicrosoftWindows computers,Apple Inc. (NASDAQ: AAPL)of the Mac series, Cloud Platform, and more.

But Intel has faced repeated challenges in recent years. Intel's share price has fallen about 48% in the last three years after it lost market share in the CPU market and ended its more than decade-long relationship with Apple.

As a result, the company has made significant structural adjustments to its business model, which could lead to returns in 2024 and beyond. In June of last year, Intel announced a "fundamental shift" to an in-house foundry model for its business, which it believes will result in $10 billion in savings by 2025. This change will allow Intel to use the same technology as theTaiwan Semiconductor Manufacturing Co.Similarly, the company has become a major provider of foundry capacity in North America and Europe.

In addition, Intel is moving into the AI space. in December 2023, the company debuted a line of AI chips, including the graphics processing unit (GPU) Gaudi3, designed to challenge market leaderNvidia The company also demonstrated its new Core Ultra processor and Xeon server chips, which include a neural processing unit to run artificial intelligence programs more efficiently. The company also demonstrated its new Core Ultra processor and Xeon server chips, which include a neural processing unit to run artificial intelligence programs more efficiently.

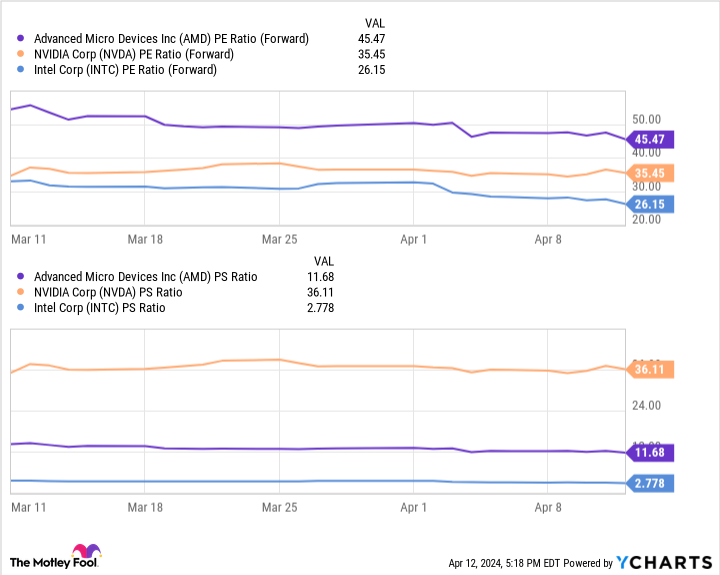

Chip stocks are one of the best ways to invest in technology stocks. With the growing need for more powerful hardware in almost every industry sector, demand is unlikely to go away anytime soon. The chart above shows that Intel is one of the most highly valued chip stocks.

With the two biggest competitors, Nvidia andAdvanced Micro Devices In comparison, Intel has the lowest forward price-to-earnings (P/E) and price-to-sales (P/S) ratios. Intel's broad prospects for business model change and its expanding position in artificial intelligence make its stock a good choice this year.

2. Apple

It's not easy to be an investor in Apple this year, with its stock down 8% since January 1st.

Macroeconomic headwinds caught up with the company in 2023, leading to four consecutive quarters of declining revenue. the first quarter of 2024 finally broke the streak, with revenue up 2% year-over-year to $120 billion, exceeding Wall Street's expectations by more than $1 billion.

However, exceeding expectations was not enough to allay investors' concerns about other areas of Apple's business. in the first quarter of 2024, total aggregate sales in the iPhone division grew by 61 TP3T, but sales in China declined by 131 TP3T. China's increasing preference for domestic brands over iPhones is a threat to Apple's business in its third-largest market.

However, like Intel, Apple is also making major changes to its business, and on April 11th, the company's stock jumped 4%, its best performance in nearly a year. A Bloomberg report revealed that Apple is overhauling its Mac computer lineup to focus on artificial intelligence.

