.

Let's talk about some of the investments we've been working on recently.

Part-time job is not a long-term plan, if you want to change your order, you still have to let the money you earn to realize more in your own place in order to improve your quality of life. Recently, I have also talked with my friends about some investment projects that I have recently come into contact with, and I would like to refer to how to choose these projects.

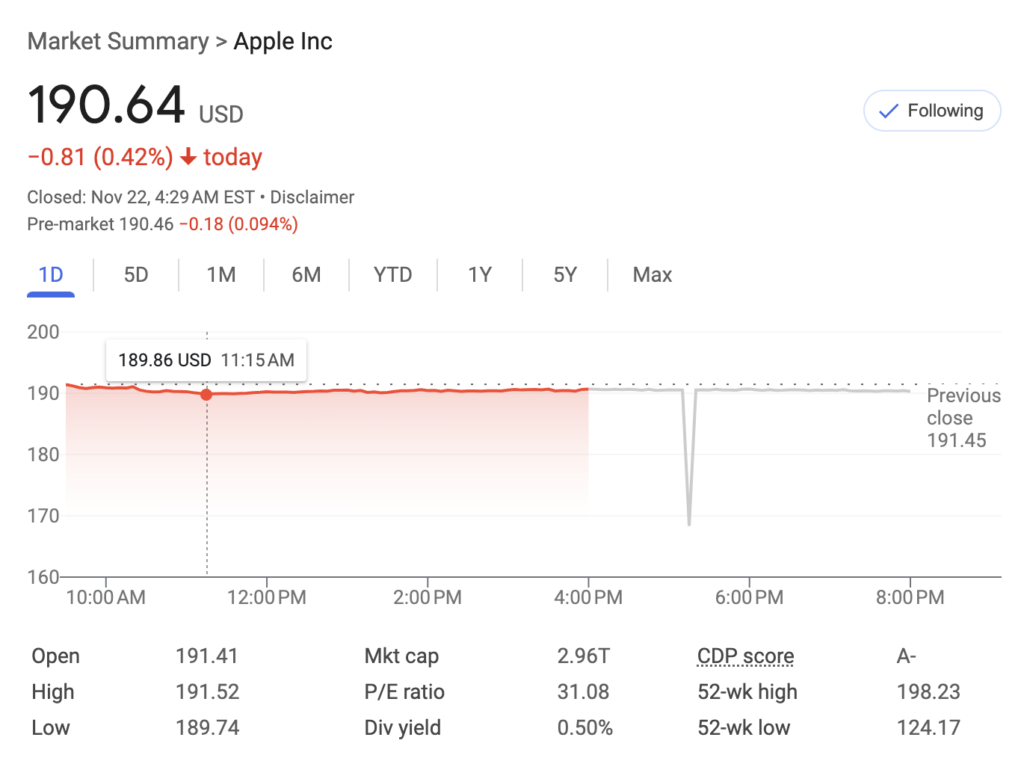

stock market

Speaking of the stock investment market, many people will not feel unfamiliar, in contact with the Internet in this area of the modern people will have understood, but this is also the need for a certain ability to be able to, not blindly into this line can be a direct win. At that time, I was also in contact with a long time, tried to get some experience, but the risk here is also quite big. Investing in potential stocks or large-cap stocks with stable growth can be done by paying special attention to sectors that show strong growth potential or have stable returns, such as technology, healthcare, renewable energy, and so on. For example, Apple this kind of large-scale technological innovation company, this kind of relatively stable, there is a new type of intelligent artificial technology, this year's openai is definitely worth investing in, the stock is also very optimistic, this type of revolutionary innovation company is particularly optimistic, the future is also certainly intelligent artificial era. Personally, I am also very optimistic about this piece, but openai this piece of stock you may not be able to buy much, but with its related application areas can be concerned about, especially those who can actually land. There is renewable energy this piece, the future of resources is certainly less and less, the current revolutionary renewable energy has not yet appeared, but also more and more renewable energy companies can pay attention to. At present, I am also personally very optimistic about this piece, but some small stocks really do not recommend, especially for novices and some of the stability of the ordinary people to say.

Bonds and fixed income products

This is for those investors with low risk requirements, most of which are not risky, but they are risky, just with a lower risk coefficient. Government bonds, corporate bonds or municipal bonds are usually lower risk. But this is not something you can buy just because you want to. Because of its low risk factor, most people have a need to buy it, so you have to pay special attention to when it is open for purchase.

real estates

In chatting about the project also talked about this, but not too much to talk about, because for us ordinary people, this is not possible to invest, unless they have a need to buy a house, investment to buy a house and then turn after, now it is impossible to realize, and there is not so much capital in circulation, the loan to buy is also impractical, unless it is really a last resort, there is a real need to do so. I don't really like property speculators either, it affects the market. Besides, it takes a particularly large amount of capital support to build this kind of housing. Anyway, apart from the need to buy a house, I have not touched the real estate sector, but the surrounding investment can be considered, rather than just focusing on the real estate sector only houses. I think if this piece of the best can have a few years of experience, otherwise cross-border contact is not very good, completely do not understand the industry is not good.

Science, technology and innovation

This is also a great demand for investment, we as an ordinary person, if really is very optimistic about the industry and their own relevant experience, I think it is possible. We ordinary people to say that they go to do this thing may not be into, but partners together to do is also possible, research and development and innovation is certainly a need for a lot of investment, they do not have the capital investment, only technology and management capabilities that will have to find a partner, anyway, this is the direction of the future, but remember that this is to eat the technology out of the effect, or else a long period of time to maintain the investment of funds can not be maintained for a long time. Like openai this piece belongs to the field of technological innovation, other fields can also.

Cryptocurrency and Blockchain

Talk about this piece, because this is not a new thing, there are a lot of people into contact, of course, some people rely on this to get rich, but also some people because of this body into can not pull themselves out of this piece is a general direction, no legal definition of it good and bad, but here is also worth can invest in the project. In the future, this aspect will also be used. But I personally will not consider this piece, can not see what a good project.

Startups and Venture Capital

When investing in a start-up company, you need to be careful and make sure you do your research on all aspects of the business. Sometimes you invest in a company that looks very promising, but has been losing money, not able to obtain self-sufficiency, and has been investing money into it. I have friends who have had the same experience. It's really hard for a startup to operate for 10 years and still not be self-sufficient. Investing in a startup is a high-risk but high-reward project, but you really need to be careful. Here are a few things to keep in mind:

- Gain an in-depth understanding of the company's business model, market potential, competitive environment, financial position and management team. Verify the truthfulness and accuracy of all information.

- A talented and experienced team is the key to startup success. Evaluate the background, experience, and abilities of the team members.

- Determine whether the company's products or services meet market demand, as well as market size and growth potential.

- Review the company's financial statements, including revenues, expenses, cash flow and earnings projections. Ensure that the company's financial position is sound.

- Assess all potential risks associated with the investment, including market risk, technology risk, operational risk, etc.

- Startups often take a long time to grow, and investments should be made with sufficient patience and long-term commitment.

Emerging markets investment and sustainable and socially responsible investment, personal retirement and education savings accounts, etc. will not talk about, in fact, the basic general direction is the above content of the sub-division of the field, or according to their own actual situation and investment, anyway, the investment risk or have to look at their own degree of ability to withstand is not to blindly carry out the investment. At present, I am still in contact with the stock investment market in this area as well as other areas of concern.