.

Fuel Costs Show Why Transportation Markets Are So Challenging for Suppliers

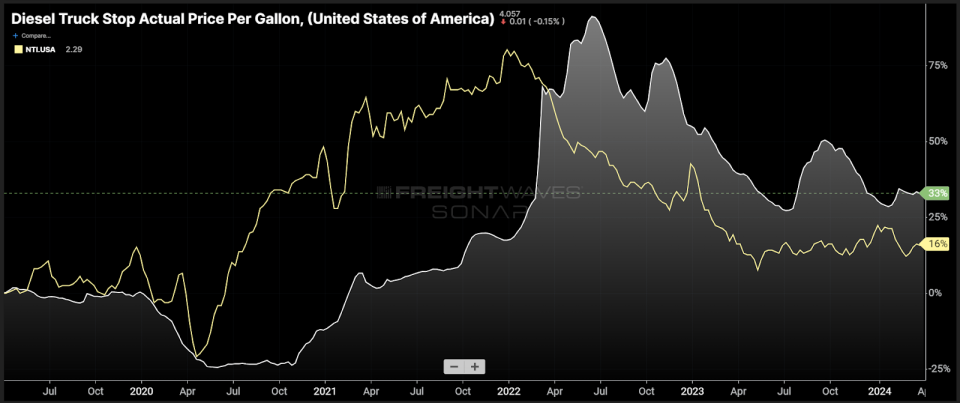

Chart of the Week:Diesel Trucks Real Price per Gallon, National Trucking Index - SONAR: DTS.USA, NTI.USA

Compared to April 2019, the retail cost of diesel fuel (DTS) rose by 331 TP3T, while the National Truckload Transportation Index (NTI), which measures all spot prices, rose by only 161 TP3T over the same time period.This means that carriers are far worse off in the spot market than they were in 2019 due to the inability to pass through operating costs fully.

Fuel is only one of many trucking cost inputs that have risen dramatically over the past five years, but it is relatively the single largest measurable cost among carriers nationwide. It is also a clear example of how desperate the truck spot market has become.

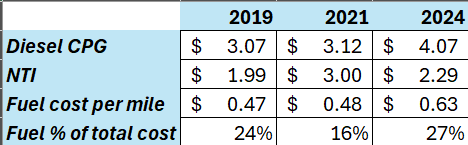

Calculating the average cost per mile based on 6.5 mpg, which is the industry standard on which many fuel surcharges are based, we get the results in the chart below:

Average diesel cost per gallon and NTI values are taken from the beginning of April each year. To the casual observer, the cost-per-gallon estimates for 2019 through 2024 may not seem all that compelling, but when viewed alongside the cost estimates for the more profitable years, the fluctuations are very noticeable.

The backdrop for Whole Noodle is that 2019 and 2024 are arguably the two weakest trucking capacity environments in history; carriers have virtually no pricing power. The market in 2021 is almost the exact opposite.

The fact that carriers appear to have less pricing power than in 2019 should not be taken lightly. This suggests that the 16% increase in nominal rates does not reflect a degree of desperation.

Fuel costs are often second only to driver wages in a carrier's total cost of ownership. According to the 2023 ATRI report, driver wages increased by 301 TP3T from 2019 to 2022. maintenance costs did the same, increasing by 301 TP3T.

The point is that 16%'s rate increase actually declines when inflated operating expenses are factored in. Adding these together means that carriers will almost certainly continue to lose money in the spot market.

Why is this happening?

Profitlessness is not sustainable in a free market. This statement is not news, but it is the severity of the unsustainability that is most alarming. For transportation service providers, this environment is much worse than 2019.

