.

Where Will Amazon Stock Be in 5 Years?

Over the past few months.Amazon (NASDAQ resonance code: AMZN)Shareholders of the stock are happy. The stock has risen 45% in the last six months and 22% year to date.

With a market capitalization of $1.93 trillion, Amazon's stock recently surpassed its all-time high set in 2021 as investors have become increasingly optimistic about the profitability of its e-commerce business and the resurgence of growth in the cloud computing space as a result of the recent boom in artificial intelligence (AI).

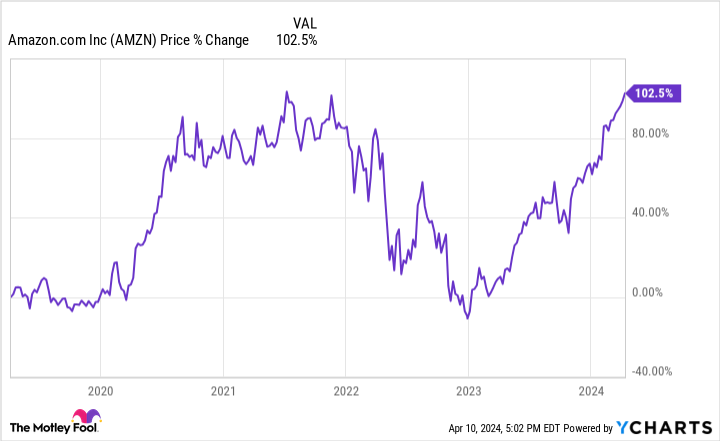

Amazon's stock price has risen 100% in the past five years, but what will happen in the next five years? Will it be able to repeat this glorious performance and translate again? Let's take a look.

E-commerce profit clutches, more growth in the future

Even though the online store has been in operation for nearly 30 years, Amazon's e-commerce and global retail business continues to grow at a rapid pace. in 2023, North American sales grew by 121 TP3T to $353 billion, and the international business grew by 111 TP3T to $131.2 billion.

Despite the fact that Amazon's platform is such an important part of the e-commerce landscape, it is estimated that online shopping currently accounts for only 15.6% of retail sales in the U.S. If that number continues to rise over the next 10 to 20 years, and Amazon maintains its market share, there are still plenty of years left to increase sales.

The biggest bright spot in the growth of Amazon's eCommerce division is where it comes from. Third-party seller services grew 191 TP3T year-over-year last quarter, and advertising services grew 261 TP3T. These high-margin segments, if they can keep up their rapid growth, can drive overall profitability.

That's exactly what we're seeing today. in Q4 2023, North American operating margins reached 6.11 TP3T, up in each of the last six quarters, reversing a negative 0.31 TP3T in Q4 2022. in 2024, investors should look for e-commerce margins to continue to rise.

Cloud Computing Rebound

The company's most profitable division is its cloud computing arm-Amazon Web Services (AWS.) In 2023, it generated more than $90 billion in sales, $24.6 billion in operating income, and a profit margin of 27.11 TP3T.

However, as early as late 2022 and early 2023, there were significant concerns about AWS' slowing growth. Revenue growth rates fell from 28% in Q3 2022 to 12% in Q2 2023 as the company helped its software customers save money after the peak of the pandemic.

Today, those fears have been proven to be overly pessimistic. aws revenue growth accelerated in the fourth quarter to $13%, which sent the stock higher. The revenue outlook for 2024 and 2025 is favorable with the rapid rise of artificial intelligence services. These new products require a lot of cloud computing to run, and AWS is looking to partner withAlphabet The Google Cloud andMicrosoftTogether with Azure, the company is one of the leaders in this field. For example, the company has signed an extensive agreement with fast-growing startup Anthropic.

Analysts predict that cloud computing will continue to rise at double-digit annual growth rates over the next decade and beyond. If Amazon can maintain its market share leadership, as it has in e-commerce, the future of AWS is unlimited.

Where will Amazon's stock price be in five years?

To estimate where Amazon's stock price will be in five years, we need to make some estimates for e-commerce and AWS profits. We assume that e-commerce (excluding unprofitable international business) grows at a 12% annualized sales growth rate over the next five years, with margins expanding to 10%, which would lead to North American retail profits of $62 billion in 2028.

This is also true for AWS, which is assumed to grow at 12% over five years and maintain a profit margin of 27%. By 2028, AWS profits will reach $43 billion. Adding these two figures together, Amazon's earnings will reach $105 billion in 2028, not including earnings growth from other divisions such as international e-commerce or satellite Internet services.

Here comes the hard part: what is Amazon's 2028 earnings multiple? The exact answer is impossible, but with its broad competitive advantages in cloud computing and e-commerce, I think the stock should command a price-to-earnings ratio of 30 times above the market, or price-to-earnings (P/E).

Multiply $105 billion by 30 and you get a market capitalization of $3.15 trillion, or an upside of 66% from today's price. while not translating, it appears that Amazon still has upside for long term shareholders.

Should you invest $1,000 in Amazon right now?

Consider this before buying Amazon stock:

Motley Fool Stock AdvisorA team of analysts have just selected what they believe to be the most popular analysts in the world at the moment.-est (superlative suffix)The name of the person is suitable for the investor to purchase10Only ...... and Amazon is not one of them. The 10 stocks that made the list could generate huge returns in the coming years.

Consider April 15, 2005Nvidia) when it was on the list ...... If you invested $1,000 at the time of our recommendation.You will have 540,321dollar! *Stock Advisor provides easy-to-use stock investment tools for investors.

Stock AdvisorIt provides investors with an easy-to-learn blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Stock Advisor The service has contributed to the S&P 500 Index's return since 2002.translate twiceMuch*.

View these 10 stocks."

*Stock Advisor's Report as of April 8, 2024

Suzanne Frey, an Alphabet executive, is a member of The Motley Fool's board of directors. John Mackey, former chief executive officer of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. brett Schafer owns shares of Alphabet and Amazon. the Motley Fool owns and recommends shares of Alphabet, Amazon, and Microsoft. the Motley Fool recommends the following options: Microsoft 2026, Microsoft 2026, Microsoft 2026, and Microsoft 2026. The Motley Fool recommends the following options: Microsoft January 2026 $395 Call Option Long and Microsoft January 2026 $405 Call Option Short. The Motley Fool has a disclosure policy.

Where Will Amazon Stock Be in 5 Years? This post was originally published by The Motley Fool.