.

RCL, CCL, MGM: Which leisure stock is worth buying?

Inflation over the past few years has really wreaked havoc on leisure and entertainment companies such as RCL, CCL and MGM. There is no doubt that when the basic costs of living (such as housing and food) are at the height of the inflationary boom, it's hard to hoard money for a vacation, whether it's a cruise or a simple trip to Las Vegas.

As easy as it would be to postpone such a vacation, I think the end (or at least the beginning of the end) of inflation may mark the return of leisure.

All parts of the economy remain in good shape (no recession yet). While we are certainly not out of our sleepy state yet, with certain Fed members considering fewer interest rate hikes due to the strength of the U.S. economy, one can't help but imagine that consumers will find a way to keep themselves going. They begin to be more selective with their discretionary cash.

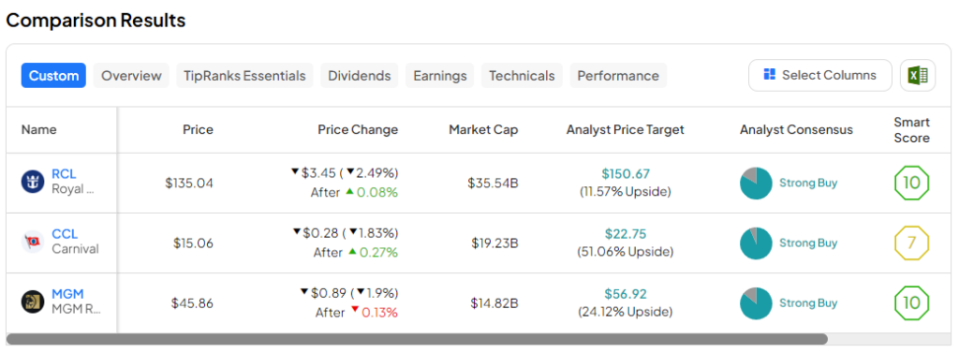

In any case, let's use the power of the TipRanks comparison tool to keep an eye on three of Wall Street's most bullish leisure stocks right now.

Royal Caribbean Cruises (NYSE:RCL)

Over the past year, Royal Caribbean Cruises' stock price has risen so high that it has left its industry competitors in the dust. At the time of writing, RCL stock is hovering at record highs, having risen more than 300% from the dark abyss of 2022.

While Royal Caribbean has been enjoying the joys of upward mobility, its peers are still struggling to maintain any positive momentum. Just take a look at the stock charts of the major cruise lines and you'll understand the unfolding story. For the foreseeable future, Royal Cruises seems poised to grab market share.

There's no doubt that the premium nature of the company's cruise line (and there's nothing more premium than Royal Cruises) is reaping huge rewards as it captures the strong demand for bookings for the most leisurely of trips. With a clear advantage over its peers (fabulous new ships such as the Silver Nova have already sailed, and Utopia of the Seas is set to sail this summer), and with no sign of a reversal in demand, I have to remain bullish on Royal Cruises' stock.

Why buy an old cruise ship at a lower price when the latest and greatest cruise ships are packed with profound innovations and offer unparalleled luxury to those who seek it?

Royal Caribbean has shown that sometimes you have to spend money to make money. Not only that, but as more and more travelers seek (and pay for) the best, Royal Caribbean will gain more market share and long-term profitability.

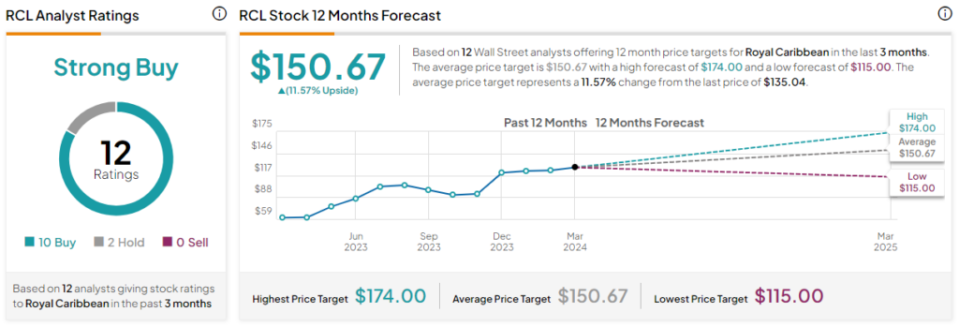

What is the target price for RCL stock?