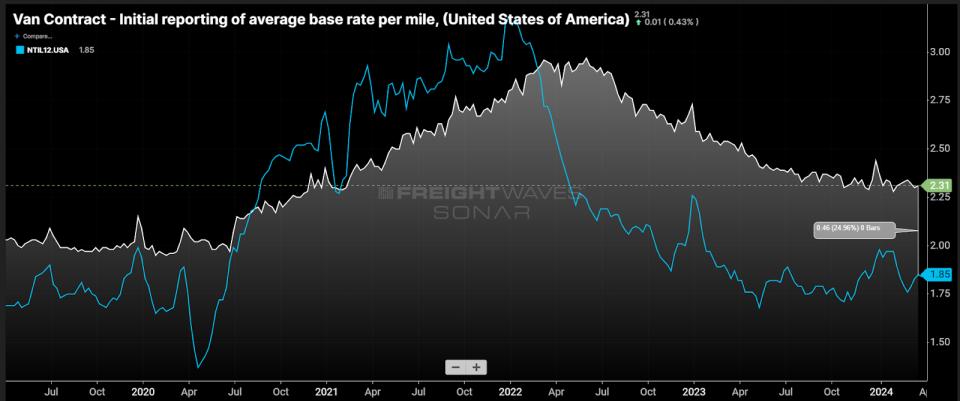

With long term rates or carry rates at or near spot market levels, anyone who purchases or manages transportation faces a serious risk of service failure, which is inevitable if the market changes.

Carburetor base rates in the SONAR invoice database (VCRPM1) show that, excluding fuel costs of over $1.20 per gallon (where standard fuel surcharges are concerned), the carpet name rates are on average about 25% higher than spot market rates.The invoice data is heavily biased toward large carrier and large shipper carpet name agreements, which represents the domestic trucking environment in the U.S. This is representative of much of the domestic trucking environment in the U.S.

Shippers who find their rates in line with spot rates may seem to be in a good position in the short term, as they can make significant cost savings. But it's like playing the stock market: you need to get out before the market changes, or you risk losing a lot of money on a failed service.

Fluctuations in the freight market can be blamed on neither the shipper nor the carrier/broker. It is a by-product of the free market. Most of the players on both sides will be chasing the dollar in the short term. This can be very fruitful if the timing is right and the details are actively monitored. If the trader wants to take a more hands-off approach, a different strategy is needed.

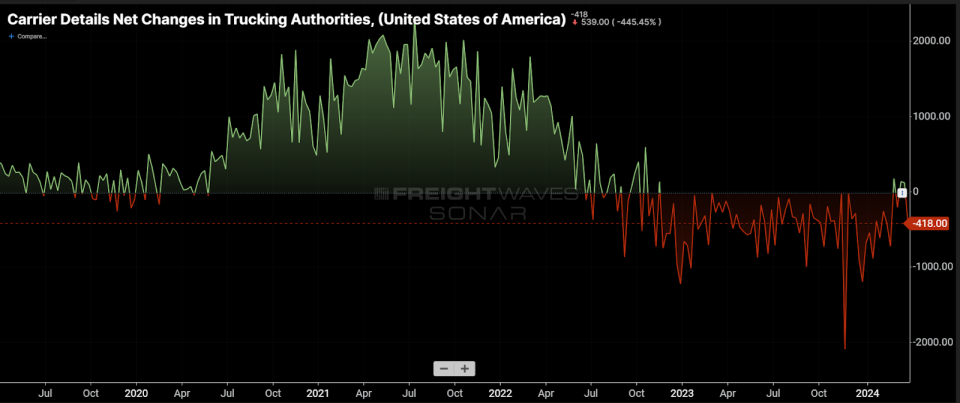

The continued deterioration of active trucking operators is another sign that the market is approaching equilibrium. The apparent manifestation of this mechanism is very slow and can occur with little warning.

There is no direct signal that the market is turning blue. But history tells us that a turnaround can happen almost overnight.

Thanks to Kyle Taylor, SONAR Account Manager, for his help in finalizing this week's chart.

About this week's chart

FreightWaves' Chart of the Week is a SONAR-selected chart that provides an interesting data point to describe the state of the freight market. Selected from thousands of potential charts on SONAR, the charts help participants gain a real-time, intuitive understanding of the freight market. Each week, market experts publish a chart on the front page with commentary. The "Chart of the Week" is then archived on FreightWaves.com for future reference.

SONAR aggregates data from hundreds of sources, presents the data in graphs and maps, and provides real-time industry commentary that freight market experts want to know.

The FreightWaves data science and product teams release new datasets every week to improve customer satisfaction.

For SONAR logo, please click here.

The postFuel Cost shows why the transportation market is so challenging for providersappeared first onFreightWaves.