.

Today's Market News: April 08

After falling last week on fears of a rate cut, the market gradually moved higher this morning to kick off the new trading week.

On Friday, a better-than-expected jobs report boosted all three stock indexes, a strong performance that propelled theSPDR Dow Jones Industrial AverageindicesETF Trustfund(DIA),SPDR Standard & Poor's 500indicesETF Trustfund(SPY) andInvesco QQQ Trust Fund (QQQ)et exchange traded funds higher: as much as the strong performance of the labor market supports a "higher for longer" interest rate environment, it also suggests a strong economy, which should be good news for corporate earnings, which kicked in this week.

Investors are also looking forward to the release of the key inflation data, the Consumer Price Index (CPI), on Wednesday.

Economists surveyed by Dow Jones expect the Consumer Price Index (CPI) to rise by 0.3% in March from the previous month, with the annual total expected to be 3.5%, up from 3.2% in February. Economists expect the annual core CPI (which excludes volatile food and energy prices) to fall to 3.7% from 3.8% last month. 3.7%.

These figures show that while inflation continues to ease, it does remain high, even stubbornly so. If inflation is not fully contained, the Fed will continue to keep interest rates higher. This could have an impact on bond ETFs, which suffer in a higher interest rate environment.

As fears of rate cuts hit the interest rate-sensitive bond market.iShares 20+ Year Treasury Bond ETFTLT has been under pressure for months. Since the beginning of the year, TLT has fallen by more than 5%, and its price (currently at $91.38) is still close to this year's lows.

Interest rate cuts are likely to affect other sectors such as real estate and consumer discretionary, which could be boosted by lower interest rates meaning lower borrowing costs.

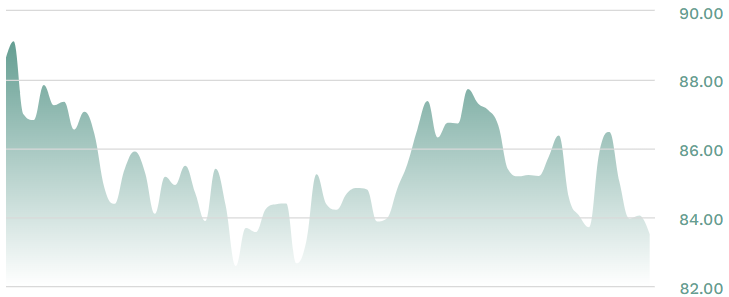

VNQ is the largest real estate ETF-Pioneer Real Estate VNQ is an ETF that has performed well over the past few years as the Fed kept interest rates low during the coronavirus pandemic, but so far this year VNQ has been sleepy for fear that rates will stay high. But so far this year, VNQ has been struggling, dropping nearly 5% on fears that interest rates will continue to rise, and waiting for a rate cut could provide investors with a buying opportunity.

VNQ YTD

Source: etf.com

In addition to inflation, investors will be paying close attention to corporate earnings that kick off this week. Delta Air Lines is set to report on Wednesday, which will have an impact on the 210 ETFs that hold the company's stock.U.S. Global Jets ETFJETS rallied more than 1% ahead of Wednesday's earnings announcement.

But all eyes will be on the big banks on Friday as they officially kick off earnings season. Wells Fargo and JPMorgan Chase will release their first-quarter results before the close of business. Investment firm BlackRock will also report on Friday before the bell.

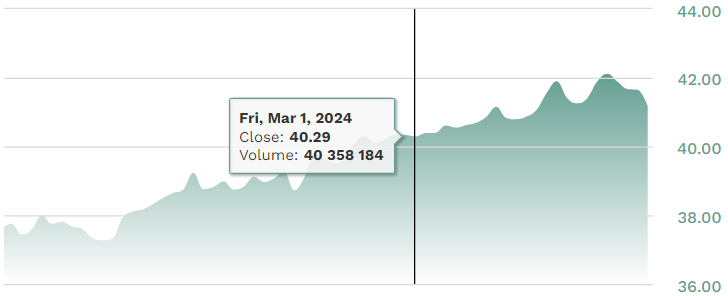

Financial Select Sector SPDR FundThe XLF was slightly higher on Monday. The fund, which broadly reflects the health of the financial sector, has risen nearly 10% so far this year as rising interest rates have boosted profit margins in the banking sector.

XLF YTD

Source: etf.com

Permalink | © Copyright 2024etf.com Press validate it