.

JPMorgan warns of growing disconnect between continued stock rally and delayed rate cuts

-

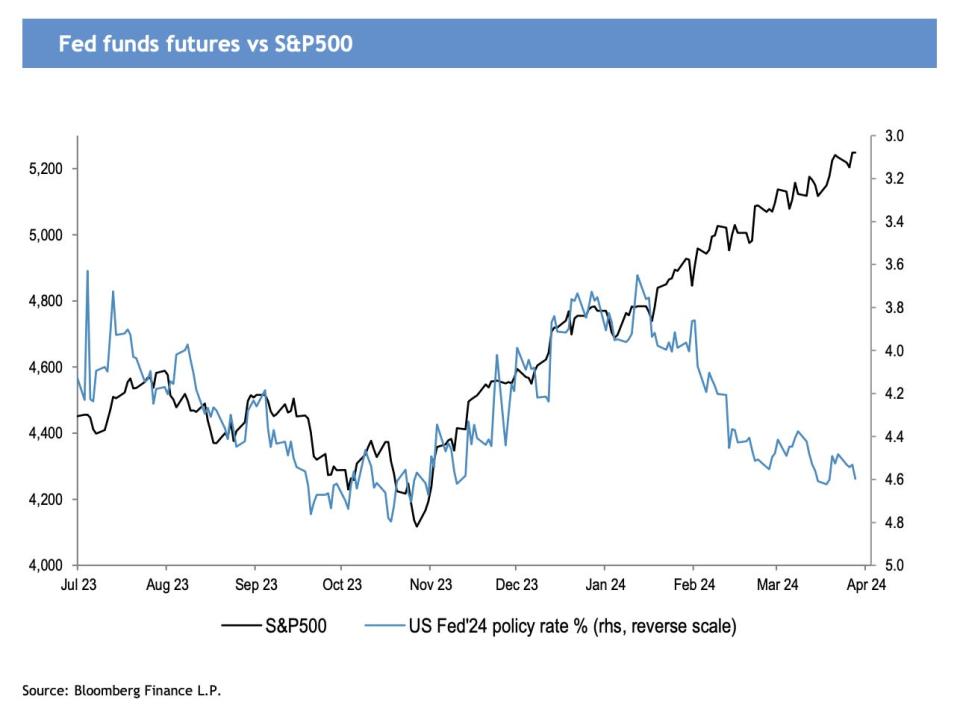

JPMorgan says the widening gap between the stock market's surge and the Fed's continued push to cut interest rates should be cause for concern.

-

The expected rate cut has dropped back to 80 basis points, reminiscent of the stock market downturn in October last year.

-

Analysts emphasized market growth expectations for the second half of this year, but warned against thinking this would boost earnings forecasts for 2025.

JPMorgan said it was worrying that the stock market was still setting records despite signs that a rate cut would be delayed.

JPMorgan's Mislav Matejka and his team noted in a research note sent to clients on Tuesday that stocks have surged 30% since the trough in October last year, which was largely driven by expectations of a rate cut in March. Three months later, however, those expectations have been pushed back considerably.

On closer inspection, Wall Street initially priced in an 80 basis point Fed rate cut during the October downturn. As the market surged, expectations were revised to 180 basis points in January when dovish sentiment peaked. Now, those forecasts have been revised back to 80 basis points.

"The stock market snubbed the recent pivot correction, which may have been a mistake," the analysts wrote in their report.

JPMorgan also believes that bond yields will head south in the second half of the year, but inflation swaps will also rise, which could further delay a rate cut. This, coupled with the fact that bond yields are again lower than expected, signals "a lot of complacency in the bond market on the inflation risk side".

Artificial intelligence-driven tech stocks are driving the S&P 500 to a wave of gains in 2024. Meanwhile, rising inflation has prompted the Fed to push its first rate cut from March to June. Even so, some analysts are predicting that a June rate cut is less than 50% likely due to the latest inflation index.

Matejka's team further noted that the assumption of market growth in the second half of this year does not imply an upward revision of earnings forecasts for 2025.

In addition, they emphasize that market complacency about downside risks is worrisome, and that recession odds of only 7% are likely to be understated. In addition, the uptick in cyclicals and defensive stocks reflects the levels seen during the recovery from the 2009-2010 global financial crisis, signaling potential consolidation.

"This one is unlikely to be a template and could be a headwind. The next time bond yields fall, we don't think the market will react as positively as it did in November-December - we may be looking at a more traditional correlation between yields and equities," the team added.

Read the original