.

Better High-Yield Telecom Dividend Stocks: Verizon or AT&T?

Usually, forVerizon Communications (NYSE: VZ)respond in singingAT&T (NYSE: T)Interested investors are most concerned about their dividends. Neither company has a strong growth pattern and both stocks have relatively high yields.

So, let's see which stock is best suited for the income-driven investor.

pre-dividend

Verizon and AT&T have similar dividend yields; Verizon's current quarterly dividend is $0.665 per share with a yield of about 6.31 TP3T, while AT&T's quarterly dividend is $0.2775 per share with a yield of about 6.41 TP3T.

However, Verizon's dividend growth has been more consistent. Last September, the company raised its dividend, marking the 17th consecutive year of dividend increases. During that time, the company's quarterly dividend has increased from $0.43 in 2007 to $0.43 today.

On the other side of the coin, AT&T cut its dividend by nearly half from $0.52 in 2022. The company has not raised its dividend since the cut. However, the dividend cut is not an isolated incident. WarnerBrother DiscoveryCompany ((NASDAQ resonance stock code: WBD)Sells its position in theWarnerMedia split intoWarner Brothers found it.The dividend was reduced at the same time as the interest in the company was reduced.

The best way to determine the safety of each company's dividend is to see how well its cash flow covers the dividend.

In 2023, Verizon generated $37.5 billion in operating cash flow. At the same time, it pays a dividend of just over $11 billion. The dividend cover is 3.4 times. AT&T's operating cash flow in 2023 is $38.3 billion. It pays a dividend of $8.1 billion. The dividend cover is 4.7 times.

At present, both companies have very high dividend cover. This gives both companies ample cash flow to invest in their businesses, pay down debt, and even buy back stock.

Another factor that affects the dividend is debt and leverage. In order to maintain the dividend, a company needs to keep its leverage within a reasonable range Verizon ended the year with $148.6 billion in debt and a leverage ratio (net debt/adjusted EBITDA) of 3.1x. For unsecured debt, the leverage ratio was 2.6x. For unsecured debt, the leverage ratio was 2.6x, and Verizon's long-term goal is to reduce its unsecured debt leverage ratio to 2x.

AT&T's net debt at the end of 2023 is USD 130.6 billion. Its year-end leverage ratio was 3x. The company expects leverage to fall to 2.5x by the first half of 2025.

While both companies would like to reduce their leverage, with their current cash flows, both companies can easily pay down their debt while paying dividends.

Seeking Growth

In 2023, AT&T outperformed Verizon on the growth side of the equation, with overall revenues increasing by 1.41 TP3T to $122.4 billion. Verizon's revenue declined by 2.11 TP3T to $134 billion. In the important wireless business, AT&T's revenue grew by 4.4%, while Verizon's wireless service revenue grew by 3.2%.

In 2023, AT&T added 1.7 million postpaid wireless subscribers, along with 1.1 million new AT&T fiber subscribers, while Verizon added 2.0 million postpaid wireless subscribers and nearly 1.2 million retail broadband subscribers.

Looking forward, AT&T expects wireless revenue growth of approximately 3% in 2024, and Verizon expects wireless service growth of 2% to 3.5%.AT&T expects adjusted EBITDA growth of approximately 3%, and Verizon expects adjusted EBITDA growth in the range of 1% to 3%.

Currently, both companies are looking to achieve modest revenue growth.

AT&T overtakes Verizon

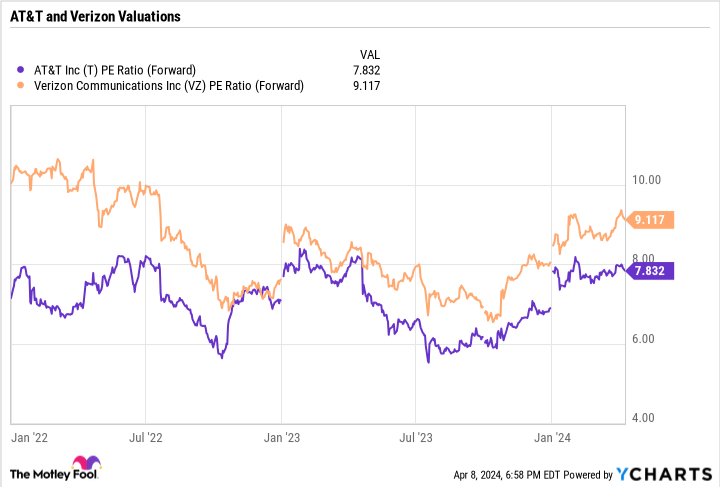

In terms of dividend yield, dividend coverage, balance sheet strength, and revenue growth, AT&T slightly outperforms Verizon on all fronts, though the difference is generally small. However, from a valuation perspective, AT&T is clearly the cheaper stock, with a forward P/E of less than 8x versus more than 9x for Verizon. The valuation gap may be due to AT&T's previous dividend cut, but the gap is narrowing.

Given its lower valuation and slightly better metrics, AT&T looks like a better buy for dividend-paying shares than Verizon at this time.

Should you invest $1,000 in AT&T now?

Before buying AT&T stock, consider the following:

Motley Fool Stock AdvisorA team of analysts have just selected what they believe to be the most popular analysts in the world at the moment.-est (superlative suffix)The name of the person is suitable for the investor to purchase10Only ...... and AT&T were not among them. The 10 stocks that made the list could generate huge returns in the years to come.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View these 10 stocks

*Stock Advisor's Circular as of April 8, 2024

Geoffrey Seiler holds shares of Warner Bros. Discovery.The Motley Fool holds shares of Warner Bros. The Motley Fool recommends Verizon Communications.The Motley Fool has a disclosure policy.

Better High-Yield Telecom Dividend Stocks: Verizon or AT&T?Verizon or AT&T?Originally Posted by The Motley Fool