.

Genuine Parts Stock (NYSE:GPC): Dividend King Trading at a Discount

Genuine Parts(NYSE:GPC) is favored by income investors. It's a respected member of the elite group of stocks known as the "Dividend Kings". With 68 consecutive years of dividend increases, this specialty retailer of automotive, replacement, and industrial parts has one of the most commendable track records in the industry. As a result, the stock price is rarely discounted. With strong earnings growth contrasting sharply with last year's weak share price trend, the company's valuation has slipped to attractive levels. As a result, I am increasingly bullish on this premium carrier.

Dividend King Rarely Sold

Through my research on dividend growth stocks, I have come to realize that the elite members of the dividend stock universe rarely sell. These are often high quality companies with excellent track records in terms of earnings and dividend growth. As a result, investors are often willing to pay higher valuations for these stocks.

This would seem to be a major problem for the dividend aristocrats (those who have increased their dividends for more than 25 years and are members of the S&P 500 Index ("Dividend Aristocrats")).SPXThis applies to both the Dividend King (stocks that are members of the index) and the Dividend King (stocks that have had dividend increases for 50 years or more and are included in the index or not). As a result, I have found that buying these stocks as their valuations adjust to more reasonable levels is ultimately a wise decision.

I'm sure the same can be said for GPC stock today. Before we dive in, however, let me endorse the stock's almost unparalleled record of annual dividend growth. You see, Genuine Parts is not only "only" a "Dividend King" company - there are only 55 other companies that hold that title - but its 68-year record of dividend growth is the second longest in the world.

The only company with a longer dividend record is American States Water Co.(NYSE:AWR)Genuine Parts and Dover Corp. have been in business together for 69 years.(NYSE:DOV) and Northwest Natural Gas(NYSE:NWN) are in second place, and both companies have grown their dividends for 68 consecutive years.

When it comes to a high quality growth record, Genuine Parts has maintained a commendable growth rate over the years, despite being a well-established company with decades of sustained growth. Over the past 10 years, Genuine Parts has posted a compound annual growth rate (CAGR) of 7.8% in earnings per share and 5.9% in dividends per share, and FY2023 is no exception. In fact, EPS is at a new high and growth is even accelerating again.

FY2023: A Year of Record Earnings

As mentioned earlier, Genuine Parts has delivered strong earnings growth in FY2023. The stock's valuation seems to be hovering at attractive levels, as the stock price doesn't seem to be responding accordingly. So, let's take a look at Genuine Parts' FY2023 report, where the company reported another record year of earnings.

