.

Got $1,000? These hot growth stocks are perfect for you!

One of the great things about investing in stocks is that different types of stocks are suitable for different types of investors. One type of stock is particularly popular these days: growth stocks. These are companies that are expected to grow their earnings faster than the market average. It is easy to see why growth stocks are also popular. They give investors a chance to get market beating returns and capitalize on the company's future success.

If you have $1,000 to invest (meaning you have an emergency fund saved up and high-interest debt paid off), these two companies are worth considering. By investing $500 in each of these two companies, Bubbles will give investors access to the top companies in a fast-growing industry.

1. CrowdStrike

CrowdStrike (NASDAQ: CRWD)is one of the world's premier cybersecurity companies and is working to strengthen its competitive edge.

Although artificial intelligence (AI) has recently become mainstream, it is far from a new technology, as evidenced by CrowdStrike, which has been using AI to automate cybersecurity processes since it released its first platform in 2011. It is essentially a precursor to the pure AI solution model.

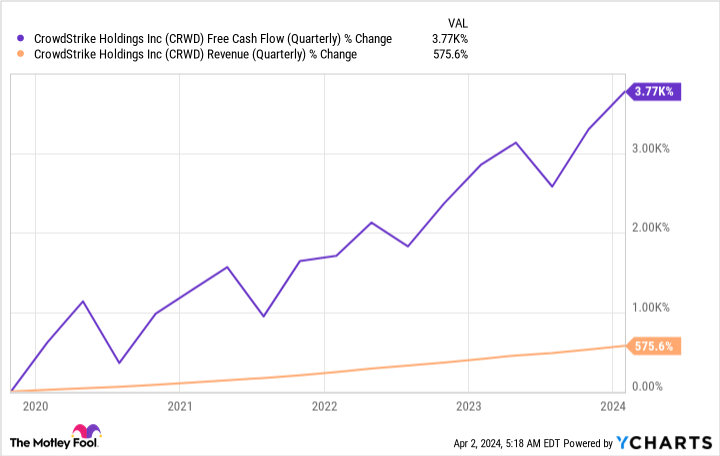

CrowdStrike's jump in pure AI cybersecurity solutions has been quite profitable for the company. In the fourth quarter, the company generated $283 million in free cash flow, an increase of 35% year-over-year, which is much higher than a few years ago.

CrowdStrike's impressive free cash flow growth has been driven by its growing annual recurring revenue (ARR), a key financial metric for companies like CrowdStrike whose business model is subscription-based. In FY2024, CrowdStrike generated $875 million in new ARR, bringing its total to $3.44 billion.

Free cash flow and return on net assets are good indicators of a company's financial health, as they show its ability to generate profits from a stable revenue base. And in terms of its market opportunity, this appears to have more room to grow.

CrowdStrike and IDC, a market intelligence firm, project the total addressable market (TAM) for AI-native security platforms to reach approximately $100 billion by 2024. By 2028, they expect the total addressable market to reach $225 billion, validating CrowdStrike's growth opportunity in this particular cybersecurity space.

CrowdStrike is ready for the long haul.

2. DraftKings

DraftKings (NASDAQ: DKNG)It has become the US leader in online gaming and iGaming and shows no signs of slowing down anytime soon.

Although DraftKings has been in existence for more than a decade, the recent decision by the U.S. Supreme Court to allow states to independently legalize and regulate sports betting has opened up a new world of opportunity for the company. So far, the company has capitalized on this fast-growing market.

In the fourth quarter of 2023, DraftKings realized revenue of $1.23 billion, up $44% year-over-year. perhaps more importantly, the company's adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) finally turned positive at $151 million (up $201 million year-over-year).

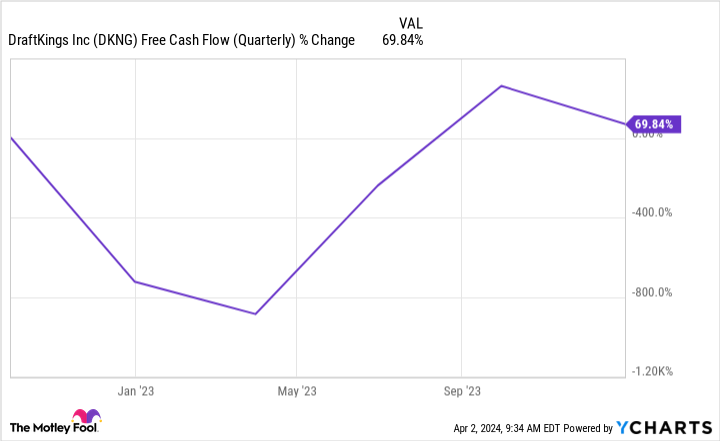

DraftKings has stated that its current priority is to capture as much market share as possible, so profitability is not a priority, but its recent impressive financial performance hints that profitability may be on the horizon. This is especially true if DraftKings' free cash flow continues its current trend.

In FY2024, DraftKings expects its free cash flow to be in the range of $310 million to $410 million, which gives it plenty of room for financial maneuvering and allows it to supplement organic growth with other forms of growth, such as acquisitions. DraftKings recently acquired Jackpocket, the No. 1 lottery app in the U.S., for $750 million, showing that it doesn't mind doing the latter.

DraftKings' acquisition of Jackpocket will give it a foothold in the over $100 billion lottery industry. It will also enable it to cross-sell products, increase customer acquisition and strengthen its overall business by opening up new revenue streams and reducing the risks of a centralized business model.

There is no denying that the U.S. sports betting market is growing rapidly (for better or worse), and DraftKings is one of the leaders in the industry. This is a recipe for good value returns to shareholders.

Should you invest $1,000 in CrowdStrike right now?

Before buying shares of CrowdStrike, consider the following:

Motley Fool Stock AdvisorThe analyst team has just named what they believe to be the best value for investors.10Only ...... and CrowdStrike were not included. The 10 stocks that made the list could generate huge returns in the years to come.

Consider April 15, 2005Nvidia) on the list at ...... If you invested $1,000 at the time of our referralYou will have $545,088.! * *

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Stock Advisor The service has contributed to the S&P 500 Index's return since 2002.translate twiceMuch*.

View these 10 stocks."

*Stock Advisor's Circular as of April 4, 2024

Stefon Walters owns shares of DraftKings. the Motley Fool recommends CrowdStrike for its position. the Motley Fool has a disclosure policy.

Got $1,000? These hot growth stocks are worth buying now.