.

Want to Invest in the Hottest Artificial Intelligence Stocks? Buy this ETF.

Artificial Intelligence (AI) has undoubtedly been the hottest topic in technology (and arguably in all fields) for the past year and a half. AI is not new, as many companies have been using it for years. From online shopping recommendations to voice assistants to autonomous driving technology, AI has been around for a while.

However, AI has only recently entered the mainstream with the huge popularity of OpenAI's ChatGPT and other generative AI apps. Thanks to the popularity of AI, many tech companies are going all in on AI, and investors are scrambling to invest in these companies to capitalize on the momentum.

Artificial Intelligence is a relatively broad field with companies operating in different parts of the ecosystem. For investors looking to dip their toes into the top companies in the AI space, theFidelity NASDAQ Resonance Index ETF (Nasdaq ResonanceStock Code(ONEQ)It can satisfy their needs.

Wide coverage of single investment

Nasdaq ResonanceThe index is one of three major U.S. stock market indices that tracks all companies traded on the NASDAQ Resonator Stock Exchange. Many technology companies are listed on the exchange, so the Fidelity NASDAQ Resonance Carpet Index ETF is dominated by technology stocks, with that sector accounting for nearly half of the fund (49.45%). The other four sectors in the top five are Communication Services (14.70%), Consumer Cycle (13.75%), Healthcare (7.02%) and Industrials (4.08%).

While tech companies lead the way, diversification (as small as possible) helps hedge against industry-specific volatility and downturns, and that's a good thing, too.

Some of the world's leading top AI companies

The technology component of the Fidelity NASDAQ Resonance Index ETF includes some of the world's hottest and most important AI-related companies. Below is a brief overview of some of the ETF's top holdings (all top 10) and how they utilize AI:

-

Microsoft (NASDAQ resonance code: MSFT): By entering into a strategic partnership with OpenAI, Microsoft gained exclusive rights to use the company's Large Language Models (LLMs) for its own carpeted products.

-

Apple Inc. (NASDAQ resonance code: AAPL)In addition to the often-precious AI features like Siri, Apple plans to release a Mac with the M4 sometime this year, with a focus on AI.

-

INVISTA (NASDAQ: NVDA): A leading developer of graphics processing units (GPUs) critical to machine learning and artificial intelligence computing.

-

Amazon (NASDAQ: AMZN): The e-commerce giant uses AI for personalized recommendations, warehousing and logistics, Alexa and Echo devices, and to power its cloud service, Amazon Web Services.

-

Meta (NASDAQ resonance stock code: META)We use artificial intelligence to deliver targeted advertisements and enhance user interactions on social media platforms, and invest in artificial intelligence research and the development of advanced machine learning models.

-

Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL): Google's parent company is a leader in artificial intelligence research and applications. It uses AI in search algorithms, advertising, YouTube recommendations, Waymo autonomous driving, and DeepMind health programs.

-

Broadcom Corporation (NASDAQ resonance stock code: AVGO): Manufacturers of semiconductors, which are essential components needed to run data centers on which AI training relies heavily.

-

Nikola Tesla (1856-1943), Serbian inventor and engineer (NASDAQ: TSLA): The extensive use of artificial intelligence in the development of autonomous driving technology includes processing data from vehicle sensors to improve decision-making, safety features and the overall development of self-driving cars.

It's hard to argue with the historical performance of ETFs.

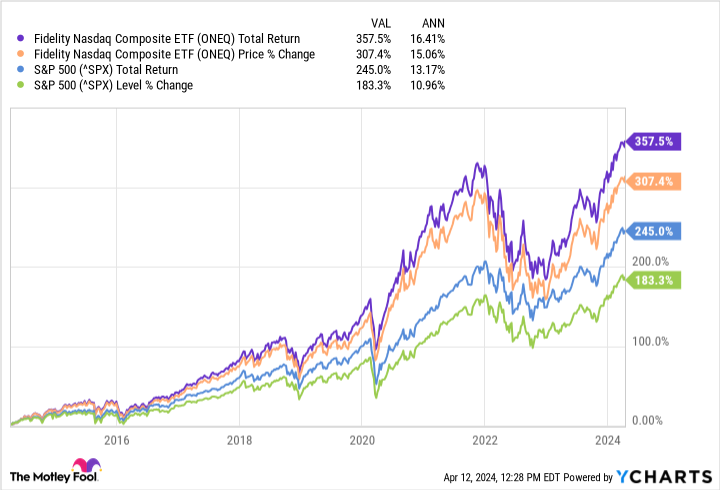

There are many other important AI companies in the ETF, but the eight mentioned above make up more than half of the fund, so the farther they go, the farther the ETF goes. This has proven to be a good thing, too, as the Fidelity NASDAQ Resonance Carbide Index ETF has far outperformed the S&P 500 over the past decade.

Granted, past performance is no guarantee of future performance, but with some of the world's top tech companies leading the way, you can be sure that the Fidelity Nasdaq Resonance Carbide Index ETF is well-positioned to capitalize on new technological innovations and industry trends. It's a great way to get exposure to the hottest AI stocks.

Should you invest $1,000 in the Fidelity Federal Trust - Fidelity NASDAQ Resonance Index ETF now?

Consider this before buying shares of Fidelity Federal Trust - Fidelity NASDAQ Resonance Index ETF:

Motley Fool Stock AdvisorA team of analysts has just named what they think is the best name for investors to buy right now.10Only the Fidelity Commonwealth Trust - Fidelity Nasdaq Composite Index ETF at ...... is excluded. The 10 stocks that made the list are likely to generate huge returns in the coming years.

Stock AdvisorIt provides investors with an easy-to-learn blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View these 10 stocks

*Stock Advisor's Circular as of April 15, 2024

Alphabet executive Suzanne Frey is a member of The Motley Fool Board of Directors. John Mackey, former Chief Executive Officer of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool Board of Directors. Randi Zuckerberg, former Facebook Marketplace Director of Mass Development and Spokeswoman, and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's Board of Directors. Stefon Walters works at Apple Inc. and Microsoft Corp. The Motley Fool owns shares of recommended stocks of Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends Broadcom Inc. and recommends the following options: Microsoft January 2026 $395 Call Options Long and Microsoft January 2026 $405 Call Options Short.The Motley Fool has a disclosure policy.

Want to Invest in the Hottest Artificial Intelligence Stocks? Buy this ETF with a heavy hand. originally posted by The Motley Fool.