.

Tesla shares down 6% this week as slowing electric car market hits sales, pricing and future strategy

Tesla shares slid 3.61 TP3T on Friday, ending a week in which the stock fell nearly 61 TP3T, with weakening demand for electric cars hitting sales and possible future product changes putting pressure on the stock.

On Friday, Reuters reported that Tesla canceled plans to build a long-awaited electric car (sometimes called the Model 2) for less than $30,000. Citing three sources familiar with the matter, Reuters said Tesla would instead focus on self-driving robot rentals. Elon Musk, Tesla's chief executive officer, said on X, the social media platform he owns, that Reuters was "lying again".

But in the first quarter, Tesla shares fell by nearly one-third, making it the worst-performing stock in the S&P 500, and the news capped a tough second quarter for the electric car giant.

But Tesla's bad week started on Tuesday, when it announced first-quarter delivery figures that were seriously below market expectations.

According to Bloomberg, Tesla delivered 386,810 vehicles worldwide in the first quarter, well below the expected 449,080. That number was down nearly 10% from the same period last year, when Tesla delivered 423,000 vehicles. Compared to the fourth quarter, Tesla's deliveries were down more than 20%.

The decline also marked the first year-over-year drop in first-quarter deliveries since 2020, when the U.S. was in the midst of a flu pandemic.

Tesla's mass deliveries also showed a sharp sequential decline compared to the record 484,000 units delivered in the fourth quarter.

"The discrepancy between deliveries and production implies an incremental inventory of around 46,000 units, which confirms that in addition to the known production bottlenecks (Freimantle and Berlin), there may be serious Demand.

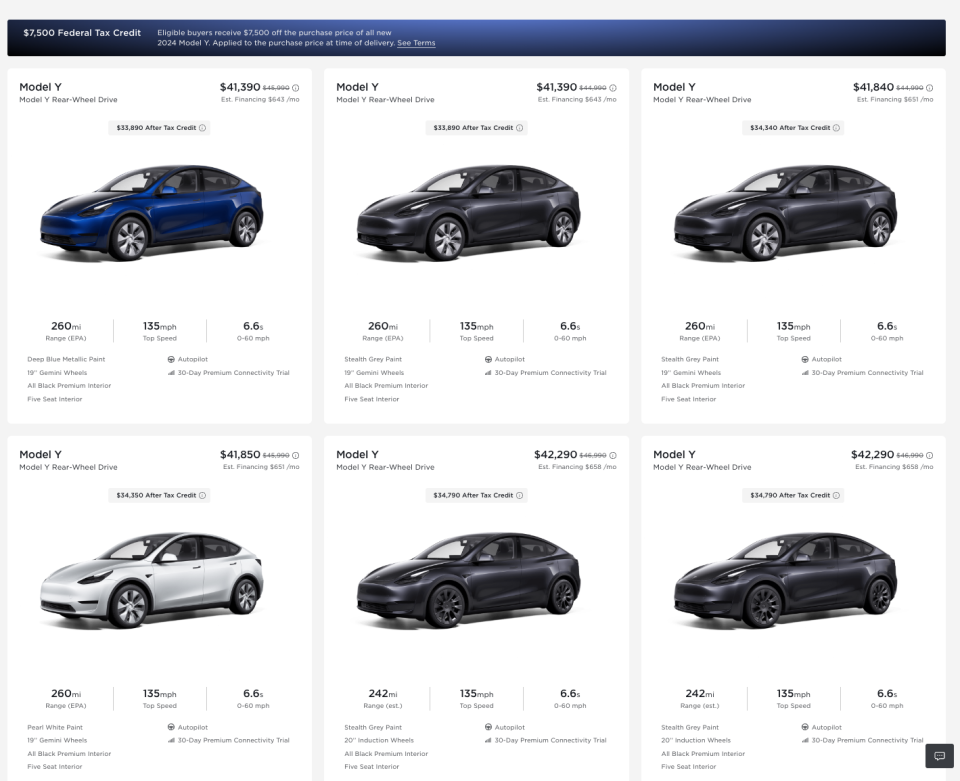

But just a day before Tesla reported disastrous first-quarter deliveries, the company actually raised the price of the Model Y, its most popular model.

In the U.S., Tesla has raised the price of all three models of its most popular Model Y SUV by $1,000. Tesla has done the same in China, raising the price of the Model Y Long Range by 5,000 yuan ($675) to $304,900 for the Model Y, and by 5,000 yuan to $368,900 for the Performance version.

Tesla subsequently backtracked.

In China, in addition to free trials of its self-driving software, the company has started offering new incentives such as zero-interest loans of varying lengths depending on the amount of the down payment. China's electric car market is one of the most competitive in the world, and with rival Xiaomi selling out its first model in 24 hours, Tesla may have to slash prices again to boost demand.

The situation in the United States is similar.

Despite the April 1 new order price increase, many Model Ys in Tesla's inventory are still available for thousands of dollars off MSRP. According to Tesla's website, Model Y SUVs in stock (such as the rear-wheel drive version) are $4,600 less than the custom order price, while the Long Range and Performance Model Ys are discounted by $5,000 in some cases, depending on location.

Tesla's performance this quarter was a big disappointment for investors.

CFRA analyst Garrett Nelson has been expecting Tesla's next-generation electric models to be a "catalyst" for this year's stock price decline. Friday's surprise report from Reuters challenges that view.

While resonance X's rebuttal suggests that some details may still be up in the air, drastically slashing the price of existing inventory and increasing incentives in China are not the kind of opening statement Wall Street wants to hear from Tesla for the new quarter.

"Demand is slowing, competition is fierce in China, and the European market hasn't grown in five quarters," Guggenheim analyst Ronald Jewsikow told Yahoo Finance Live on Thursday.

"Structurally, there are emerging risks in all three districts, and even if we move beyond the very confusing first quarter financial report, there is reason for concern."

Pras Subramanian is a reporter for Yahoo Finance. You can find more information on Twitter respond in singing Instagramfirst (of multiple parts)Concerned about himThe

Click here for the latest stock market news and in-depth analysis, including events affecting the stock market.

Read the latest financial news from Yahoo!