.

Why did Taiwan's semiconductor stocks rise on Tuesday while Arm Holdings and Micron fell?

The semiconductor industry has seen a lot of activity over the past year or so. Stocks in the field are generally on a positive trend, thanks in large part to recent developments in artificial intelligence (AI). The rise of these advanced algorithms has been fueled by state-of-the-art processors, which have driven the growth of the industry.

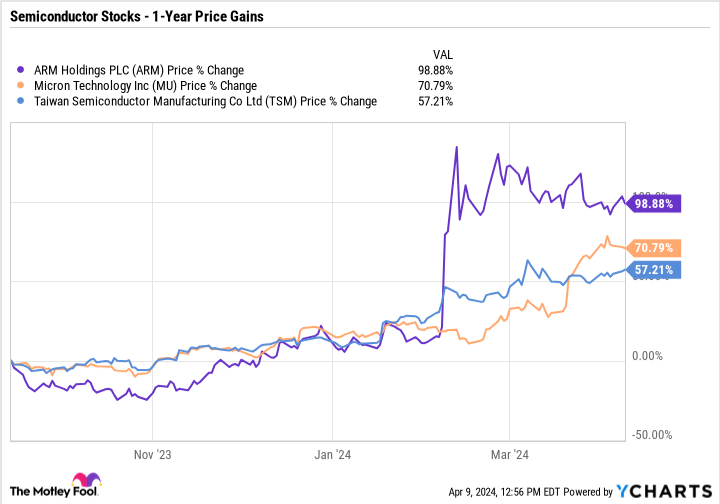

However, stocks in the sector have risen rapidly over the past year, sometimes even outperforming the basic noodles. In recent weeks, investors have been taking a step back and watching for positive catalysts in their favorite chip companies before pushing for the next leg up.

That seems to be the case today, as the semiconductors are clearly performing unevenly despite the surprisingly good news. Initially.Arm Holdings (NASDAQ: ARM)Up 4.81 TP3T.Taiwan Semiconductor Manufacturerfirms(New York Stock Exchange: TSM)) climbed 3.8%.Micron Technology Inc. (NASDAQ resonance code: MU)Over time, however, the three stocks lost momentum, with Arm and Micron down 2.1% and 0.2%, respectively, and Taiwan Semiconductor up just 0.8% as of 1:07 p.m. ET.

Alarming

Taiwan Semiconductor (commonly known as TSMC) continues to ride the coattails of yesterday's big reveal. As part of the CHIPS Act, the U.S. government announced that the company will receive up to $6.6 billion to help it build manufacturing facilities in Phoenix. TSMC also agreed to expand its plans to add a third factory to the massive complex.

according toThe Wall Street Journal.reports that more large grants are expected to be announced in the near future and that Micron will be one of the likely beneficiaries.

There's more good news from Micron. According toDigiTimes The company reported Tuesday that it plans to raise prices for DRAM and NAND chips by 25% in the second quarter, citing "sources at memory module companies" but noting that negotiations are still ongoing and that it has yet to formally announce the price hike. This is not too surprising as industry observers expected prices to rise after the earthquake in Taiwan earlier this month.

Additionally, during Micron's recent earnings call, Chief Executive Officer Sanjay Mehrotra stated that he expects "pricing levels for DRAM and NAND will increase further in FY2024, ...... FY2025 revenues will be at record highs and profitability will improve significantly".

Arm Holdings also has positive news.MicrosoftThe company is set to unveil a line of AI-centric laptops, which will be powered by Arm-based processors, at a special event next month. According to The Verge, the company is becoming increasingly confident that these laptops will outperformApple Inc.of the MacBook Air, the latter running its own M3 AI chip. These devices have been dubbed "Next Generation AI Copilot PCs," referring to Microsoft's line of AI-enabled digital assistants.

To buy or not to buy

While Koon has had a positive year after a big run-up, two of the three companies are in negative territory (at the time of writing). This teaches an important lesson for investors: while it is important to pay attention to good and bad news about a company, it is equally important not to ignore the day-to-day volatility of the stock price, which can be unpredictable.

In terms of valuation, Taiwan's semiconductors sell for just 23x forward earnings, making them a bargain at this price point. Micron, at less than 4x forward sales, is equally compelling.

Arm is a bit more complicated, as its growth prospects are impressive. The stock trades at 83 times forward P/E and 27 times forward sales, which at first glance seems ridiculously expensive. However, this does not take into account the company's growth trajectory. In terms of price-to-earnings and growth (PEG) ratios, Arm's stock has a P/E ratio of less than 1, which is the standard for an undervalued stock.

It's still early days for artificial intelligence, and it's likely to continue to drive the chip industry. AI is expected to be a $1.3 trillion market by 2032, which suggests semiconductor stocks have plenty of upside in the months and years ahead.

Should you invest $1,000 in a Taiwan semiconductor manufacturing company now?

Please consider the following before buying shares of Taiwan Semiconductor Manufacturing Co:

Motley Fool Stock AdvisorThe analyst team has just selected what they think is the best name for investors to buy now.10Only ...... and Taiwan Semiconductor Manufacturing Company were not included. These 10 stocks could generate huge returns in the coming years.

Stock AdvisorProvides investors with an easy-to-learn blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 8, 2024

Danny Vena owns shares of Apple and Microsoft.The Motley Fool owns and recommends shares of Apple, Microsoft, and Taiwan Semiconductor Manufacturing Company.The Motley Fool recommends the following options: long Microsoft Jan 2026 $395 calls and short Microsoft Jan 2026 $405 calls.The Motley Fool has a disclosure policy. The Motley Fool has a disclosure policy.

Why did Taiwan's semiconductor shares rise on Tuesday, while Arm Holdings and Micron shares fell?