Apple is a dominant player in the consumer technology sector, with market share leadership in most of its product categories. Consumers are extremely loyal to Apple's brand, which could make the company a major growth driver of public adoption of AI, and thus a lucrative market position. Therefore, it is expected that future products will be more focused on generative technologies.

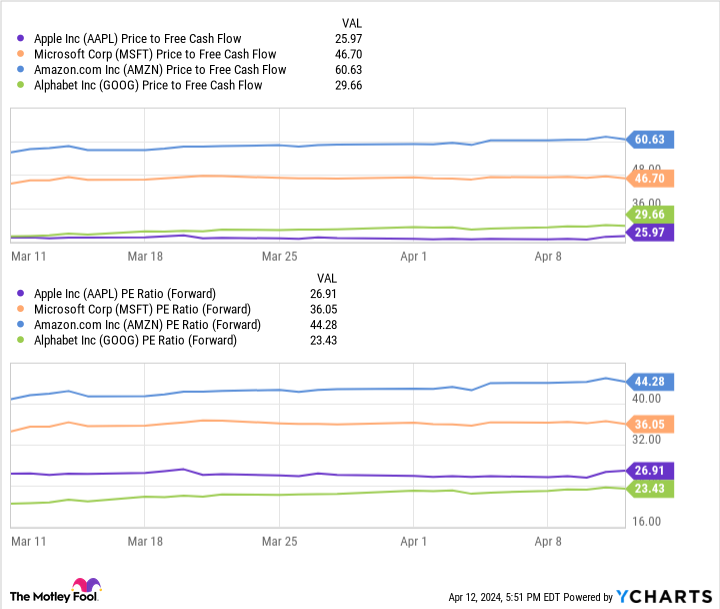

In addition, despite the recent headwinds, Apple's free cash flow last year reached $107 billion, far exceeding that of Microsoft,AmazonmaybeAlphabet This figure shows that Apple has the financial strength to continue to invest in its business to overcome recurring challenges. This figure shows that Apple has the financial strength to continue to invest in the business and resonate with recurring challenges.

Apple's high free cash flow also makes it one of the most highly valued stocks among large technology companies. The chart above shows that Apple has the lowest free cash flow to price ratio and the lowest forward P/E among its many competitors.

The company is known for providing investors with substantial and stable returns over the long term. I have no objection to Apple continuing this trend over the next decade, and its stock is worth considering now.

Should you invest $1,000 in Intel now?

Consider this before buying Intel stock:

Motley Fool Stock AdvisorA team of analysts have just selected what they believe to be the most popular analysts in the world at the moment.-est (superlative suffix)Worth investing in10Only ...... and Intel were not among them. The 10 stocks that made the list are expected to deliver strong returns over the next few years.

Consider April 15, 2005NvidiaWhat happens when you get on the list ...... If you invest $1,000 in our recommendations, theYou will have 540,321dollar! * *

Stock AdvisorIt provides investors with an easy-to-learn blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Stock Advisor The service has contributed to the S&P 500 Index's return since 2002.translate twiceMuch*.

View 10 Gift Certificates

*Stock Advisory Rates as of April 8, 2024

Suzanne Frey, an Alphabet executive, is a board member of The Motley Fool. John Mackey, former chief executive officer of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. dani Cook has no position in any of the stocks mentioned above. the Motley Fool has holdings in Advanced Micro Devices, Alphabet, Amazon, The Motley Fool recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing Company, Inc. The Motley Fool recommends Intel, and recommends the following options: January 2023 Long Intel $57.50 Calls, January 2025 Long Intel $45 Calls, January 2026 Long Microsoft $395 Calls, January 2026 Short Microsoft $405 Calls, and January 2026 Short Microsoft $395 Calls. 405 Calls in January 2026, Bearish Microsoft $405 Calls in January 2026, Bearish Intel $47 Calls in May 2024 The Motley Fool has a disclosure policy.

Two Ultra-High-Growth Tech Stocks to Buy for 2024 and Beyond was originally published by The Motley Fool.