.

Is Crocs stock still worth buying?

As I predicted in November.Crocs (NASDAQ resonance code: CROX)The stock is finally cheap as hell. Shares of the love-it-or-hate-it bubble clog company have risen more than 60% in the past six months. After some problems with HeyDude, the casual shoe brand it acquired in early 2022, management is trying to get the business back on track.

By some measures, Crocs shares are still cheap - assuming the company can get its growth back on track this year. Let's take a look at the latest situation and what it means for investors.

HeyDude remains a major drag

In early 2022, Crocs acquired the HeyDude brand for $2.05 billion in cash (debt financing), with the founders of HeyDude issuing new shares. It was a transformational move, adding a high-growth emerging footwear business that is expected to generate sales of no less than $700 million in 2022 - a move that complements Crocs' own iconic status among its many loyal fans.

It started out well, but by 2023 it was clear that HeyDude had over-expanded, and there was (and still is) too much inventory floating around. Where there was (and still is) too much inventory floating around, Crocs management is aggressively scaling back the number of retail name partners and authorized digital distribution channels.

As a result, HeyDude's sales in 2023 were $949 million, a significant increase from when HeyDude was acquired, but a decrease from the small leisure lifestyle brand's sales in 2022. This is a significant increase in sales from when HeyDude was acquired, but a decrease in sales from 2022 for the small casual lifestyle brand. HeyDude's 2022 sales of $986 million, including sales in the months leading up to the acquisition, far exceeded Crocs' initial projections.

The pain isn't over. 2024, management expects HeyDude's sales to be "flat or slightly up." The priority is to revitalize sales growth and achieve healthy profitability. Goon hopes to improve HeyDude's adjusted operating margin, which would help the company's overall profitability return to 25% in 2024, up from 22% last year.

Can the Crocs brand sustain its business growth?

Meanwhile, the company's foam clog business had another stellar year in 2023, with aggregate sales of the Crocs brand growing 13% to $3 billion. In the forecast, management took a conservative stance, expecting the brand's sales to grow 4% to 6% in 2024.

It is clear that this is no longer a growth business, at least for the time being, as consumers around the world continue to slow down on discretionary spending. In this economic climate, expansion in new regions such as Asia and new product categories such as sandals can only go so far. So why has the share price risen so much in recent months? Earnings growth.

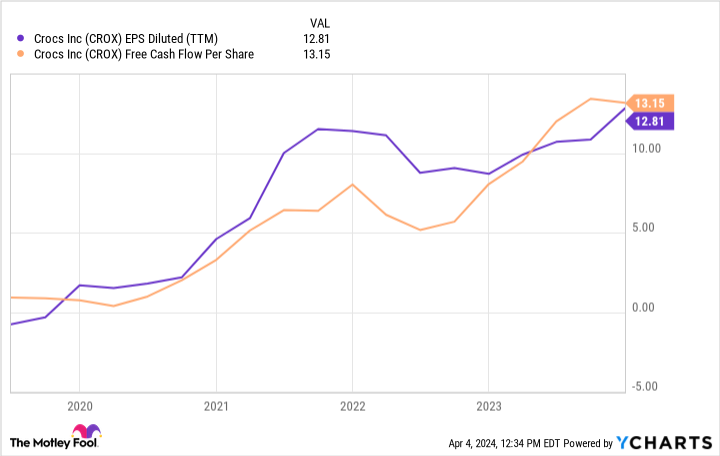

Even after taking into account the new shares issued in connection with the HeyDude acquisition a few years ago, Crocs' earnings per share (EPS) and free cash flow per share (FCF) have risen to record highs. On an adjusted basis (excluding non-recurring items), EPS is expected to grow by 4% in 2024, not including any positive benefits from the share buyback.

Don't get your hopes up for the share buyback just yet, though. By the end of 2023, Crocs will still have to pay down its long-term debt balance of $1.64 billion (although this is lower than the $2.3 billion it had the previous year).

Regardless, right now Crocs shares are trading at 11x 12-month trailing EPS and 10x FCF, which looks like a much fairer valuation than they were at the time of last year's swing. I am content to continue to hold my current position. However, I would like to see signs of growth, especially from HeyDudes later in 2024, before I eat into it some more.

Should you invest $1,000 in Crocs now?

Consider this before you buy Crocs stock:

Motley Fool Stock AdvisorThe analyst team has just selected what they think is the best name for investors to buy now.10Crocs is not one of the 10 stocks listed on ....... The 10 stocks that made the list could generate huge returns in the years to come.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 4, 2024

Nicholas Rossolillo and his clients have a position in Crocs. The Motley Fool recommends Crocs. The Motley Fool has a disclosure policy.

Is Crocs Stock Still Worth Buying? This post was originally published by The Motley Fool.