.

Best Stocks to Buy Right Now Amazon & Walmart

Amazon (NASDAQ resonance code: AMZN)respond in singingWal-Mart (New York Stock Exchange: WMT)) are two of the largest companies in the United States in terms of sales. They have a lot in common and a lot of differences. They've both undergone stock splits in the last few years, Wal-Mart's most recent last month, and their stocks are on the rise. So, which is the better buy today? We'll see.

Amazon's rationale for more diverse revenue streams

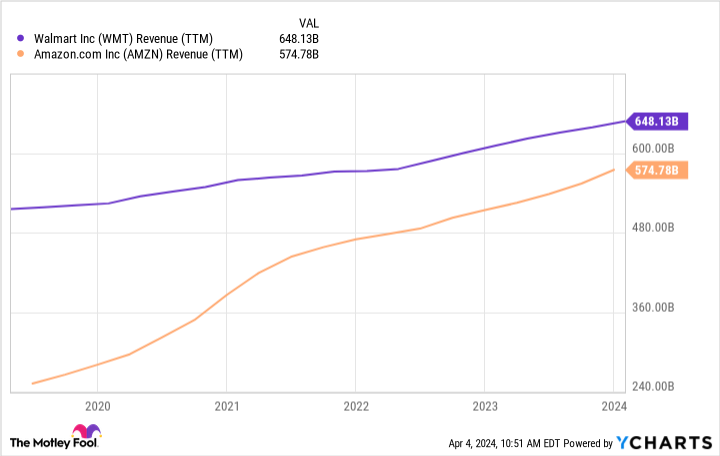

Amazon is the second largest company in the U.S. after Walmart, with net sales of $575 billion in 2023. However, Amazon's e-commerce business is far ahead of Walmart's, accounting for 37.6% of total e-commerce sales in the U.S., compared to Walmart's distant 6.4%. As e-commerce continues to grow as a percentage of retail sales, it will help Amazon catch up to Walmart's overall lead in retail sales.

But Amazon is much more than e-commerce. E-commerce sales, including sales from Amazon's online store and third-party sales, accounted for $67% of Amazon's total revenue in the fourth quarter, outpacing Walmart's sales growth. In addition, Amazon operates a cloud computing business, Amazon Web Services (AWS), which accounted for 141 TP3T of total sales in the quarter. many of Amazon's smaller business units represent high-growth opportunities.

Advertising is Amazon's fastest-growing business, up 27% in the fourth quarter from a year earlier, and it's becoming its next big business. Amazon doesn't have a breakdown of its other businesses, but its acquisition of MGM Studios last year gave it a competitive streaming business upgrade, and its healthcare business is also growing.

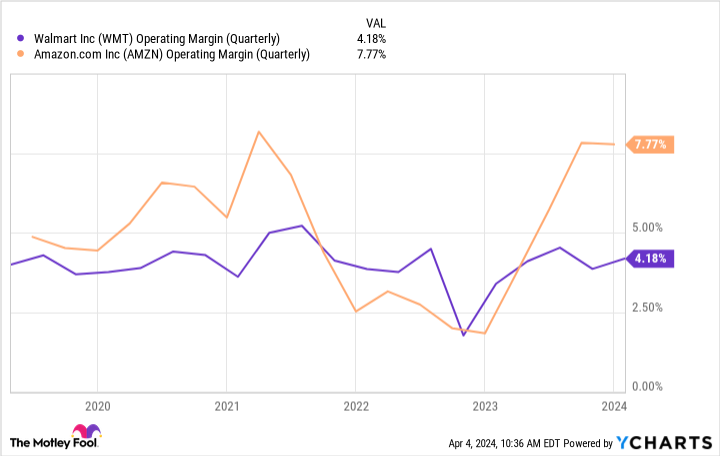

In total, Amazon is growing faster than Walmart, with year-over-year revenue growth of 14% in 2023, and in addition to the pressure it will experience in 2022, Amazon's operating margins will typically be higher.

Amazon's many businesses, especially its investment in artificial intelligence (AI), have given it good momentum. It has already launched a wide range of AI-generating tools that could change its customers' game rules. It has years of growth potential ahead of it.

Wal-Mart's case lead too good to miss?

Amazon is growing faster than Walmart, but in FY2024 (ended Jan. 31), Walmart's revenues are up 5.71 TP3T year-over-year. this is achieved on a much larger base, and while Amazon has been growing faster than Walmart for a long time, it can't seem to quite catch up.

Wal-Mart has 10,500 stores worldwide, with more than 4,600 in the United States alone. If that seems like saturation, Wal-Mart plans to open 150 supercenters in the next five years. It also plans to open 30 new Sam's Club stores and remodel nearly 300 U.S. stores.

Regardless of the growth of e-commerce, Wal-Mart has an unrivaled network of stores with discounted prices that shoppers love. That's partly why Wal-Mart's operating margins remain low; Wal-Mart's model is to generate sales volume, and food-carrying is a lower-margin business.

Walmart's business doesn't quite have the same reach as Amazon's, and it sticks to its retail roots. But it does have other ways to increase sales. Recently, Walmart announced the acquisition of streaming media platformVizioThis gives it access to the advertising media and allows it to compete with Amazon for attention. This gives it access to the advertising medium and allows it to compete with Amazon for eyeballs and leverage its advertising business.

Finally, Wal-Mart also pays a dividend, an attractive feature for passive income investors that Amazon does not offer.

Buying Better: Conclusion

Both are successful stocks that have created value for shareholders over the years. Each stock is attractive to investors; growth-oriented investors may want to buy Amazon stock, while risk-averse or dividend-paying investors may prefer Wal-Mart.

However, if I have to choose one, I would choose Amazon. Even though Amazon is a growth stock, it has enough track record not to pose high risk and has stable earnings. It has amazing potential in many areas, and it's a leader in artificial intelligence. This is a perpetual stock that can take its place in most investment portfolios.

Should you invest $1,000 in Amazon right now?

Consider this before buying Amazon stock:

Motley Fool Stock AdvisorA team of analysts have just selected what they believe to be the most popular analysts in the world at the moment.-est (superlative suffix)The name of the person is suitable for the investor to purchase10Only ...... Amazon is not one of these stocks. The 10 stocks that made the list could generate huge returns in the coming years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View these 10 stocks

*Stock Advisor's Circular as of April 8, 2024

John Mackey, former chief executive officer of Amazon subsidiary Whole Foods Market, is a board member of The Motley Fool.Jennifer Saibil has no position in any of the stocks mentioned above.The Motley Fool has stock recommendations for Amazon and Wal-Mart.The Motley Fool has a disclosure policy. The Motley Fool has a disclosure policy.

The Best Stocks to Buy Right Now: Amazon & Wal-Mart was originally published by The Motley Fool.