.

Two Top Cheap Stocks Ready for Action

Many stocks interested in artificial intelligence (AI) have surged recently. Last year.NvidiaThe stock price has more than tripled.MicrosoftThe stock price has risen by 45%, easily surpassing theStandard & Poor's 500The index rose by 22% over the same period.

But the AI boom hasn't ignited every stock in the world, and you can still find some great undervalued companies in the AI corner of Wall Street.

Data Warehouse SpecialistSnowflake (NYSE: SNOW)and process automation specialistsUiP ath (NYSE: PATH)Two of these tantalizing AI stock picks. These two stocks have underperformed the S&P 500 over the past year, with year-to-date price declines exceeding 20%.

If that's the case, both companies should see strong business growth from the artificial intelligence boom that preceded them. Judging by today's modest share prices, both stocks seem poised for a big rally. Let me tell you what I mean.

Artificial Intelligence Automation Business Growth

UiPath combines Artificial Intelligence with automation to streamline business processes. Their platform uses AI to analyze and model human interactions with digital systems, providing businesses with the tools to accurately automate tasks powered by AI. This combination makes UiPath a unique service provider in the field of AI-driven business automation, also known as Robotic Process Automation (RPA).

The company's software robots aren't big pieces of automated hardware, but rather software programs that automate tasks that used to be done by humans. They're often referred to in the industry as "robots," but that's not the term UiPath prefers.

These computer applications work within existing computer systems and can help organizations complete repetitive tasks such as filling out forms or updating records, saving time and reducing errors. They can help organizations save time and reduce errors by completing repetitive tasks such as filling out forms or updating records.UiPath's software is deeply integrated with the Common Business Platform, enhancing its ability to deliver effective RPA solutions across different industries and hyper-specific customer needs.

You'd think an AI specialist like this would see its stock price soar in 2024, but UiPath's stock has only risen 20% in 52 weeks, including a drop of 22% since the new year. But UiPath shares are up just 20% in 52 weeks, including a drop of 22% since the new year, and down 77% from their all-time high in mid-2021, when the inflation crisis was pushing investors away from growth stocks.

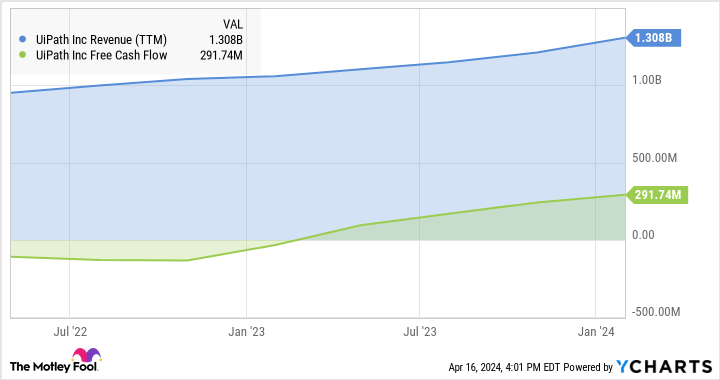

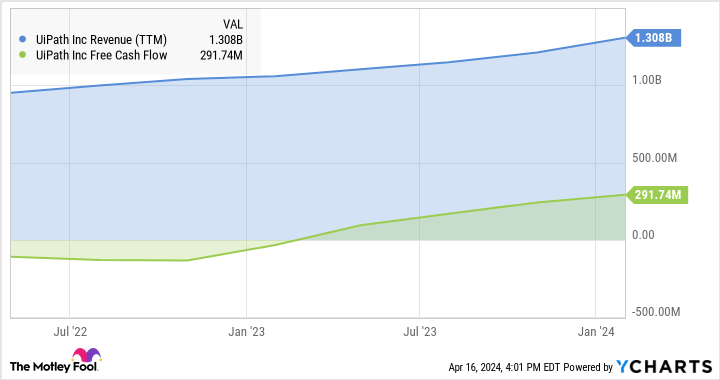

But have you seen UiPath's growing cash profits and soaring revenues?

UiPath's financial performance underscores the company's importance in an increasingly automated business world. For investors ready to bet on the long-term development of RPA technology, the mismatch between its name's share price and its thriving financial performance could be an overlooked opportunity, and UiPath is among the leading providers.

UiPath stock may be poised for a big jump as companies continue to pursue efficiency and innovation.

Make it easy for AI experts to access clean data

Snowflake helps enterprises to store a lot of information in the cloud, but it's not just storage. But it's more than just storage; Snowflake provides intelligent tools that allow organizations to dig into their data to find valuable clues on how to achieve growth or cost savings, making the data work hard for them. It's like keeping a well-organized virtual filing cabinet that can be accessed from anywhere.

As a super-librarian of AI systems, the company has played a major role in the generative AI boom. It organizes and manages a huge amount of important data, which AI engines use to learn and get smarter. For companies using AI tools, easy access to clean, organized, always-available data is invaluable.

Building a solid knowledge base for AI is key, and that's Snowflake's strength. For example, companies can connect their Snowflake data storage directly to their UiPath tools. Whether you're training a UiPath system or analyzing new business data in real time, Snowflake's seamless data flow makes it easy.

As I'm sure you've guessed, Snowflake's business is now in full bloom. Tracking sales have more than doubled in two years, fueling strong cash flow growth:

However, Snowflake's stock chart does not reflect its soaring sales and profits.

Last year, the company's stock price rose just 61 TP3T, and year-to-date in 2024 it's down 241 TP3T. It's not as obviously underpriced as UiPath, with just 18x sales and 64x free cash flow, but this fast-growing stock is already earning every penny of its premium.

So if you're looking for a very affordable AI stock in today's market, UiPath is worth considering. If you're willing to take a bolder bet on AI-driven sales growth, Snowflake is worth a second look.

Should you invest $1,000 in Snowflake now?

Before buying shares of Snowflake, consider the following:

Motley Fool Stock AdvisorA team of analysts have just selected what they believe to be the most popular analysts in the world at the moment.-est (superlative suffix)The name of the person is suitable for the investor to purchase10Snowflake is not one of the 10 stocks listed on ....... The 10 stocks that made the list are poised to generate huge returns over the next few years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View these 10 stocks

*Stock Advisor's Circular as of April 15, 2024

Anders Bylund has a position in Nvidia.The Motley Fool has positions in Microsoft, Nvidia, Snowflake, and UiPath.The Motley Fool recommends the following options: long Microsoft Jan 2026 $395 calls and short Microsoft Jan 2026 $405 calls. The Motley Fool has a disclosure policy.

Two Top Cheap Stocks to Prepare for a Bull Market was originally published by The Motley Fool.