.

Regretting missing out on INVISTA's amazing rally? Buy 1 Incredible Artificial Intelligence (AI) Stock Before It Hits $1 Trillion in Market Capitalization

INVISTA firms(NASDAQ: NVDA)has been one of the hot companies in the Artificial Intelligence (AI) boom as customers are lining up to buy its powerful graphics cards so as not to miss out on the rapid advancement of the technology that promises to give a huge boost to the global economy.

According to PricewaterhouseCoopers, AI will contribute up to $15.7 trillion to global GDP (gross domestic product) by 2030, and Nvidia will play a central role in driving AI-related economic growth through its GPUs, which play an important role in the training of large-scale language models (LLMs) and the development of AI applications. Nvidia will play a central role in driving AI-related economic growth.

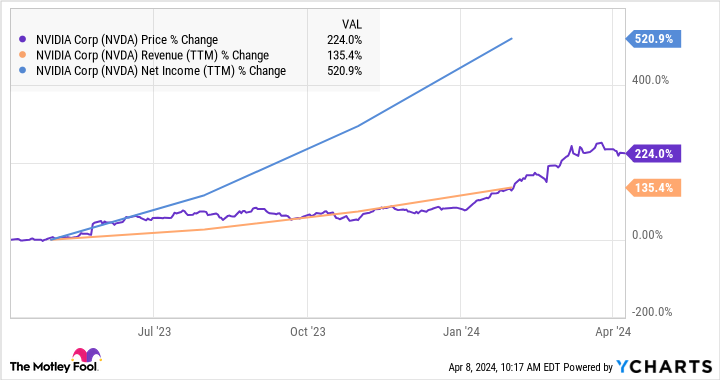

All of this explains why Nvidia has been growing at an astounding rate, causing its stock price to soar.

However, if there is no foundry partner, it is not possible for the company to provide a service to the customers.Taiwan Semiconductor Manufacturing Co. Ltd. (Taiwan Semiconductor Manufacturing (math.) genus(NYSE: TSM)(commonly known as TSMC), Nvidia's rise is unlikely to materialize. This is because Nvidia is a fabless semiconductor company, which means it only designs chips and leaves the manufacturing to foundries like TSMC.

So investors looking for an Nvidia proxy to get in on the AI craze would do well to buy TSMC stock, as TSMC is likely to bring impressive upside to join the trillion-dollar market cap club. Let's take a look at why that's the case.

TSMC's Capacity Expansion Should Help Accelerate Growth

TSMC has been rapidly expanding its production capacity to help Nvidia meet the huge demand for its artificial intelligence chips. According to market research firm TrendForce, the company is estimated to have allocated 40% to 50% of its advanced chip packaging capacity to Nvidia so that the latter can increase its AI chip supply.

What's more, TSMC will reportedly increase its production capacity for advanced chip packaging, formally known as chip-on-wafer and wafer-on-substrate (CoWoS), to 240,000 units this year, up from 120,000 units last year. By the end of the year, TSMC's monthly production capacity for CoWoS packages is expected to rise to 26,000 to 28,000 chips per month, suggesting that Nvidia could continue to increase its AI chip production.

What's more, TSMC has now received a US$6.6 billion grant from the U.S. government and a US$5 billion loan facility so it can build more plants in Arizona. TSMC has already built two plants in Arizona, which are due to come on stream in 2025 and 2028 respectively, and with the latest grant it will build a third. The total mass of TSMC's three U.S. plants will cost $65 billion.

The third plant will be used to manufacture advanced 2-nanometer (nm) chips that will be used in artificial intelligence and military applications. Notably, TSMC expects to begin pilot production of 2nm chips for Nvidia, with volume production of these chips beginning in 2025.

Moving to a 2nm process is likely to play an important role in helping Nvidia maintain its dominant position in the AI chip market. For example, Nvidia's move from a custom 5nm framework for its Hopper AI GPUs to TSMC's custom 4nm process for its upcoming Blackwell GPUs, which Nvidia claims can deliver a 7- to 30-fold jump over its current flagship H100 processor, while reducing power consumption by 25 times.

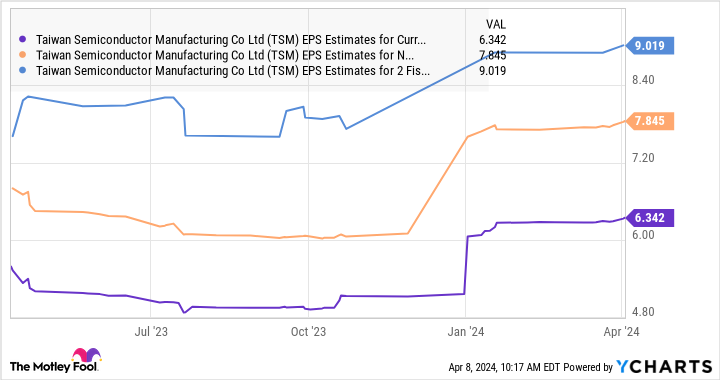

As a result, it looks like TSMC will benefit from Nvidia's AI chip dominance, which should ideally help fuel the company's strong revenue and earnings growth. That's probably why analysts are sharply raising TSMC's earnings growth estimates.

The stock's valuation and potential upside suggest that buying the stock is a no-brainer.

TSMC stock trades at a price-to-earnings ratio of 28 times and a forward price-to-earnings ratio of 23 times. Both of these multiples are belowNasdaq Resonance 100 The index trades at a 30x earnings multiple (using the index as a proxy for technology stocks). As we saw in the chart in the previous section, TSMC's bottom line could jump above $9 per share in 2026.

Assuming that TSMC does achieve this goal, and that its price-to-earnings ratio is 30 times in three years, in line with that of the Nasdaq Resonance 100 Index, its stock price would reach $270, a jump of 86% from its current level. TSMC's current market capitalization of $750 billion means that it is on track to join the trillion-dollar club within the next three years.

All of this suggests that investors looking for an AI stock with an attractive valuation should consider buying TSMC in a big way, as it appears to have huge upside that could help push its market capitalization well past $1 trillion.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing Corporation now?

Consider the following before purchasing shares of Taiwan Semiconductor Manufacturing Company:

Motley Fool Stock AdvisorThe analyst team has just selected what they think is the best name for investors to buy now.10Only the stock ...... Taiwan Semiconductor Manufacturing Company is not included. These 10 stocks are likely to generate huge returns in the coming years.

Consider that on April 15, 2005Nvidia) on the list when ...... If you invested $1,000 at the time of our referralYou will have 533,869dollar! * *The

Stock AdvisorProvides investors with an easy-to-follow blueprint for success, including guidance on building an investment team, regular updates from analysts and two new stock picks each month. Stock Advisor The rate of return for the service since 2002 has been the same as that for the S&P 500 index, but the rate of return for the service has been the same as that for the S&P 500 index.quadruple*.

View 10 Gift Certificates

*Stock Advisory Rates as of April 8, 2024

Harsh Chauhan does not hold any of the above stocks.The Motley Fool holds recommendations for Nvidia and Taiwan Semiconductor Manufacturing Company.The Motley Fool has a disclosure policy.

Regretting Missing Out on INVISTA's Surprising Rally? Buy 1 Incredible Artificial Intelligence (AI) Stock Before It Hits $1 Trillion in Market Cap was originally published by The Motley Fool.