.

Like Amazon? This alternative stock could have even more upside.

technology giantsAmazon (NASDAQ resonance code: AMZN)has been a sensational long-term investment, thanks to the company's apparent "fixation". It went from asurname GionThe online bookstore developed into an all-encompassing e-commerce platform. Later, it even went beyond e-commerce to develop businesses such as shipping and logistics, digital advertising, cloud computing, and healthcare services.

Another company that is expanding its business scope is Singapore's Rio Tinto.Sea Limited (New York Stock Exchange: SE)The company has an e-commerce platform and a gaming division. The company has an e-commerce platform and a gaming division, and also provides fintech services. It is not satisfied with its core Asian market. Instead, it wants to expand its business globally.

Even though shares of Gwen Sea are down 85% from their all-time high, I think it's a better buy than Amazon stock. Here's why.

First of all, Amazon is still a great company

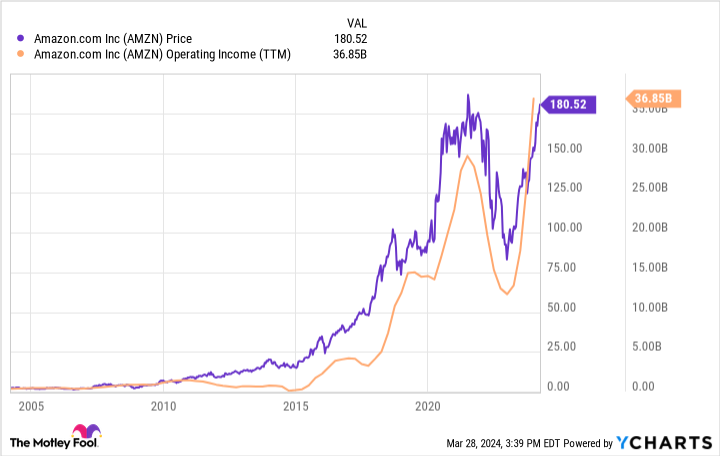

Make no mistake: Amazon is still a great company. Amazon's stock price is near an all-time high due to soaring operating profits. In fact, the chart below shows the strong correlation between Amazon's operating profit and stock price over the past 20 years.

Over the past decade, Amazon's surge in operating profits has been largely due to the success of its Amazon Web Services (AWS) cloud computing services - AWS provided the company with 67% of operating revenue in 2023. However, in recent years, Amazon's operating margins have fallen as it has invested heavily in logistics to keep up with the rapidly growing demand for e-commerce.

Amazon's operating profits are now normalizing as investments are winding down. Koon expects Amazon to make between $8 billion and $12 billion in profits in the upcoming first quarter alone. So I wouldn't be surprised if there is more room for Amazon stock to rise.

Amazon may be a safer bet for making money than Sea stock. That said, if all goes well, Sea stock could be poised for even more upside.

Why Sea stock is worth buying

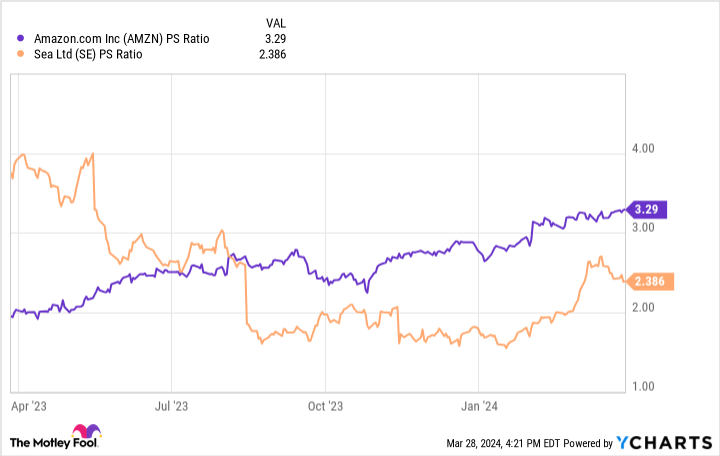

First, it's worth noting that Sea stock is cheaper than Amazon stock on a price-to-sales (P/S) basis.

Valuing a stock like Sea at just two times sales suggests that investors don't believe the company can grow - at least not profitably. But I think the company's recent performance disproves both arguments.

See the chart below, which shows the financial performance of all three of Sea's business units. Officially, the company refers to these three business units as E-Commerce, Digital Entertainment and Digital Financial Services. Note that the Earnings column refers to adjusted earnings before interest, taxes, depreciation and amortization (EBITDA).

|

Business Segments |

Revenue Growth |

Profit |

|---|---|---|

|

E-commerce |

24% |

($214 million |

|

Digital Entertainment |

(44)% |

US$921 million |

|

Digital Financial Services |

44% |

US$550 million |

Source: Press release from Sea. Graphs and tables drawn by the author.

Sea has declining revenues in one segment and an adjusted EBITDA loss in another. But across the board, Sea's revenues are up in 2023 and it is a profitable company. Therefore, the company can grow profitably because it is doing so now.

Therefore, the question is not whether this company can grow profitably; the real question is whether it can seize a big opportunity.

The opportunities facing Sea cannot be overstated. The company operates in rapidly digitizing growth economies such as Indonesia, Brazil, and India. As these markets develop, so does the potential for growth.

Take Sea's e-commerce business in Brazil, for example. 2020 was the year the company entered the Brazilian market. Four short years later, in February of this year, the company opened its 10th distribution center in Brazil.

These Brazilian distribution centers represent a significant investment for Sea. But as mentioned earlier, this is also a huge opportunity. Research firm Mordor Intelligence estimates that the e-commerce market in Brazil currently stands at $53 billion. But it predicts that by 2029, the market will grow at a staggering 19% compound annual growth rate for carriers, and other research firms are similarly predicting double-digit growth. sea is building the infrastructure to capitalize on this market.

Sea has invested heavily in e-commerce. But it's worth noting that its growth is becoming more sustainable. in 2023, the business unit did make a loss of $214 million in adjusted EBITDA. But that's almost 15 percent higher.Billion dollarsThis point should not be overlooked.

It's not just e-commerce; Sea's financial services division is clearly on fire as well. The company expects its digital entertainment division to have a good year in 2024, too, with its hit gameFree FireIt's going to be very profitable for the division. Koon management expects double-digit growth to resume this year, and with the Koon issue resolved, it will soon be reactivated in the huge Indian market.

Sea's revenue for the past 12 months was only $13 billion, but it still has a lot of room for growth given its market size, market growth and strong demand for its products and services and those of its competitors.

With Amazon's current 12-month trailing revenue approaching $600 billion, I think there's much less room for upside, which is why Sea is a company investors should consider buying.

Should you invest $1,000 in Sea Limited now?

Before buying shares in Sea Limited, please consider the following:

Motley Fool Stock AdvisorThe analyst team has just named what they believe to be the best value for investors.10Only the stock ...... and Sea Limited were not included. The 10 stocks selected will generate huge returns in the coming years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 4, 2024

John Mackey, former chief executive officer of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors.Jon Quast has no position in any of the stocks mentioned above.The Motley Fool has positions in Amazon and Sea Limited and recommends both companies. The Motley Fool has a disclosure policy.

Like Amazon? This Alternative Stock Could Have Higher Upside. Originally posted by The Motley Fool.