.

1 Chipmaking Stocks Betting Big on Artificial Intelligence

A big battle is brewing in one of the lesser-visited areas of the artificial intelligence (AI) industry: chip design software. Several buyout deals have been announced, and electronic design automation (EDA) leaderSynopsys ((NASDAQ resonance stock code: SNPS)respond in singingAnsys (NASDAQ resonance stock code: ANSS)A mega-acquisition between the two companies was also pending. Shortly after this announcement, a second EDA software company, EDA Software Inc.Cadence Design Systems (NASDAQ resonance code: CDNS)revealed its new supercomputing platform for simulating electronic systems.

Japanese chip makerRizal electronic(Renesas) (OTC: RNECY)Not to be outdone, the company announced its intention to acquire a smaller EDA software provider.Altium (OTC: ALMF.F).. Is something big brewing in the AI market?

Risa seeks software boost

Renesas is an integrated device manufacturer that both designs and manufactures semiconductors. This is a hybrid business model that has been making a comeback in recent years. In addition to Japan's emergence as the preferred destination for Oriental manufacturing, Renesas' resurgence is thanks to the electric vehicle (EV) revolution and a plethora of other, more mature manufacturing processes for chips in industrial and power applications (as opposed to the 耑 chips used in data centers for AI, etc.).

Among a number of other smaller acquisitions aimed at bolstering their power chipsets, I wrote last year about the partnership between Renesas andWolfspeed (NYSE: WOLF)The deal will see the latter buy silicon carbide (SiC) wafers for next-generation applications such as electric motors for electric vehicles.

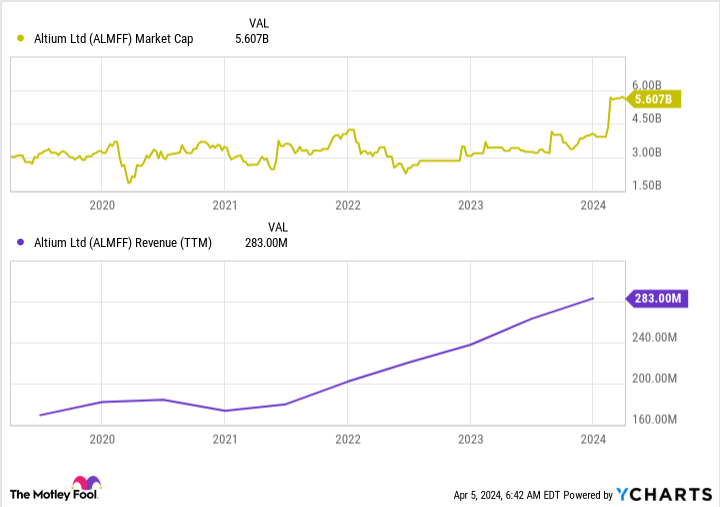

However, Altium is a minor competitor to EDA software giants Synopsys and Cadence, and its acquisition is another matter entirely. Australian-based Altium (notably, Wolfspeed is also a chip design customer) had revenues of just $139 million in the first half of fiscal year 2024. Yet Renesas will shell out AUD 9.1 billion (USD 6 billion at April 5, 2024 exchange rates). This is a significant premium.

Renesas said it aims to improve its ability to provide software and digital tools to customers, many of whom, such as automakers, are non-technical and may need help implementing next-generation electronics.

Artificial Intelligence Tidal Wave Coming Soon?

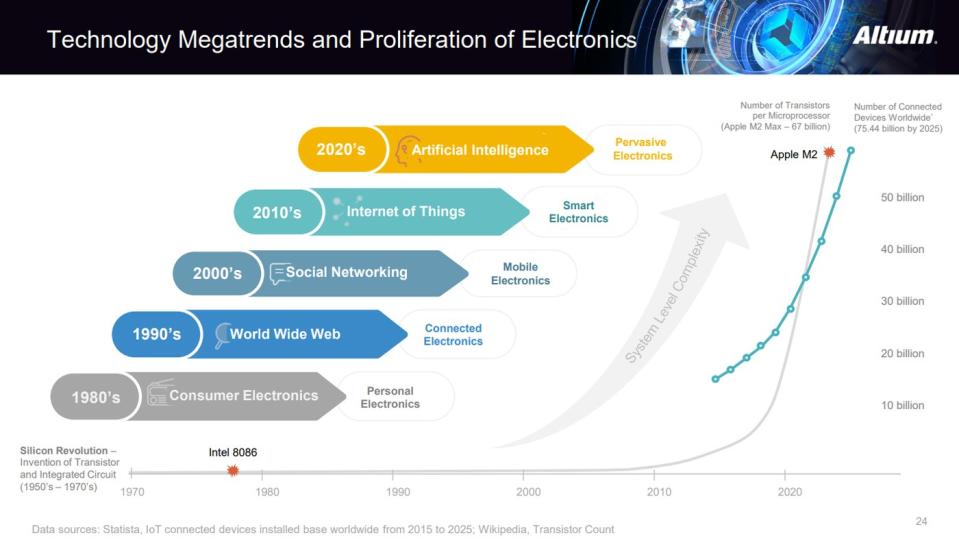

Currently.INVISTAfirms(NASDAQ: NVDA)of data center AI systems is all the rage as companies look to use their data to "train" new AI systems. But over the next decade, all of these AI systems will need to go to theSomewhere. It is only by doing so that users can benefit from their creations.

This may be where Renesas sees a huge opportunity to compete with Synopsys and Cadence in the field of electronic system design by acquiring Altium. From automobiles to automated factory equipment to smart home devices, customers are interested in embedding smart computing systems into a wide range of device ecosystems, providing semiconductor manufacturing companies with a path to continued growth.

All of the new AI that is embedded in the device itself, rather than in the data center, will require more complex hardware. It will also require more energy-efficient hardware, like the kind Renesas has been working on (again, with the Wolfspeed deal). Renesas can provide not only the chips, but also the software that will make these AI devices a reality, thus securing its place in the years to come.

Renesas could be a hidden growth stock in the artificial intelligence race. If it can continue its strong momentum in its semiconductor manufacturing and design business in the automotive, industrial equipment and consumer electronics sectors, then its shares could be a potential bargain.

Should you invest $1,000 in Rizza Electronics now?

Consider the following before buying shares of Risa Electronics:

Motley Fool Stock AdvisorA team of analysts have just named what they think are the best values for investors.10Only ...... and Renesas Electronics is not one of them. The 10 stocks that made the list could generate huge returns in the coming years.

Consider April 15, 2005Nvidia) when it was on the list ...... If you invested $1,000 at the time of our recommendation, theYou will own 539,230dollar! *Stock Advisor provides easy-to-use stock investment tools for investors.

Stock AdvisorIt provides investors with an easy-to-learn blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Stock Advisor The service has contributed to the S&P 500 Index's return since 2002.translate twiceMuch*.

View these 10 stocks."

*Stock Advisor's Circular as of April 4, 2024

Nicholas Rossolillo and his clients own shares of Cadence Design Systems, Nvidia and Synopsys. The Motley Fool recommends Altium, Cadence Design Systems, Nvidia, Synopsys and Wolfspeed. The Motley Fool recommends the use of Ansys. The Motley Fool has a disclosure policy.

1 Chip-Making Companies Make Big Bets on Artificial Intelligence was originally published by The Motley Fool.