.

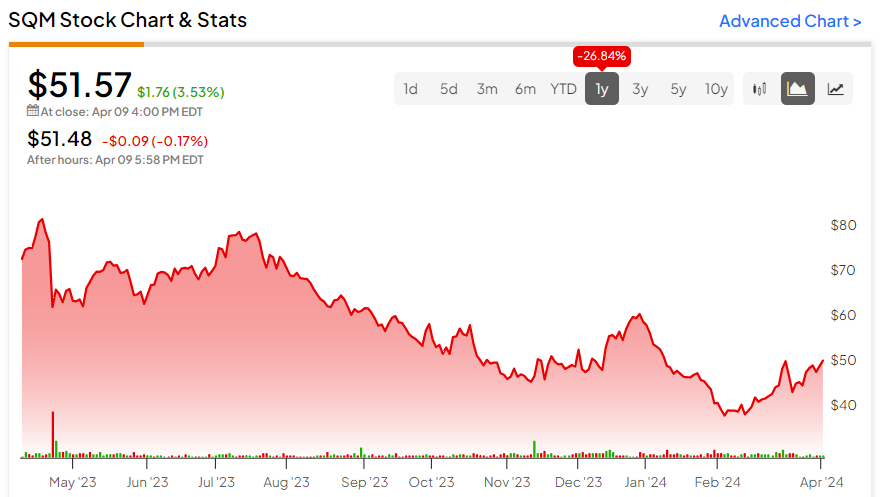

SQM stock: down 27%, can this dividend giant rebound?

Sociedad Química y Minera de Chile S.A.(NYSE:SQM)SQM, which produces lithium, fertilizers and chemicals (and also pays a large dividend), has had its share of highs and lows over the past few years, but I'm not sure if the stock can rebound. However, I'm not sure if the stock can rebound, as SQM recently signed a Memorandum of Understanding regarding a deal proposed by the Chilean government that would see SQM become a minority name partner (49%) in its current operations from 2030, and demand for its lithium products is volatile.

The stock is currently down about 27% over the last 12 months, but that doesn't give me a buy signal, which is why I'm neutral on SQM.

Rise and fall cycle of lithium

The price of lithium has been on a roller coaster ride for the past two years. The price of the silver-white metal is set to soar in 2022, fueled by electric vehicle (EV) hype. However, SQM is part of the supply surge as suppliers around the world look to respond to the electrification agenda.

Coupled with the slower than expected penetration of electric vehicles, lithium prices fell sharply in 2023, reaching multi-year lows. This is a boom-bust cycle that highlights the challenge of matching the rapid growth in demand with the relatively long lead times required to increase lithium production.

The decline in lithium prices was evident in the Company's full year results. Full year revenues for the Company's lithium division decreased by approximately 361 TP3T compared to 2022. record high sales volumes partially offset the impact of the price decline, with sales increasing by nearly 101 TP3T from the prior year.

One of SQM's strengths, however, is that it has remained profitable despite the sharp drop in lithium prices last year. It has high quality resources that it can profitably mine even at current prices.

Looking ahead, the company's management remains hesitant to provide a clear outlook for the lithium business. Matron Gerardo Illanes said demand will increase by 20% this year, but emphasized that the timing of new supplies coming on line, noting that delays are common, could have a positive impact on actual prices.

"We have seen stabilized prices over the past three months and we do not yet have information that would allow us to anticipate significant changes over the next three months," said Matrix Financial Services. For me, the overriding message from the earnings call was one of uncertainty.

Given the volatility of lithium, it is positive that SQM continues to invest in other areas such as iodine and potassium. However, these areas remain a relatively small part of the company's business. The company's success remains closely tied to the actual price of lithium. It's also worth emphasizing that while lithium has risen in popularity due to the electric car hype, some battery makers have developed lithium-free batteries, which are claimed to be as efficient as lithium. Looking ahead, this adds another layer of uncertainty.

Clarity in Chile

One of the biggest worries facing SQM 麪 in recent years has been the fear of losing its production leases in Chile. Amid calls to nationalize the industry, investors are concerned that SQM will lose its main lithium resource, as its lease in the Atacama Salt Lake expires in 2030.

Thus, the proposed deal with the Chilean government would avoid a lose-lose situation; SQM would maintain a stake in the operation, but only a minority one (49% of the site). Chilean state-owned mills giant Codelco will be the main partner. If the deal is finalized, it will undoubtedly provide investors with some clarity and reduce the risk of possible negative equity.

The agreement with the Chilean government, which is still under a Memorandum of Understanding (MOU), suggests a shift in focus for SQM. It now appears that the company may be prioritizing its lithium business in Australia. The San Diego-based company recently entered into an agreement with Tambura Metals, Inc.(Tambourah) Metals) (Australian Stock Exchange Stock Code: TMB) signed a revenue agreement covering the Australian explorer's Vermilion North project. This was reached on the basis of the existing Holland Hill carpet venture, also located in Western Australia.

Analyze SQM's valuation

SQM is currently trading at 7x TTM earnings and 10x forward earnings. That's not the kind of move we want to see, and analysts are predicting that the next year will be less profitable than the one just past. In fact, analysts believe that over the medium term, SQM's earnings could decline by 14% per year. I personally take these forecasts with a grain of salt, as I am very cautious in my lithium price forecasts in this volatile market.

Do analysts think SQM stock is worth buying?

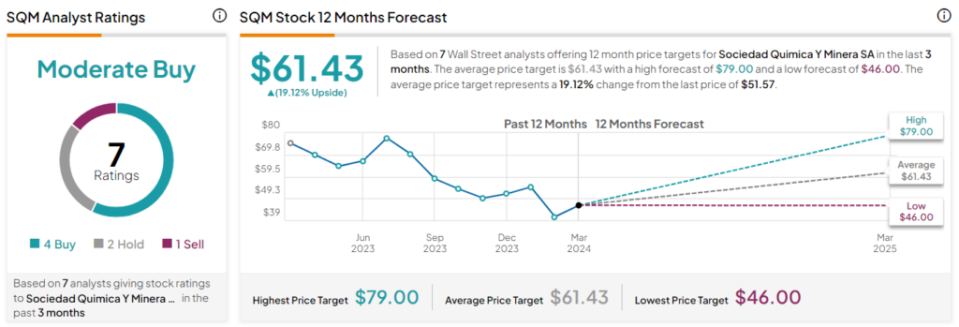

Based on four buys, two holds, and one sell over the past three months, SQM stock currently has a consensus rating of "Moderate Buy" on TipRanks. sociedad Quimica Y Minera S.A. has an average target price of $61.43, implying a 19.11% upside. TP3T upside. The stock has a high estimate of $79.00 and a low estimate of $46.00.

Bottom line on SQM shares

Few investment opportunities offer any certainty. Most companies in the industry can be very successful one moment and then fall flat on their faces the next. However, in my view, few investment opportunities are as uncertain as SQM is right now.

The conclusion of the Chilean lease negotiations will provide some clarity, which I believe investors will welcome with open arms, but many uncertainties remain. Chief among them is the dynamics of lithium supply and demand. That said, I applaud SQM's low production costs and remain neutral on the matter.

Disclosure of information