.

S&P 500 Bull Market: This Is the Worst Investment You Can Make Right Now

Over the past year, the stock market has been soaring. Standard & Poor's 500 Index (SNPINDEX: ^GSPC)It has risen more than 45% from its lows at the end of 2022. We're now in bull market territory and the stock doesn't seem to be slowing down.

It's an exciting time to invest, but the right investment strategy is the key to maximizing returns. While there is no one-size-fits-all approach to building wealth in the stock market, there is one mistake that can do more harm than good.

A Common Investment Mistake to Avoid

While many people are optimistic about the stock market right now, others are concerned that perhaps the best buying opportunities have passed. Worse still, some investors may be concerned that stock prices have no choice but to fall.

So it's tempting to hold off on investing to watch the market move. On the surface, this may seem like a smart strategy, but trying to time the market can be extremely risky - and limit your long-term returns.

The stock market is somewhat massively unpredictable, so no one can say exactly how it will perform in the coming weeks or months. If you wait to invest until prices soar, you will miss out on these potential gains. The longer you wait, the more gains you may be giving up.

But what if we invest now and the price goes down?

Many investors share a common fear of investing before the price drops. However, even a fall in the price of a stock is not necessarily a bad time to buy, as long as you keep your eye on the long term.

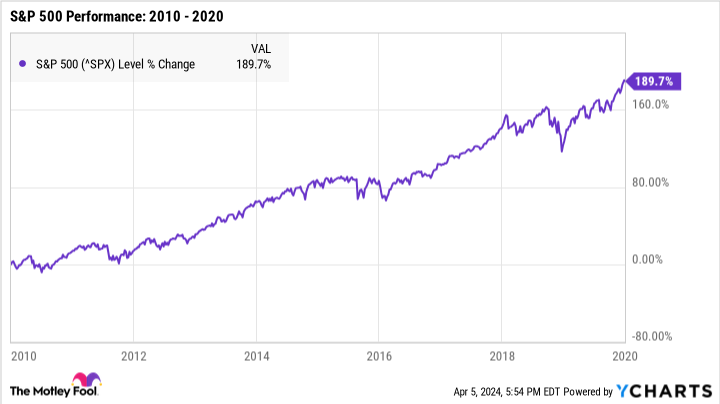

For example, let's say you invested in the S&P 500 Index Fund in January 2010, just as the Great Recession was ending and the market was in the early stages of a new bull market. The Great Recession had just ended and the market was in the early stages of a new bull market, but there was still some significant volatility on the horizon. However, if you had stayed invested, you would have earned an aggregate return of nearly 190% over 10 years.

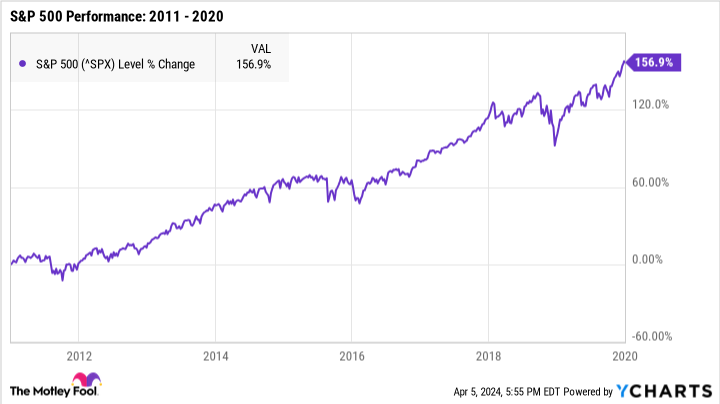

On the other hand, let's say you wait until January 2011 to start investing. The market has been in a bull market for about a year and a half, and the stock price has risen steadily over that time. However, by 2020, you will only get a return of about 157%.

Let's say you wait a little longer and start investing in January 2013. At that point, the market has been on a tear for several years. There won't be any real volatility in the market until the end of 2015, which seems like the safest time to buy. However, by 2020, you will only get a return of about 127%.

Market volatility is normal and unavoidable. If you put off investing until it's "safer" to do so, you're missing out on valuable time to let your money grow.

Although it may sound counterintuitive, it is often safer to invest now, regardless of the market. If the stock price goes down, just ride it out and keep investing until the market recovers. Waiting for the right time will only make it more difficult to see significant returns over time.

Keys to Investment Success

Taking a long-term view is the key to maximizing returns in the stock market, but choosing the right investments is equally important. Not all companies are capable of long-term growth, and unstable stocks may have a hard time recovering from market downturns.

There is no single right way to invest, but the healthiest stocks are those with solid fundamentals, from strong financials to competent leadership to industry competitive advantage.

The more robust your portfolio is, the more likely it is that your investments will recover from volatility. The longer you give your capital to grow, the more you are likely to earn over time. Starting to invest now will help maximize your potential returns, no matter what the markets do in the future.

Don't miss this second chance to make money.

Ever feel like you're missing out on the opportunity to buy the most successful stocks? Then you'll want to hear this.

On rare occasions, our expert team of analysts will recommend companies that they believe are poised for a major rally."Double Down" StocksIf you're worried that you're missing out on an investment opportunity, now is the time to buy before it's too late. If you're worried that you're missing out on an investment opportunity, now is the perfect time to buy before it's too late. The numbers speak for themselves:

-

Amazon:If you had invested $1,000 when we doubled our investment in 2010.You will have $20,844.! * Apple: If you invested $1,000 when you doubled your investment in 2010.You will have $20,844.

-

Apple:If you had invested $1,000 when we doubled our investment in 2008, you would have beenWill have $32,000! * Netflix: If you had invested $1,000 when we doubled our investment in 2010, you would have had $20,844!

-

Netflix:If you invested $1,000 in 2004 when we doubled our investment, you wouldWill have 343,086 Dollars! *Netflix:If you had invested $1,000 when we doubled our investment in 2004, you would have had343 086 dollar

Right now, we're issuing "double down" alerts for three incredible companies that may not be available again anytime soon.

View 3 Grab "Double Down" Stocks"

*Stock Advisor's Report as of April 8, 2024

Katie Brockman does not own any of the shares listed above.The Motley Fool does not own any of the shares listed above.The Motley Fool has a disclosure policy.

S&P 500 Bull Market: This Is the Worst Investment Position You Can Make Right Now was originally published by The Motley Fool.