.

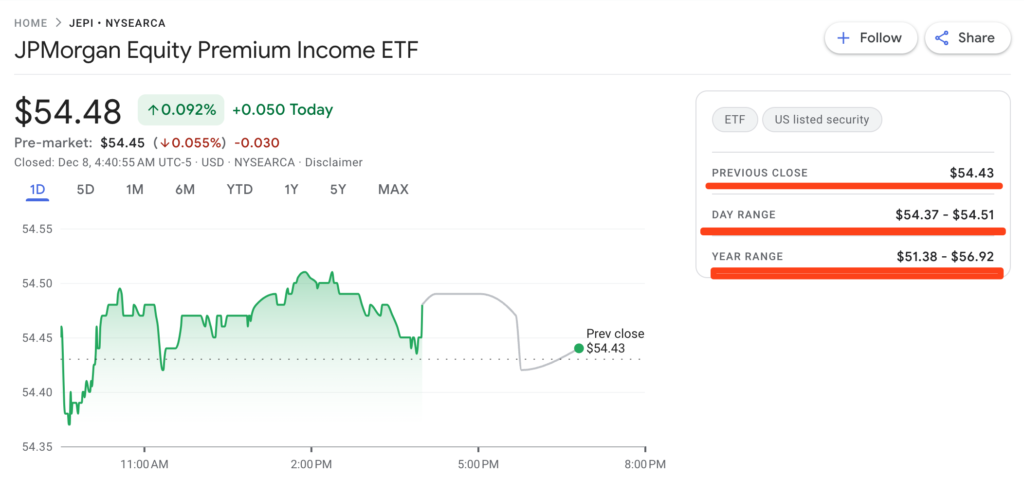

JEPI stock latest quote 2023

When it comes to stock market investing, "JEPI" (JPMorgan Equity Premium Income ETF) is a frequently talked about topic. JEPI is an exchange-traded fund (ETF) managed by JPMorgan that aims to provide investors with the long-term growth potential of the stock market while also generating a relatively stable income stream. In this article, we will take a closer look at JEPI's features, performance and its potential value to investors.

JEPI's Investment Strategy

JEPI's primary objective is to pursue equity market returns while minimizing volatility and providing regular income. To achieve this objective, the fund employs a unique investment strategy that combines equity and options strategies. It invests in a basket of high quality stocks while selling call options to generate additional income. This combined strategy aims to provide above-average returns while maintaining reasonable capital growth.

History of JEPI

Since its launch, JEPI has been one of the stable performing ETFs in the market. It has not only realized capital appreciation during bull markets, but has also shown resilience during bear markets. JEPI's performance can be attributed to its conservative portfolio and smart options strategy, which has enabled it to maintain a relatively stable performance across different market environments.

Income and dividends

JEPI is an attractive option for investors looking for a steady stream of income. It pays regular dividends, usually monthly, which is particularly attractive to retired investors or other income-sensitive investors who need regular cash flow. That said, investors should be aware that dividend income may vary with market conditions and fund performance.

Risk Factors

Although JEPI is designed to minimize volatility and provide stable income, it is not without risk. Stock market volatility, poor company performance, and general economic factors may affect its performance. In addition, while an options strategy may generate additional income, it may also limit capital growth in certain market conditions.

JEPI is a unique investment option that is better suited for investors who seek a combination of stock market growth potential and income stability. Its portfolio strategy provides a way to balance market volatility with income generation. But as with any investment, JEPI should be considered carefully within the context of an investor's overall financial planning and risk tolerance.

Before considering investing in JEPI or any other financial product, investors are advised to conduct thorough research and consider consulting a financial advisor. Each person's financial situation and investment objectives are unique, and it is important to develop an investment strategy that is tailored to your individual needs.

Suggest newcomers to buy this stock first understand clearly, first familiar with its history and current operations and then according to their own actual situation to decide, the above is some of my experience involved in the summary, I hope to help people who need this. I'm holding this stock now and will continue to keep an eye on it, the overall performance is very good.