.

One Wall Street Analyst Believes 21% Upside to Micron Technology Stock

Micron Technology Inc.firms(NASDAQ resonance code: MU)The company's shares have soared to new highs this year as the memory chip leader is on the verge of resuming profitable growth.CitiThe stock still has room to rise, according to analyst Dr. Christopher Danely.

After speaking with the company's management team, the analyst maintained a Buy rating on Micron's stock, with a $150 price target, which would represent a 21% upside from Friday's closing price of $123.58.

Why Buy Micron Stock

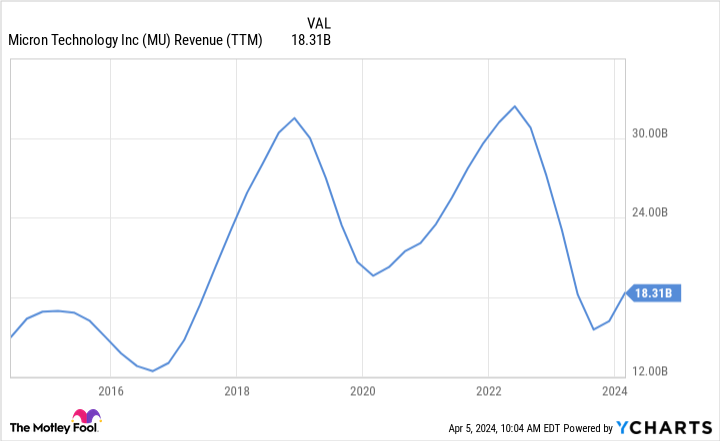

Micron is one of the leading suppliers of Dynamic Random Access Memory (DRAM) and Solid State Storage for computers, smartphones and data centers. Due to cyclicality, revenues from these products fluctuate significantly every few years, and you can see the downward trend since 2022.

However, Micron is beginning to experience a recovery, which could lead to significant revenue growth in the coming years.

Demand for artificial intelligence (AI) servers has been "exceptionally strong," Koon said in its most recent financial report. The uptick in demand has helped tighten supply and drive up the price of memory chips. The company's revenues for the second quarter of its fiscal year 2024 (which ended Feb. 29) rose 58% year-on-year.

Looking ahead to fiscal 2026 earnings estimates, the company's shares trade at a modest forward price-to-earnings ratio of 12. That's not a cheap valuation for a company in a cyclical industry, but Koon believes that record revenues in fiscal 2025 could push the stock above analysts' price targets.

Should you invest $1,000 in Micron now?

Before buying Micron Technology stock, consider the following:

Motley Fool Stock AdvisorA team of analysts have just named what they think are the best values for investors.10Only stock ...... Micron Technology (MicronTechnology is not one of them. The 10 stocks that made the list are poised to generate huge returns over the next few years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 4, 2024

Citigroup is an advertising partner of The Ascent, a Motley Fool company. john Ballard does not hold any of the above shares. the Motley Fool does not hold any of the above shares. the Motley Fool has a disclosure policy.

A Wall Street Analyst Says Micron Technology Stock Has 21% Upside was originally published by The Motley Fool.