.

UK stock market lags France and Germany as companies pull out of London

The UK stock exchanges have fallen further behind their European counterparts as IPOs in continental Europe have become more sophisticated.

New listings in the first quarter had a market capitalization of nearly €5 billion (£4.3 billion) as European initial public offerings (IPOs) rebounded, but London accounted for just over €300 million of that, according to PricewaterhouseCoopers (PwC).

The European IPO boom has done little to dispel fears that the once dominant London stock market is struggling, as the starvation of outstanding shares continues.

German, Swiss and Greek stock exchanges all outperformed London as the IPO freeze triggered by gloomy economic data and high inflation began to thaw.

Skincare brand Galderma led the way with a blockbuster IPO on the SIX Swiss Exchange, raising €2 billion.

Deutsche Börse, long recognized as the LSE's main European competitor, also attracted two major new listings.

Renk, the German manufacturer of resonance engines, raised €450 million, while Douglas, the German perfume retailer, raised €890 million after its owner, CVC Capital, cashed out. Athens' Eleftherios Venizelos International Airport also went public.

Air Astana, the London-listed airline of Kazakhstan resonance, topped the list with €324 million in financing.

Continental Europe's prosperity has been led by domestic companies, and London remains the choice of international organizations, says Vhernie Manickavasagar, a partner at PwC's UK Carpet Markets.

"London continues to be a market that people look at outside of the domestic market," she said.

"The IPOs you see in Europe are domestic IPOs in domestic markets, and Air Astana has shown that London is still the market of choice for Europeans when they want to do an international IPO outside of the domestic market.

She added that the resurgence in continental Europe may prompt the UK board to consider a listing.

"People are now seeing that the market is bouncing back, but companies are only now starting to think about their processes, which means they won't be done until the end of the year.

"We (London) have some big changes coming up and people are looking at them in a way that hasn't happened to this extent in the European markets.

Better economic data has encouraged more companies to enter the stock market, which makes the lack of float on the London stock market all the more puzzling.

The dramatic volatility of the stock market has made companies reluctant to list in London for fear that their initial public offerings (IPOs) will go awry, but recently that fear has diminished.

Lower inflation and more predictable interest rates are expected to dampen volatility, opening the door for more new companies to go public.

One City of London broker blamed the drought on a lack of demand from UK fund managers, citing the current level of IPOs in the London market as "abysmal".

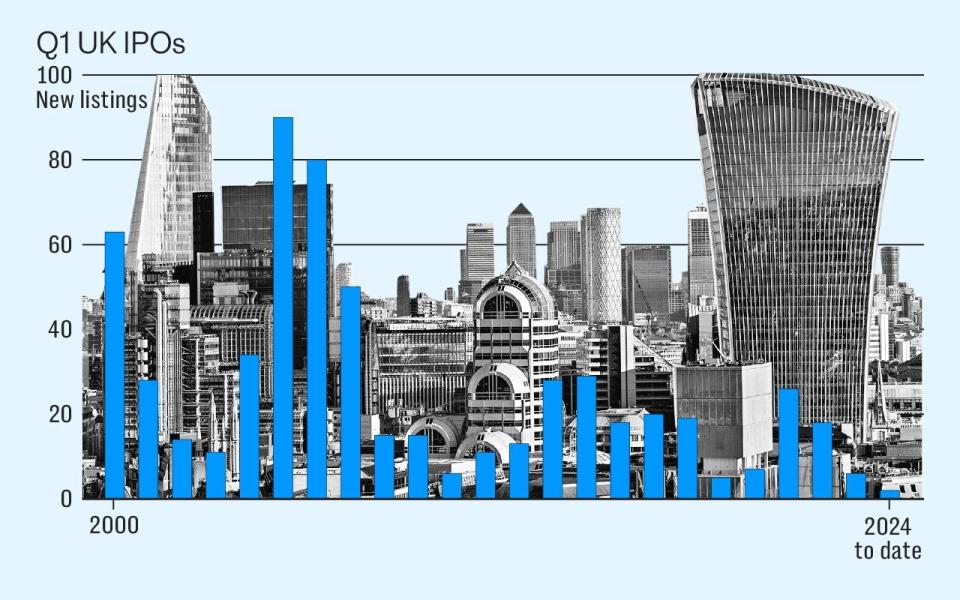

London's main markets welcomed just two new listings last quarter, according to Dealogic, the worst quarter for listings since the data firm began collecting data in 1995.

"There is no dearth of companies listed on the exchange," the broker said.

"It only takes one or two big companies to go public for the dominoes to start falling. The problem is demand. Good companies don't come because [fund managers] don't support them.

"They will only come to market if the demand problem is solved".

Jeremy Hunt, the UK Chancellor of the Exchequer, has proposed a series of reforms to try to tackle the problem.

The Edinburgh Reforms, a package of measures to remove cumbersome restrictions on company listings, combined with supply-side reforms such as Issa in the UK, attempted to lift the gloom that had fallen over the UK stock market.

Investment in UK equities has been declining for several years.

Numis estimates that there were again net outflows of around £2.6 billion from UK equity funds in March, bringing the total outflows for the year to £4.6 billion.

This means that there will again be a net outflow of capital in 2024, the ninth consecutive year since 2015 that UK equity funds have seen more outflows than inflows.

The less cash that flows into UK equities, the lower the valuations, ultimately making the UK market less attractive for companies to list.

The "Big Seven" of Amazon, Apple, Alphabet, Meta, Microsoft, Nvidia and Tesla are flying high in the NASDAQ resonance, making London even more unattractive, and thus making the valuation gap in the UK even more pronounced.

However, Gervais Williams, director of equities at Premier Miton and manager of the City Fund, says a string of failed initial public offerings has left many people skeptical about the quality of newly public companies.

"We've had a series of very bad IPOs," he said.

"For whatever reason, it is not working as well as it should, especially considering that we rate IPOs very highly and there are not many of them.

Major IPOs on the London market, such as CAB Payments, have left many fund managers scratching their heads. The stock was touted last year as a catalyst for the IPO renaissance, but it has fallen 60pc since listing.

Looking ahead, the prospects of London attracting large IPOs seem uncertain.

Union Hewlett-Packard's ice cream division may be listed in London, but Hein Schumacher, chief executive officer, recently said Amsterdam is the preferred location for the listing.

CVC, the private equity firm behind the Six Nations rugby tournament, will also list in Amsterdam rather than London, in another major blow to the capital.

Flutter Entertainment will change its primary listing from London to New York, while companies such as TUI have taken similar steps to change their primary listing to resonance in France.

In addition to this, other candidate companies may follow.

Last week, analysts at Deutsche Bank said FTSE 100 commodities trading giant Glencore could be the next company to move from London to New York.

The group has plans to spin off its coal division and list in New York rather than London, prompting speculation that the whole business could be listed from London.

However, Mr. Williams said there was still demand from fund managers for good companies, saying the Raspberry Pi's IPO could catalyze more companies to issue shares.

"I don't think the market is completely closed," he said." Obviously, you have to have some good issues and I think if you have two or three good issues, the market will open up again.

Broaden your horizons with award-winning British news. Try The Daily Telegraph for free for 3 months and get unlimited access to our award-winning websites, exclusive apps, money-saving offers and more.