Analysts consider RCL stock to be a "Strong Buy" stock, with 10 "Buys" (Buys) and 2 "Holds" (Holds) in the last three months. "RCL stock has an average price target of $150.67, suggesting an upside potential of 11.6%.

Carnival Cruise Lines (NYSE: CCL)

For deep value investors looking to bet on an underdog, Carnival Cruise Lines appears to be the more attractive comeback option. There's no doubt that Royal Caribbean Cruises has reversed its share price trend in recent quarters, but Carnival isn't far behind, posting an impressive 53% gain over the past year.

It's not clear how Carnival will be able to win a share of the market before its rival, the High B耑. Perhaps the expansion of the cruise market bull market will work in Carnival's favor. Regardless, I remain bullish on CCL stock, primarily because of its moderate valuation and favorable positioning among budget-conscious families.

Like Royal Cruises, Carnival has benefited from similar industry dynamics (record bookings and improving margins). While Carnival has its own new ship (the Carnival Jubilee) to get travelers excited and ready to book, it has also had to balance fleet expansion investments with debt reduction plans. It's a delicate balance, but as the industry continues to recover, so will CCL's share price.

Notably, the collapse of the Baltimore Bridge is expected to reduce adjusted earnings by $10 million. In any case, the impact of this disaster on the company's bottom line seems to be largely apparent.

What is the target share price of CCL stock?

Analysts consider CCL stock to be a "strong buy" stock, with 14 analysts giving it a "buy" rating and 1 analyst giving it a "hold" rating over the last three months. The average price target for CCL stock is $22.75, implying an upside potential of 51.1%.

MGM Resorts International (NYSE:MGM)

In addition to cruise ships, MGM Resorts is a fascinating option for investors looking to buy leisure stocks at low multiples. At the time of writing, shares of the iconic Las Vegas company trade at 14.9 times, well below the average price-to-earnings ratio for the resort and casino industry of 20.7 times. Just last week, Mizuho(Mizuho)NYSE:MFG) stepped up to the plate and gave MGM a Buy rating, saying its shares are undervalued.

Indeed, MGM is a prime candidate to benefit as consumer disposable income rebounds. As such, I will continue to be bullish on the stock as we head into the summer months." Mizuho's Ben Chaiken said, "We see a compelling path of value creation in FCFs and sharebacks, with MGM theoretically able to buy $4-$5 billion of shares over the next five years.

There's no doubt that MGM may not be the darling of growth, but it's certainly a cash cow - and one that could get even fatter as the demand for leisure travel begins to grow.

With the rise of digital gaming, gamblers can place their bets from the comfort of their own homes, which is reminiscent of the fact that more and more people are getting into the roll of the dice. Not only does this mean that digital gaming is on the rise, but it could also lead to more trips to Las Vegas. Either way, MGM is a good company to invest in as the economy heats up.

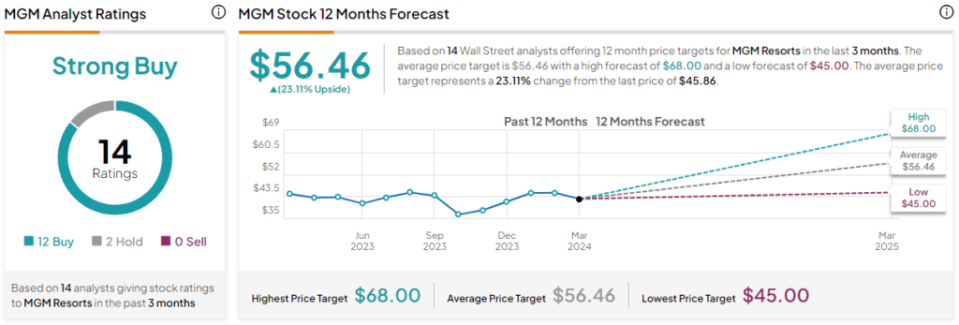

What is the target price for MGM stock?

Analysts consider MGM stock to be a "Strong Buy" stock, with 12 "Buys" and 2 "Holds" over the past three months. MGM stock has an average price target of $56.46, implying an upside potential of 23.1%.

enlightenment

With the U.S. Economy Continuing to Show Strength and Flexibility, Diversified Stocks May Continue to Move Higher From cruise lines to the iconic buildings of Las Vegas, the strong U.S. economy is like a giant wave that makes all the waves. Of these three "Strong Buy" stocks, Wall Street seems to be most bullish on CCL's stock, which is expected to rise as much as 51% in the coming year.

Disclosure of information