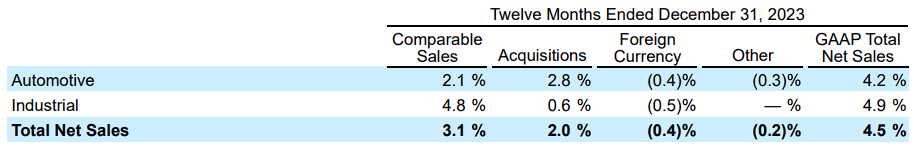

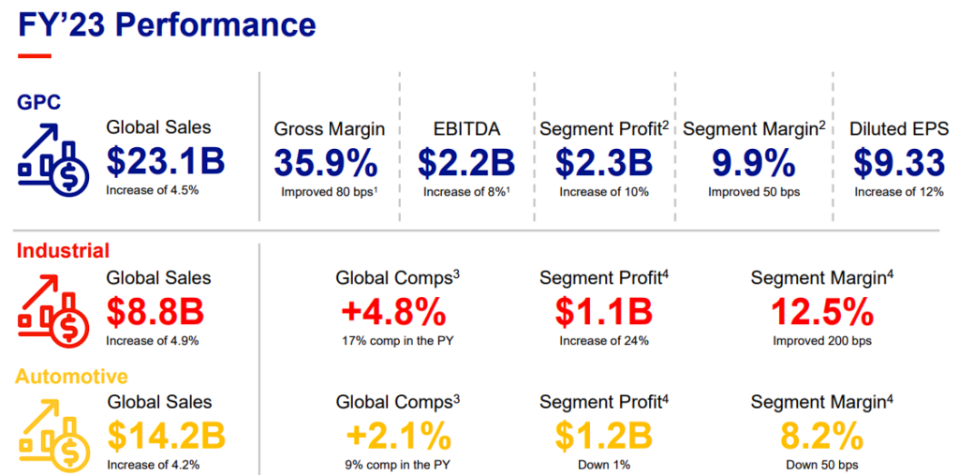

For the year, Genuine Parts' revenues reached a record $23.1 billion, an increase of 4.5%, while comparable sales increased by 3.1%, and acquisitions generated 2% of growth, offsetting a 0.4% unfavorable impact from foreign exchange rate changes and a 0.2% unfavorable impact from other impacts.

While revenues grew modestly, GPC's gross margin reached 35.91 TP3T and segment margin reached 9.91 TP3T, up 80 basis points and 50 basis points, respectively. In addition, the company purchased 1.8 million shares for $261 million, reducing its share count by approximately 11 TP3T, all of which combined resulted in record earnings per share of $9.33, an increase of 12.31 TP3T on a U.S. GAAP basis and 11.91 TP3T on an adjusted basis.

Koon's management expects the Company's earnings growth momentum to continue in fiscal 2024, with forecast adjusted earnings per share in the range of $9.70 and $9.90. This implies a midpoint year-over-year growth rate of 5%, despite the challenging operating conditions in FY2023.

Valuations are already below past averages

As mentioned above, Genuine Parts delivered significant earnings growth in FY2023, setting the stage for another record earnings year in FY2024. That said, the recent weakness in the stock price has led to a slight compression in valuation. Currently, Genuine Parts trades at a forward price-to-earnings ratio of 15.7 times, below the historical average of around 18 times.

The above-average interest rate justifies, to some extent, the below-average P/E ratio. However, significant earnings growth in FY2023, coupled with analysts' expectations of a 7% compound annualized growth rate over the next five years, strengthens Genuine Parts' investment appeal. Considering the company's excellent quality and growth track record, I think this is an attractive risk/reward investment case.

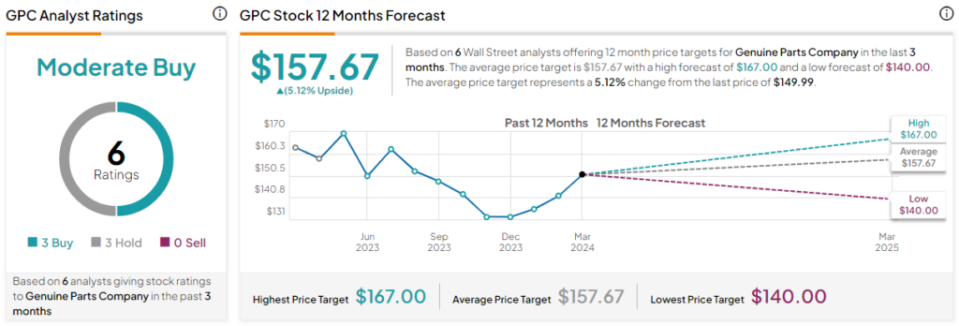

Do analysts think GPC stock is worth buying?

Based on Wall Street's view of the stock, Genuine Parts has received a consensus rating of three Buy (Buys) and three Holds (Holds) over the past three months, which is a Moderate Genuine Parts has an average target price of $157.67, indicating an upside potential of 5.1% over the next 12 months.

enlightenment

In total, Genuine Parts makes a compelling investment case for dividend growth investors. The company has a 68-year track record of dividend growth, and has demonstrated its commitment to rewarding shareholders by maintaining a very competitive earnings and dividend growth rate to this day.

Genuine Parts is expected to maintain strong earnings growth in line with historical averages over the medium term, so the company may be an attractive entry point at the moment. In particular, the stock seems to be trading at a relatively attractive valuation.

Disclosure of information