.

Is Plug Power stock worth buying?

Companies are trying to reduce their carbon footprint, and hydrogen is a clean fuel because it only produces water as a byproduct.Plug Powerfirms(NASDAQ resonance code: PLUG)For many years, the company has touted itself as the leading hydrogen fuel company.

But today, the company's shares are hovering near a 52-week low. The company's new large-scale hydrogen facility is ramping up, which is an impressive development. Should investors buy Plug Power's hydrogen fuel cell long-term potential?

Here's what you need to know.

Completion of the facility will result in significant savings for Plug Power.

Plug Power's long-awaited production facility opened in January of this year. By the second quarter of this year, it was producing 15 tons of green hydrogen per day. By the end of the year, company-wide production is expected to reach 40 tons. This is a big deal because Plug Power has always bought and resold hydrogen from its customers, and the economics of this arrangement make it possible for Plug Power to sell hydrogen to its customers.poorlyThe company's fuel is a very expensive product," he said. Plug Power bought the fuel last year for $12 to $14 per kilogram and then sold it for $6 to $7, said Paul Middleton, matron financial officer.

Plug Power estimates that by producing the fuel, its costs will drop to between $3 and $5 per kilogram, a dramatic shift in business model and costs. That's a huge shift in business model and costs. how bad is it in 2023, when Plug Power's fuel sales are $66 million and costs $246 million, a loss of $180 million to begin with?

But is that enough?

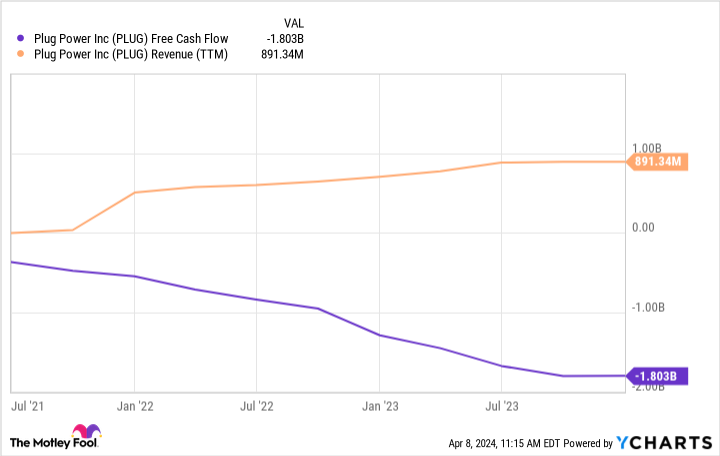

Plug Power needs more help with capital than producing its own hydrogen. It's not clear how much longer Plug Power can keep going without destroying shareholder value. For example, free cash flow is negative, and it's on the wrong side of growing faster than revenue.

In 2023, the Company's revenues grew by 27% year-over-year, but its cost of goods sold grew by 56%, not including operating expenses such as sales and marketing, research and development, or administrative costs. These expenses almost doubled, growing 72% from 2022.

Gwen emphasized that expenses will be cut back significantly this year and prices will be raised to help curb losses. Reducing losses is good, but will aggressive pricing hurt growth efforts? It's unclear how much pricing power Plug Power has. I'm skeptical that the company will be able to reduce its cash burn without sacrificing revenue growth, and Plug Power will have to prove its pricing power this year.

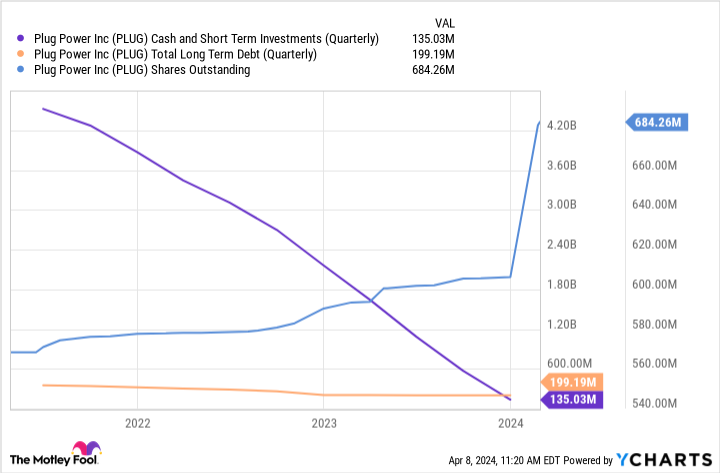

Regardless, the company is already destroying shareholder value. Over the past three years, the billions of dollars of cash on Plug Power's balance sheet have been rapidly depleted. The result has been an aggressive stock offering to raise new capital. Since 2022, the company has more than quadrupled its share count, meaning that existing shares are becoming a smaller and smaller portion of Plug Power's final profit.

Plug Power Caught in the 'Too Hard' Loop

Plug Power has the unenviable task of developing an expensive business model and establishing new markets for its products. We are making progress as more and more facilities come on line. However, there is a difference between commercial success and successful investing; Plug Power does not appear to be close to profitability, and the expected ongoing share issue to raise capital is likely to undermine the long-term investment potential of the stock.

If that's not bad enough, it's unclear how much of a role hydrogen will play in the world's long-term energy picture. If hydrogen use starts to take off, will Plug Power be able to withstand competition from wealthy energy giants? Hydrogen could eventually become a commodity business.

There are a lot of questions about Plug Power, and it is not clear how long it will take to find the answers. It's not worth the dilution of investment while waiting for answers. Consider looking elsewhere for energy opportunities.

Should you invest $1,000 in Plug Power now?

Before buying Plug Power stock, consider the following:

Motley Fool Stock AdvisorThe analyst team has just selected what they think is the best name for investors to buy now.10Plug Power is not one of the 10 stocks listed on ....... The 10 stocks that made the list could generate huge returns in the years to come.

Consider April 15, 2005Nvidia) on the list at ...... If you invested $1,000 at the time of our referralYou will have 533,869dollar! *Stock Advisor provides easy-to-use stock investment tools for investors.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Stock Advisor The service has contributed to the S&P 500 Index's return since 2002.translate twiceMuch*.

View these 10 stocks."

*Stock Advisor's Report as of April 8, 2024

Justin Pope does not own any of the shares listed above.The Motley Fool does not own any of the shares listed above.The Motley Fool has a disclosure policy.

Is Plug Power Stock Worth Buying? This post was originally published by The Motley Fool.