.

Is now the time to buy this cheap stock that has lost 55% since 2022 and yields 6%?

Since the start of the bull market in October 2022, the stock market has been on a roll.Standard & Poor's 500The index is trading near all-time highs, up 53%.

However, not all stocks have been successful.Lincoln National Corporation (Lincoln) National Corporation ) (NYSE: LNC)This is a dividend stock that sells at a low price. Although the stock has risen 48% in the last year, it is still 55% below its all-time high as the company's financial condition improves. here's why the stock is a great value investment.

The Impact of Pandemics on Life Insurance Companies Like Lincoln National Insurance Company

Lincoln National Insurance Company offers insurance and retirement plans through a variety of products, including annuities, life insurance, group non-medical insurance and defined contribution plans.

The past few years have been very difficult for the company. 2020 saw the COVID-19 pandemic wreak havoc on the economy, and the knock-on effects were felt across all industries. During the pandemic, the life insurance industry was struggling with soaring claims. According to the Council of Life Insurers, in 2020, U.S. life insurers paid out $90 billion to beneficiaries. Claims increased by 151 TP3T, the largest year-over-year change since the 1918 flu pandemic.

Many life insurers have rebounded in recent years. For exampleAflacrespond in singingUnum GroupThey are up 2,92% and 5,08%, respectively, from their March 2020 pandemic lows.However, Lincoln National Insurance Company is struggling much more.

Significant changes affecting its monitoring capital ratio

Lincoln National Bank began to rebound with its peers in 2021, but the stock failed to maintain its positive momentum. Assumptions for Guaranteed Universal Life policies changed dramatically, which impacted the company's business.

In the third quarter of 2022, Lincoln National Insurance Company reported a net loss of $2.6 billion on revenues of $4.8 billion. The loss was primarily due to a $2.2 billion increase in the life insurance reserve, as data shows that people age 75 and older are more likely than Lincoln National expects to underwrite a guaranteed universal life policy.

These changes affect Lincoln National's risk-based capital (RBC) ratio, a key metric used by the regulator to determine the minimum amount of capital an insurer needs to support its operations and underwriting.200%'s RBC ratio is the minimum required to avoid regulatory measures, while Lincoln National's standard is much higher at 400%.

After the change in assumptions, Lincoln's RBC drops to 377%, prompting management to suspend share purchases, raise equity, and cut expenses. This loss also led Fitch Ratings to downgrade Lincoln's credit rating from stable to negative. In addition, the company was delisted from the Standard & Poor's 500 Index last year.

Lincoln has made great strides in capitalizing the rebuild.

Lincoln National Insurance Company has taken steps to improve its financial position. Last year, it agreed to sell its wealth management business to Osaic. This will result in a capital gain of $700 million, which will help improve Lincoln's statutory capital position and reduce its leverage ratio. These actions are already beginning to pay dividends. At the end of the fourth quarter, Lincoln's RBC ratio returned to the management target of 400%.

The company continues to shift its business groups to higher-margin businesses. On the fourth-quarter earnings call, Chief Executive Officer Ellen Cooper said the company was repositioning "product sales to be more capital efficient and have a higher risk-adjusted return". In addition, the company is taking steps to reduce costs, laying off 5% in February to further streamline operations.

Value Investment Opportunities

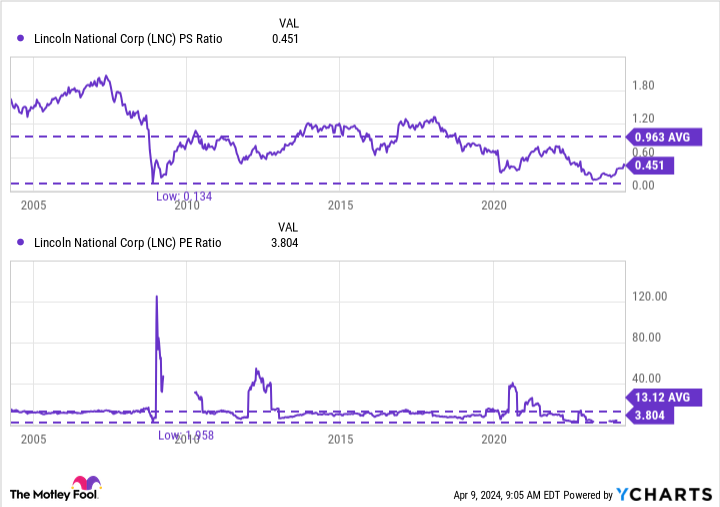

Lincoln National Bank is priced at a significant discount to its historical value. The company's price-to-sales ratio is 0.45 and the stock is at its lowest point since the 2008-2009 pandemic and financial crisis. Over the past two decades, the insurer's shares have traded at close to 0.97 times sales.

Moreover, its P/E ratio of 3.8 and one-year forward P/E ratio of 4.64 are well below the twenty-year average of 13.2. The insurer also has an attractive dividend yield of 5.9%, which is above the historical average due to the stock's low valuation.

Lincoln National Insurance Company's stock has faced significant headwinds over the past few years, but it now looks like things are looking up for the insurer. The insurer has improved its capital position and will continue to work to improve profitability and free cash flow over the next few years. This, along with its low valuation, makes Lincoln National an attractive value stock that investors should consider adding to their holdings today.

Should you invest $1,000 in Lincoln National now?

Before buying shares of Lincoln National, consider the following:

Motley Fool Stock AdvisorThe analyst team has just selected what they think is the best name for investors to buy now.10Only one stock, ...... Lincoln National Corporation, was not included. The 10 stocks that made the list could generate huge returns in the years to come.

Consider April 15, 2005NvidiaOn the list at ...... If you invest $1,000 at the time of our recommendation, theYou'll have $533,869.! * *

Stock AdvisorIt provides investors with an easy-to-learn blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Stock Advisor The service has contributed to the S&P 500 Index's return since 2002.translate twiceMuch*.

View 10 Gift Certificates

*Stock Advisory Rates as of April 8, 2024

Courtney Carlsen does not own any of the stocks listed above.The Motley Fool recommends Aflac.The Motley Fool has a disclosure policy.

Is it time to buy this cheap dividend stock that's down 55% since 2022 and yields 6%? This post was originally published by The Motley Fool.