.

Investors are chasing big companies in the artificial intelligence space. But these two lesser-known companies are the AI stocks to buy right now.

When my 94-year-old grandfather asked me about Artificial Intelligence (AI) (just last week), I believe it's safe to say that AI is the hottest trend in business and investment today. However, such a high level of interest can lead to high expectations. And high expectations often lead to overvalued stocks.

Unfortunately for investors, many companies are exaggerating their AI capabilities - a situation that has gotten so bad that the Securities and Exchange Commission (SEC) has begun investigating false claims. Fakers obviously don't make good AI investments. But good AI companies that are carriers may not be good investments today, either, because of their high valuations.

That's why I'm going to highlight the following todayAppLovin (NASDAQ resonance stock code: APP)respond in singingXometry (NASDAQ Resonance Symbol: XMTR)These are two little known companies. Both of these companies are AI stocks in Hefei. But both companies are unknown and probably undervalued, so they are better buys now.

1. AppLovin

AppLovin has about 200 mobile games, which will generate more than $1.4 billion in revenue in 2023. But Koon doesn't intend this to be a long-term business model - in fact, the company would be willing to sell the apps outright if it could find a buyer. Instead, the company is developing the apps to help collect data and train artificial intelligence models for its software business.

The company wants users to be able to find, download and use their apps, and they've asked AppLovin for help. The company's AppDiscovery software product is powered by artificial intelligence, with the latest version launching in 2023. Based on revenue growth, I'd say this is an overnight success story. In 2023, AppLovin's software revenues grew 76% year-over-year to $1.8 billion.

What's exciting is that AppLovin is realizing this growth in the midst of an economic downturn in mobile apps. According to Statista, global mobile app spending in 2023 will be $171 billion. In 2021, this figure will be $170 billion. So while this sector is not growing, AppLovin is.

Equally exciting, AppLovin is also feeding the AI model. Koon hopes that it can build on that foundation and bring more discovery and profitability to its customers. If AppLovin can provide a better service to its customers, then it has a reason to take market share from its competitors.

AppLovin's software business has higher profit margins than its apps business. As a result, as the software business grows, so do the company's profits. in 2023, the company's net income exceeded $350 million, with nearly half of that coming in the fourth quarter.

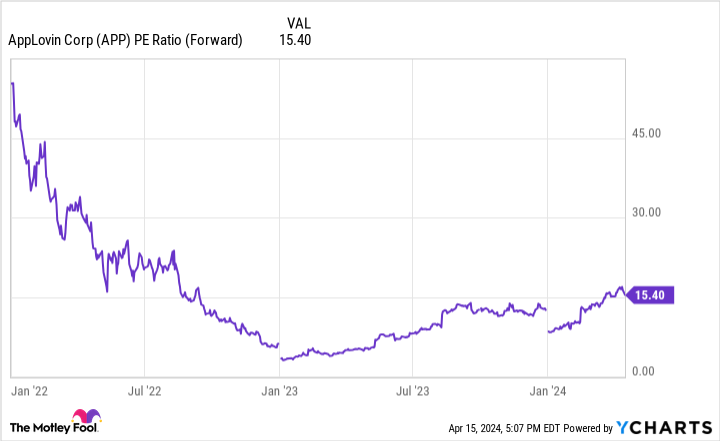

AppLovin's fourth-quarter results show strong momentum on the earnings front, and the trend is expected to continue. As a result, AppLovin shares trade at just 15 times expected earnings. This is a reasonable valuation for such a booming AI stock.

2. Xometry

Xometry hasn't jumped on the AI bandwagon. On the contrary, the company's entire business model has been dependent on AI since before it went public in 2021, before the AI trend really took off.

Xometry is in a manufacturing industry - an estimated $260 billion global market opportunity that has historically resisted technological disruption. But the company hopes its AI software will change the rules of the game.

In short, Xometry has an online marketplace where people who need customized production can bid on it instantly. The company's artificial intelligence provides buyers with real-time pricing. The company then looks for third-party manufacturers who are willing to do the work for less than their quoted price, and Xometry makes money on the difference.

Not surprisingly, the effectiveness of the AI software will make or break Xometry. If the price is too low, third-party manufacturers won't want to take the job. But if the price is too high, Xometry won't have much room for profit. Its AI needs to find the sweet spot.

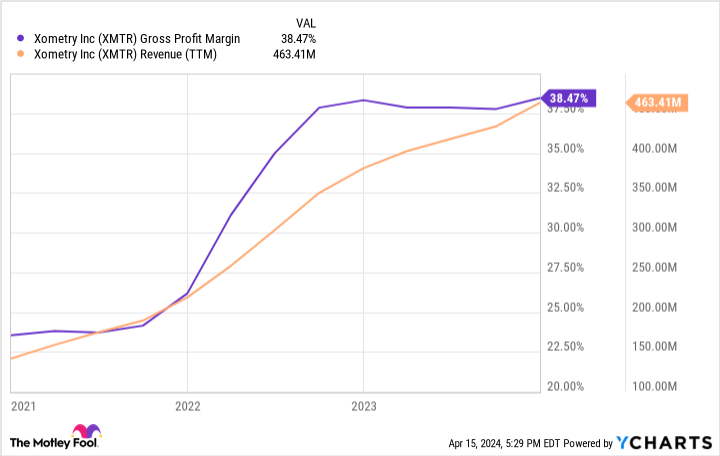

In my view, Xometry's start is encouraging. As the chart below shows, revenues continue to grow and gross margins have improved - the latter suggesting more rational pricing of its AI software.

Xometry is on the cusp of disrupting this lucrative market, and its financial data suggests that artificial intelligence software is increasingly up to the task. That alone is cause for investor concern. In addition, the company's stock is cheaply priced at less than twice sales.

I think AppLovin and Xometry stock are both good buys today. But more importantly, I want readers to be encouraged. Trends may be exciting, but that doesn't mean we have to buy a stock that is fundamentally overhyped and overvalued. For those who are willing to do a little digging, the better opportunities in hot trends may lie beneath the surface.

Should you invest $1,000 in AppLovin now?

Before buying shares of AppLovin, consider the following:

Motley Fool Stock AdvisorThe analyst team has just named what they believe to be the best value for investors.10AppLovin is not one of the 10 stocks listed on ....... The 10 stocks that made the list could generate huge returns in the years to come.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View these 10 stocks

*Stock Advisor's Circular as of April 15, 2024

Jon Quast has a position in Xometry. the Motley Fool does not own any of the aforementioned stocks. the Motley Fool has a disclosure policy.

Investors are chasing big companies in the artificial intelligence space. But these two lesser-known companies are the AI stocks to buy right now. This article originally appeared in The Motley Fool.