.

Why Arm Holdings stock fell 11% in March

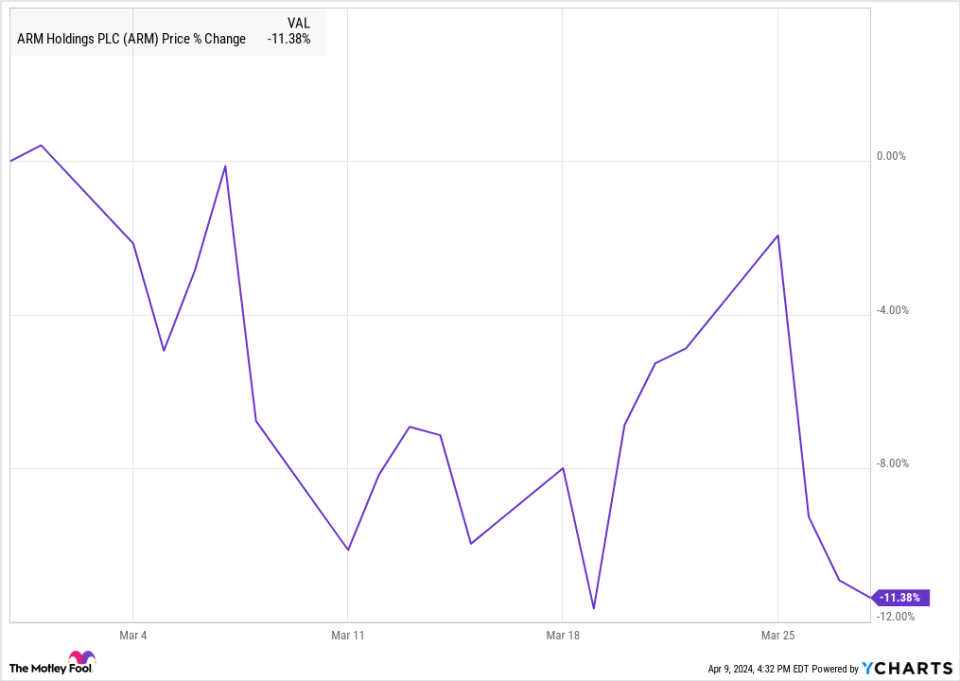

Arm Holdings (NASDAQ: ARM)Shares were among the top decliners last month as concerns about the stock's valuation seemed to overshadow the broader trend of artificial intelligence (AI).

Although there has been relatively little news on the stock, Arm missed out last month.Nvidia (math.) andSuper Micro Computer ) and other peers are on the tail end of a move higher. According to S&P Global Market Intelligence, Arm's shares fell 11% over the month as the lock-up period following its initial public offering (IPO) expired and its rally at the Nvidia Developer Conference gave way to a sell-off at the end of the month.

You can see the stock's roller-coaster performance in the chart below.

Arm's price tag weighs on stock

In February, Arm's stock soared as the chip designer's fiscal third-quarter report beat expectations, raising its guidance for the industry and claiming strong demand from the artificial intelligence boom.

Shares were volatile in March, but fell back in the second week of the month, with March 8 being the worst day of the month, when shares fell 7%. The last day of the month was due to the chipBroadcom shares (math.) andMarvellArtificial Intelligence stocks were generally down after both gave lukewarm forecasts in their quarterly earnings reports.

The following week, Arm's post-IPO lockup expired on March 12th. This sometimes triggers a sell-off as insiders are eager to sell their shares on the open market, but so Arm's share price actually rose to a high level, possibly signaling stronger than expected demand for the stock. This could signal a stronger than expected demand for the stock, and about 90% of Arm's shares were also sold by theSoft SilverHold, this may make the locks regularly fill up less often than expected.

During the week of March 18th, Arm stock rebounded after a brief decline following the launch of Nvidia's new Blackwell platform.

Finally, Arm lost 7.5% on March 26th, ending the month on a downward note, as far as possible, with no specific company news.

What's next for Arm?

Arm's chips are prized for their lower power consumption than comparable chips, which is valuable in the AI space because AI applications require a lot of power.

However, Arm stock is expensive with a forward price-to-earnings ratio of 105. For the stock to continue to move higher, it will need continued benefits from the artificial intelligence space and strong corporate performance. We'll know more on May 8, when Arm reports its fourth-quarter earnings.

Should you invest $1,000 in Arm Holdings now?

Before buying shares of Arm Holdings, consider the following:

Motley Fool Stock AdvisorThe analyst team has just named what they believe to be the best value for investors.10Only ...... and Arm Holdings were not among the stocks selected. The 10 stocks that made the list are poised to generate huge returns over the next few years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 8, 2024

Jeremy Bowman owns shares of Broadcom.The Motley Fool owns and recommends Nvidia.The Motley Fool recommends Broadcom and Marvell Technology.The Motley Fool has a disclosure policy.

Why Shares of Arm Holdings Fell 11% in March was originally published by The Motley Fool.