.

Two No-Frills Artificial Intelligence (AI) Stocks to Buy Now

Savvy investors know that buying stocks of companies that provide "logs and shovels" is a proven wealth accumulation strategy when a gold rush is underway. Speaking of the artificial intelligence (AI) boom, it's the computing infrastructure that makes the game-changing technology possible. Think chips and computer servers, not logs and sieves.

If this lower-risk approach to investing sounds appealing, read on to learn about two major AI infrastructure providers with particularly attractive growth prospects. Shares of both companies are compelling buys today.

1. Arm Holdings

Arm Holdings (NASDAQ: ARM)With a staggering 30.6 billion chips shipped in fiscal 2023, the company has a presence in virtually every technology-focused market. From personal computers (PCs) and data centers to smartphones and self-driving cars, demand for Arm's high-performance semiconductor technology is rising rapidly.

Many leading chip makers use Arm's architecture to develop their products. In September of this year, theApple Inc.extended its relationship with Arm, which will allow the tech giant to incorporate Arm's intellectual property into its customized chips for the popular iPhone and Mac until at least 2040. in November.Microsoftannounced that it will offer new Arm-based chips for its cloud computing services. In March.Nvidia) debuted a powerful Blackwell high-performance computing platform powered by Arm processors. Arm estimates that 70% of the world's population is using products made with its technology.

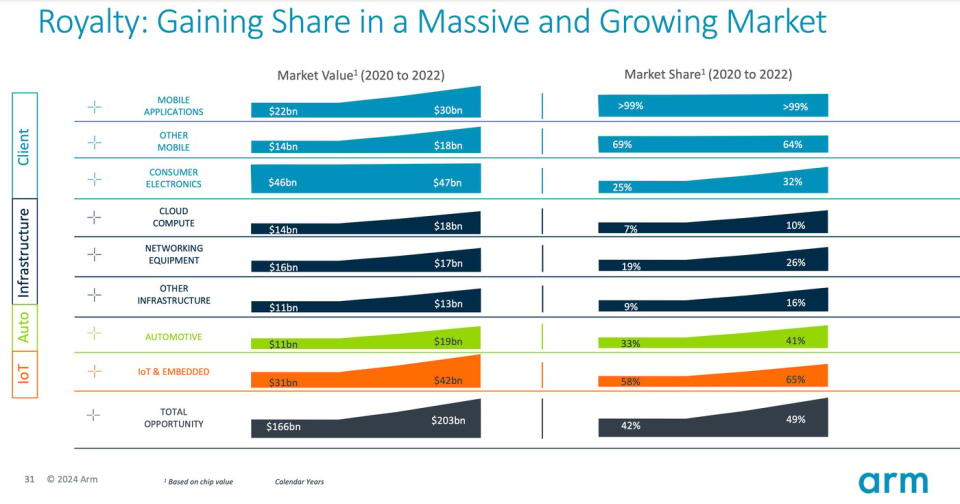

In addition, Arm is gaining market share in all of its key markets as its silicon architecture combines performance, efficiency and cost effectiveness.

Expanding market share drove strong sales and earnings growth for Arm. For the quarter ended December 31, revenue increased 141 TP3T to $824 million and adjusted net income jumped 361 TP3T to $305 million.

Increased spending on artificial intelligence solutions is driving Arm's growth." In a letter to shareholders, Rene Haas, Simmons Executive Officer, and Jason Child, Simmons Chief Financial Officer, said, "We see the need for Arm technology to enable AI everywhere, from the cloud to the edge of the hand.

In turn, Arm's sales are likely to accelerate. The company expects revenue growth of up to 42% in the fourth quarter.

"We believe that AI is the most profound opportunity we've ever had, and we're just now getting started," Haas said in an interview with Bloomberg in February.

2. Supermicrocomputer

Chipmakers aren't the only ones benefiting from the AI gold rush. Demand for high-performance servers, data storage systems and other AI-focused computing infrastructure is also soaring.Supercomputer, Inc. (Super) Micro Computer (NASDAQ resonance stock code: SMCI)is helping customers deliver the innovative hardware solutions they need for their AI ambitions, and the business is thriving.

This server specialist is closely associated with Nvidia. In turn, the unlimited demand for Nvidia's 耑 processor drove sales of complementary computing hardware from Supermicro, as the company is known.

In the second quarter of fiscal 2024, which ended on December 31, Supermicro's sales jumped 103% year-over-year to $3.7 billion. Even more encouraging, the company's net income jumped 681 TP3T to $296 million, even as it ramped up production.

Strong industry performance, coupled with encouraging ongoing sales trends, prompted management to raise its full-year revenue forecast to $14.3 billion to $14.7 billion, up from its previous estimate of $10 billion to $11 billion. This would more than double the company's fiscal 2023 sales of $7.1 billion.

In addition, Supermicro's stock price has fallen from its recent highs following the March stock offering. However, the stock sale raised approximately $1.7 billion, which the company can now use to strengthen its production network and fund other expansion plans.

These growth investments should be very fruitful for Supermicro's shareholders. According to Global Market Insights, the AI server market is expected to grow from $38 billion in 2023 to more than $177 billion by 2032. As Supermicro strives to meet the huge demand for its AI tools, investors who buy Supermicro stock today at a discounted price should be well rewarded.

Should you invest $1,000 in a supercomputer company right now?

Consider this before buying shares of Supercomputer, Inc:

Motley Fool Stock AdvisorA team of analysts have just named what they think are the best values for investors.10Only ...... and SuperMicroComputers are not among them. The 10 stocks that made the list are poised to bring huge returns in the years to come.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 8, 2024

Joe Tenebruso does not own any of the stocks mentioned above. the Motley Fool holds recommendations on Apple, Microsoft and INVISTA. the Motley Fool recommends the following options: long Microsoft Jan 2026 $395 calls and short Microsoft Jan 2026 $405 calls. the Motley Fool has a disclosure policy. The Motley Fool has a disclosure policy.

Two Artificial Intelligence (AI) Stocks to Buy Right Now Without Breaking the Bank was originally published by The Motley Fool.