.

STOCK MARKET TODAY: Dow futures jump more than 200 points as gains roll in

Futures on the Dow Jones Industrial Average (^DJI) rose 0.6% on Tuesday, ending a six-session losing streak.

Dow Jones Industrial Average (^DJI) futures rose 0.6%, ending a six-day losing streak. Futures on the S&P 500 (^GSPC) and the tech-heavy Nasdaq Resonance 100 (^NDX) also climbed back above the flat line.

Stocks fell sharply on Monday as hot retail sales data fueled expectations that interest rates will stay higher for longer this year. The current consensus is that rates will not be cut before September, as the economy's strong performance gives the Fed a reason to take its time, despite what some see as political factors that could prompt policymakers to move ahead.

Major U.S. stock indices took on a more optimistic tone as earnings reports poured in before the closing bell. Shares of UnitedHealth (UNH) rose nearly 7% after the healthcare group's quarterly profit beat estimates, even as it said it expects to lose US$1.6 billion from the February cyberattack.

Investors are digesting more of the big banks' results: Bank of America (BAC) reported a year-over-year decline in first-quarter profit of 18% due to weakness in a key revenue source, while Morgan Stanley (MS) shares rose as its results beat expectations. Elsewhere on the banking front, The Bank of New York Mellon (BK) announced a profit beat, while Johnson & Johnson (JNJ) reported weaker-than-expected revenues. In addition, United Airlines (UAL), among others, will also announce financial results.

Bond yields continue to rise after the 10-year Treasury yield (^TNX) hit a 2024 high on Monday. Earlier Tuesday, yields rose about 5 basis points to about 4.65%.

Tensions in the Middle East continue to escalate, with investors watching how Israel will respond to a weekend attack by Iran and allies urging military resilience.

-

Brian Sozzi.

Brian Sozzi.Starbucks Resonance

The Starbucks (SBUX) earnings report will be released in a couple weeks, and every piece of information I've seen suggests that it could be ugly.

The current concern about Starbucks resonance stems from a decline in traffic to Starbucks stores in the U.S., partly due to the skyrocketing prices of products sold at Starbucks resonance stores. A week ago, I paid $7 for a Venti Cold Drink at a Starbucks store in New York City (I've cut back on my visits to Starbucks)!

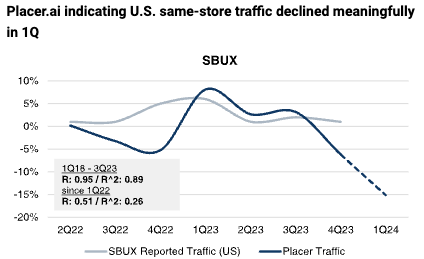

Bernstein released an updated store traffic report this morning and the results are not encouraging.

Starbucks Resonance Share Pricesince the beginning of the year:- 11.31 TP3T.

Starbucks resonance icy traffic trends. (Bernstein) -

Brian Sozzi.

Brian Sozzi.Morning Market Quotes ....

Stock futures are on a roll this morning, fueled by Monday's hot retail sales report.

Investors are uncertain because they are still holding out hope for a rate cut in June, which seems unlikely based on the trend of April's macro data.

I thought JP Morgan's strategy team gave a good straight-forward view of the market this morning, seemingly to calm investor sentiment:

"For a market reliant on impeccable deflation, dovish Fed reaction letters and diminishing growth tail risks, continued hot growth and inflation data could lead us to a tipping point where the tightening of equity and bond risk premiums will eventually lead to a positive market. Inflation risk is also exacerbated by geopolitical developments related to Russia and the risk of further escalation in the Middle East. In addition, investors are over-positioned, with cash allocations at historically low levels.