.

1 Cheaply Valued Artificial Intelligence (AI) Stocks to Buy Before April 18

Buying an Artificial Intelligence (AI) stock with an attractive valuation and impressive growth rate may seem difficult right now, as companies that can capitalize on the technology have seen their share prices soar over the past year or so.

in order toNvidiaFor example, shares of Hewlett-Packard are currently trading at 71 times trailing earnings, but it's good to see that the chip maker's premium valuation is justified by its impressive growth. On the other side of the coin, artificial intelligence software companyPalantir Technologies) is also highly valued, but its growth has not been sufficient to justify its high multiples.

However, investors who are looking to combine growth and value in the AI space are in luck, as one company - theTaiwan Semiconductor Manufacturing Co. (Taiwan) Semiconductor Manufacturing(math.) genus(NYSE: TSM)Commonly known as TSMC(TSMC)-Not only is it cheap now, but it also appears to be poised for impressive growth. Let's take a look at why investors should consider buying this stock before the company releases its first-quarter 2024 business results on April 18th.

TSMC to Deliver Stronger Than Expected Growth

In January of this year, when TSMC released its fourth-quarter 2023 financial results, the company set its first-quarter 2024 revenue estimate at $18.4 billion, which is at the midpoint of its forecast range.

However, monthly revenue statistics for the first three months of 2024 show that the company has far exceeded this target. What's more, the rate of revenue growth has accelerated month-on-month.

In January, TSMC's monthly revenue grew 8% year-over-year, followed by a 11% increase in February, and an even better 34% year-over-year increase in March. As a result, first quarter revenue was US$18.86 billion, an increase of nearly 14% year-over-year, and exceeded the consensus estimate of US$18.26 billion.

The full quarterly results are due out on April 18, and it's not surprising to see the stock soar once they're released. That's because demand for AI chips in a variety of applications is driving TSMC's growth in even bigger ways, as its March quarterly revenue tells us.

AI chip market's constant growth will become TSMC's "tailwind

Appleis TSMC's largest customer, accounting for 25% of its sales. but the smartphone maker has struggled to deliver growth, as its recent industry results show.

In addition, Apple will begin ramping up production of the iPhone in the second half of the year, and TSMC will provide chips for Apple. As a result, the chipmaker's sharp increase in revenue last month can be attributed to Nvidia, one of its top seven customers,AMD,Intel),Qualcomm(math.) andBroadcom) and other companies are in booming demand.

All of these chipmakers are focusing on delivering new AI chips while increasing production of existing products to meet strong customer demand. This is why TSMC is rapidly increasing its production capacity. TSMC's advanced chip packaging capacity is expected to double this year to 240,000 chips from 120,000 last year, driven by demand from Nvidia, which accounts for an estimated 60% of its advanced chip packaging capacity.

On the other hand, Intel recently announced a new AI gas pedal called "Gordy 3", which is based on TSMC's 5-nanometer manufacturing process. Intel has already begun shipping samples of the chip, which is expected to go into full production in the third quarter of 2024. Meanwhile, interest in Broadcom's custom AI processors is growing, and the company recently gained a new customer.

Similarly, Qualcomm is expected to benefit from the growing use of AI in smartphones and PCs. In total, TSMC is well-positioned to capitalize on the long-term growth of the AI chip market, especially considering that it is the world's leading semiconductor foundry, with an estimated market share of 61%, which far outstrips second-place Samsung's 11%.

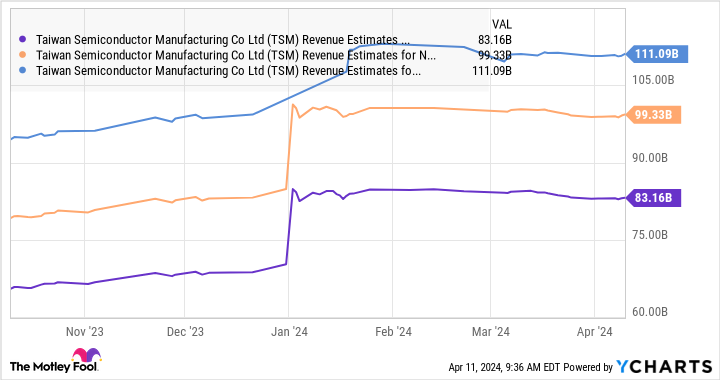

Considering that the global AI chip market is expected to grow at a rate of 38% per year through 2032, TSMC is likely to maintain its impressive momentum. The chart below shows that analysts expect TSMC's revenue to grow strongly from last year's $69.3 billion in 2024 and beyond.

So, given its attractive valuation, it seems like a good time to buy this semiconductor stock. TSMC's current price-to-earnings ratio of 29 times is lower than that ofNasdaq Resonance 100 The index is trading at a price-to-earnings ratio of 30 times (using the index as a proxy for technology stocks). 24 times forward earnings is also lower than the Nasdaq Resonance 100 Index.

What's more, TSMC's stock price is much cheaper than INVISTA's, which means a lower investment cost for TSMC in the AI chip boom.

Moreover, the evidence also suggests that TSMC is a critical player in the AI chip market, and it appears to be built for long-term growth, which is why investors would be well advised to buy this AI stock before it jumps higher (and gets expensive) after making a 40% gain year-to-date in 2024.

Should you invest $1,000 in Semiconductor Manufacturing Corporation now?

Please consider the following before buying shares of Taiwan Semiconductor Manufacturing Co:

Motley Fool Stock AdvisorThe analyst team has just selected what they believe is the current trend of-est (superlative suffix)Worth investing in10Taiwan Semiconductor Manufacturing Corporation is not one of the 10 stocks listed on ....... These 10 stocks could generate huge returns in the years to come.

Consider April 15, 2005Nvidia) on the list at ...... If you invested $1,000 at the time of our referralYou will have 540,321dollar! *Stock Advisor provides investors with easy-to-use stock investment tools.

Stock AdvisorIt provides investors with an easy-to-learn blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Stock Advisor The service has contributed to the S&P 500 Index's return since 2002.translate twiceMuch*.

View 10 Gift Certificates

*Stock Advisory Rates as of April 8, 2024

Harsh Chauhan doesn't own any of these stocks. The Motley Fool recommends Advanced Micro Devices, Apple, Nvidia, Palantir Technologies, Qualcomm and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom and Intel, and recommends the following options: Intel January 2023 $57.50 Call Option Long, Intel January 2025 $45 Call Option Long, and Intel May 2024 May Option Long. The Motley Fool has a disclosure policy.

1 Cheaply Valued Artificial Intelligence (AI) Stock to Buy Before April 18 was originally published by The Motley Fool.