.

Why Cardlytics Stock Surges 75% in the Last Month

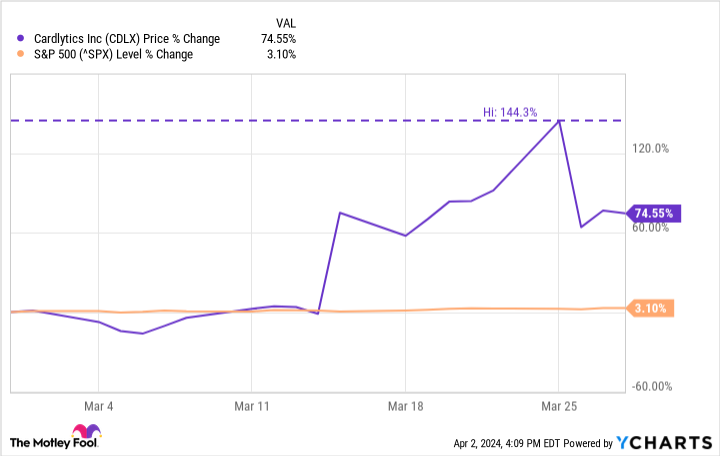

According to Standard & Poor's Global Market Intelligence (S&P Global Market Intelligence) )Data provided by adtech, Inc.Cardlytics (NASDAQ resonance code: CDLX)Shares of the company soared 74.8% in March, and investors were not at all optimistic about the company's prospects. But the company's latest financial report surprisingly showed modest growth and an improved financial position.

Cardlytics' partners are financial institutions, and the company's software helps them manage loyalty and rewards programs. This gives Cardlytics first-hand information about consumer spending. This valuable information is packaged for advertisers. Of course, there is a huge demand for this software.

On March 14, Cardlytics announced its Q4 2023 financials and its stock price skyrocketed. Monthly active users (MAUs) on its platform grew 7% year-over-year to 168 million. The increase in the number of users led to a revenue growth of 8%.

In addition, Cardlytics generated nearly $3 million in cash from operations (CFO) in the fourth quarter. That's not much. But it's a dramatic improvement over the negative CFO of $13 million in the same period last year. The top-line growth and bottom-line improvement surprised investors and sent the stock price soaring.

Unfortunately, the gains could have been much higher - as shown in the chart below, Cardlytics' stock price rose 144% at one point.

CDLX data provided by YCharts.

On March 26, Cardlytics shares fell by about a third after management announced a new financing plan. The company issued $150 million in convertible senior notes. Judging by the market's reaction, that poured cold water on investors' newfound optimism.

Does Cardlytics cost money?

In 2020, Cardlytics financed $230 million in convertible senior notes at a rate of just 1%. The problem is that these notes have an initial conversion price of $85.14 per share. That's not outrageous at the time. In fact, Cardlytics shares were trading at over $160 per share at one point. But at the current price, it's unrealistic to expect the conversion price to be reached before the June 2025 expiration date.

As a result, Cardlytics does need to refinance these notes. The company recently announced a $150 million note issue, which was later increased to $175 million. Koon's management quickly repurchased $184 million of the 2025 notes. However, investors were not thrilled with the new notes, which carried an interest rate of 4.25% and an initial conversion price of only $18.02 per share.

Further, if these notes are converted prior to the 2029 maturity date, there will be a dilution effect on Cardlytics' shareholders.

What does this mean for investors?

In 2021, Cardlytics acquired Bridg for $350 million, which was likely overpriced based on its valuation at the time. The previous financing allowed it to complete the acquisition. I can understand investors not liking the high interest rate and potential dilution of the 2029 notes. But the company is just trying to fix its past mistakes, and there's no way around that.

Thankfully, Cardlytics has emerged from its struggles. Management's goal is to achieve modest growth on the top line and break-even on the bottom line by 2024.

Cardlytics will weather the storm. The question now is whether it can capitalize on its valuable first-party data set to deliver better growth and profits in 2025 and beyond.

Should you invest $1,000 in Cardlytics now?

Consider this before buying shares of Cardlytics:

Motley Fool Stock AdvisorA team of analysts have just selected what they believe to be the most popular analysts in the world at the moment.-est (superlative suffix)The name of the person is suitable for the investor to purchase10Only ...... and not Cardlytics. The 10 stocks selected will bring in great returns over the next few years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View these 10 stocks

*Stock Advisor's Circular as of April 1, 2024

Jon Quast does not own any of the shares listed above.The Motley Fool does not own any of the shares listed above.The Motley Fool has a disclosure policy.

Why Cardlytics Stock Surges 75% in the Last Month was originally published by The Motley Fool.