.

Sweetgreen's stock price has doubled in just one month. But today, this understated pre-prandial is even more worth buying.

First Quarter 2024, Restaurants, Inc.Sweetgreen (New York Stock Exchange)Stock Code(SG)It's one of the stock market's best performers. As of this writing, shares of the salad-centric chain are up 1,15% year-to-date, doubling in the past month alone. Considering Sweetgreen stock has been trending downward since its IPO in 2021, this is a nice reprieve for shareholders.

Sweetgreen's stock price is starting to soar for some basic reasons, and that's a good thing. on February 29th, the company announced its Q4 2023 financial results, which showed a 29% year-over-year increase in revenue. Revenue for the fourth quarter was up 291 TP3T from a year earlier, but its pre-prandial margin jumped from 111 TP3T last year to 161 TP3T in the fourth quarter, which is a huge improvement.

As a result, Sweetgreen's financial position is already improving, which is why the stock has risen so much in recent weeks. Management hopes that the financials will continue to improve as it further develops robotic kitchens that will increase profitability.

However, if there is one aspect of Sweetgreen that I can criticize, it is its profitability. The company's economic outlook is promising, but its net loss for the year was still a whopping US$113 million. In other words, there is still a long way to go before its potential is realized.

For investors who like to invest in salads, there's another publicly traded company that has a great salad business. But fortunately, it does more than just salads. Today, the company's business is growing and generating profits for its shareholders.

Get to know another "salad stock."

Chicago.Portillo's (NASDAQ resonance code: PTLO)Famous for its hot dogs, crinkle cut fries and Italian beef sandwiches. But don't hold it against me for calling it a salad stock. According to Goon, its pre-preparation salad sales average $650,000 a year. By the end of 2023, Portillo's will have 84 locations, which means Portillo's is a $55 million salad brand.

Whereas, Portillo's sells much more than just salads. By 2023, its full menu will raise average annual sales per store to an impressive $9.1 million. Like Sweetgreen, these high sales bring the company the profitability of a pre-board noodle. But it's also enough sales to make the entire business profitable, which is huge for a one-unit chain with only 84 locations.

Investors should not overlook Portillo's long-term plans. Koon believes that one day it will have 600 studios, and it plans to open new ones in an orderly fashion to achieve that goal. It plans to open new stores in a systematic manner to achieve this goal. by 2024, the company hopes to open at least nine locations, which would mean nearly 11% of growth.

Portillo Prefabricated's revenue continues to grow through the opening of new stores and increased sales at older locations. In FY2023, revenues grew 16% to $680 million, and FY2024 is likely to see double-digit growth as well.

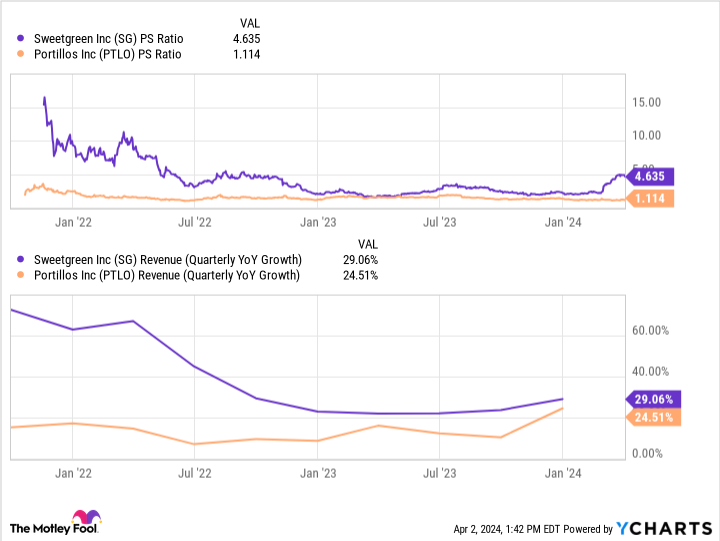

This is significant when comparing Portillo's to Sweetgreen, which is projected to grow revenues by up to 15% year-over-year in FY2024, which is comparable to the projected growth of Portillo's. However, from a price-to-earnings (P/S) valuation perspective, Sweetgreen is four times more expensive. However, from a price/earnings (P/S) valuation perspective, Sweetgreen's shares are four times more expensive.

Here's the thing: I don't think Sweetgreen's long-term opportunity is necessarily more attractive than Portillo's'. For its part, Sweetgreen is aiming for 1,000 locations, while Portillo's is aiming for 600. But given that Sweetgreen already has 220 stores to Portillo's' 84, Portillo's has a better chance of long-term growth from its current starting point.

Don't forget that Portillo's is currently profitable, with 12-month operating income of $55 million. In my opinion, that makes it the safer of the two.

As a result, Portillo's has grown at a relatively modest pace, has a much cheaper stock price, has a much more profitable business, and has relatively higher long-term growth potential than Sweetgreen's stock.

For these reasons, I think Portillo & Co. stock is clearly the better choice right now.

Should you invest $1,000 in Portillo Co. stock now?

Consider this before purchasing shares of Portillo & Company, Inc:

Motley Fool Stock AdvisorThe analyst team has just selected what they believe is the current trend of-est (superlative suffix)Worth investing in10Only ...... and Portillo's were not included. The 10 stocks that made the list could generate huge returns in the years to come.

Consider April 15, 2005Nvidia) on the list at ...... If you invest $1,000 at the time of our recommendation, theYou will have 545,088dollar! * *The

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Stock Advisor The service has contributed to the S&P 500 Index's return since 2002.translate twiceMuch*.

View 10 Gift Certificates

*Stock Advisory Rates as of April 4, 2024

Jon Quast does not own any of the above stocks.The Motley Fool recommends Sweetgreen.The Motley Fool has a disclosure policy.

Sweetgreen's stock has doubled in just one month. But this understated pre-prandial is now a better buy. Originally posted by The Motley Fool