.

This one figure could ensure Eli Lilly's dominance of the weight-loss drug market.

come with a giftfirms(NYSE: LLY)The company's stock has soared over the past year as it has expanded its presence in what could become a $100 billion drug market. The company sells two weight-loss treatments - Mounjaro and Zepbound - that are likely to become long-term blockbusters.

Lilly and peersNovo NordiskLilly has a dominant position in this market, and as much as possible, other companies, from small biotechs to large drug makers, are planning to launch products in the coming years. But there is one figure that could ensure Lilly's dominance in the weight-loss drug space.

Lilly's successes to date

First, it's important to consider the success of Eli Lilly so far: Mounjaro is approved for type 2 diabetes, but doctors often use it for weight loss, a drug that brought in more than $5 billion last year, and Zepbound, which is approved for weight loss only, generated more than $175 million in revenue in the first few weeks of commercialization.

But Lilly didn't stop there. The drug company is currently testing what could be better drugs for weight loss in phase III clinical trials: an oral tablet candidate and a candidate that interacts with three hormones (whereas Mounjaro and Zepbound only interact with two).

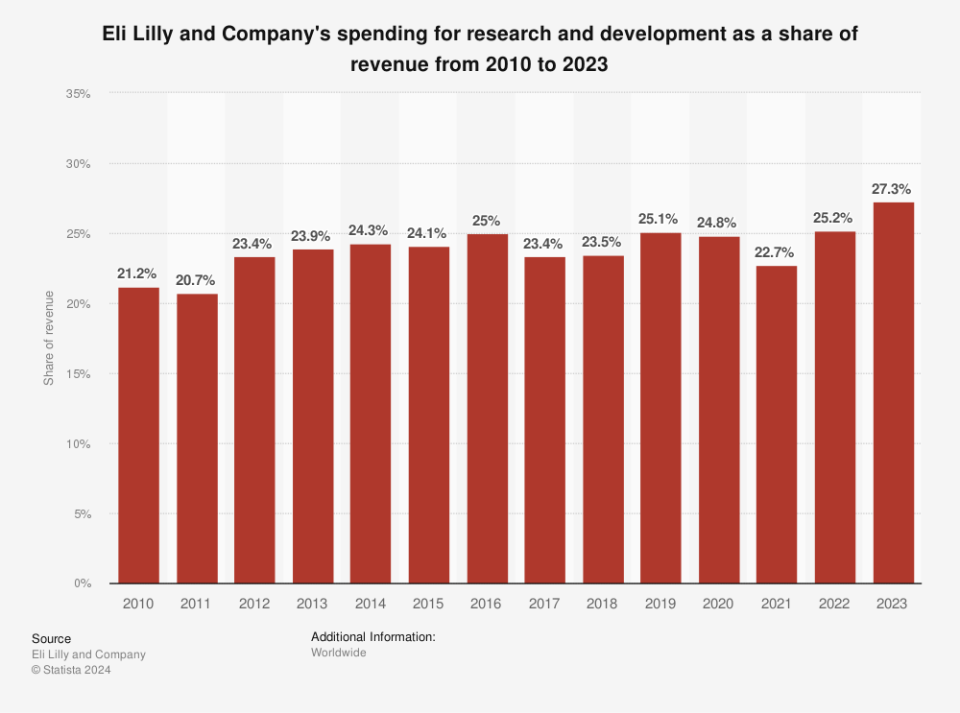

Which brings us to a number that may ensure Lilly's dominance. As the chart below shows, Lilly's R&D spending as a percentage of revenue has risen sharply over the past three years, from 22.7% to its highest in at least 13 years, and last year exceeded 27% of revenue.

That's key because it confirms Lilly's commitment to delivering better and better medicines in the weight-loss and other areas, which should translate into earnings growth.

What does this mean for Lilly stock? Although Lilly's stock price has risen nearly $1,20% in the past year, there is still a lot of room for Lilly's stock price to rise as the current weight-loss drug, as well as other drugs that may be launched in the future, will boost earnings. Therefore, Lilly is a good long-term buy for investors.

Should you invest $1,000 in Lilly now?

Consider the following before purchasing stock in Eli Lilly and Company:

Motley Fool Stock AdvisorA team of analysts has just named what they think is the best name for investors to buy right now.10Only one stock, ......, was excluded. These 10 stocks could generate huge returns in the years to come.

Stock AdvisorProvides investors with an easy-to-learn blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 4, 2024

Adria Cimino does not own any of these shares. the Motley Fool recommends Novo Nordisk. the Motley Fool has a disclosure policy.

This One Number Could Secure Eli Lilly's Dominance in the Weight Loss Drug Market was originally published by The Motley Fool.