.

ZTS, EXAS, AZN: Which Biotech Stock Is the Better Buy?

While the market has been hot so far this year, there is no shortage of moderately priced stocks with impressive growth potential. In the field of biotechnology, there are many companies that can capitalize on their technological strengths to improve all aspects of health and medicine. From genetics to minimally invasive disease diagnostics, this article will look at three stocks rated as "strong buys" - ZTS, EXAS, and AZN - that I believe are among the best investments in the biopharmaceutical space.

While individual biotech and biopharmaceutical stocks may have a reputation for being "do-or-die" stocks (drugs in development either pass post-phase clinical trials or they don't), I think the following well-run companies are uniquely positioned in the biopharmaceutical space to help investors avoid the expected I think these well-run companies are uniquely positioned in the biopharmaceutical space to help investors avoid the expected bumps in the road when investing in biotech innovators.

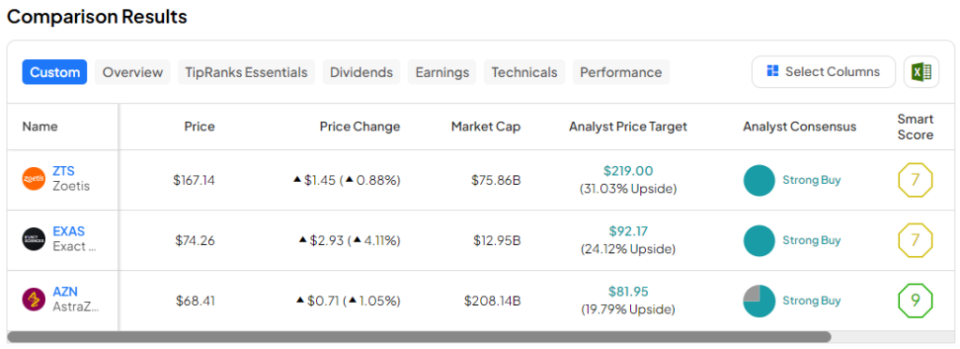

So let's take a look at three amazing (but not expensive) biotech companies currently being favored by many Wall Street analysts via the TipRanks comparison tool below.

Zoetis (NASDAQ:ZTS)

Many innovative biotechnology companies are aggressively investing in the next blockbuster treatment or drug, with companies vying for the first patent. In such a "winner-takes-all" arena, the share price of any fast-growing biotech company will tumble with the latest developments in clinical trials. To the extent that this is true, competition may be less intense in the pet and livestock health space. In fact, Zoetis is a rarity. It is a purely American large pet care company.

Granted, ZTS' stock price can still go up and down if a promising koon therapy fails to pass muster. But as a market-leading company with an extensive product line and some of the best pet care talent in the world, ZTS is well-positioned to hold on to the name through the ups and downs. At this juncture, I am as bullish as the analysts as the company looks to continue to expand its product line while continuing to cash in on its new breakout products.

In fact, Zoetis is a top-tier company with an impressive track record of successful new product launches. Most recently, osteoarthritis (OA) medicines for canines and felines, such as Librela and Solensia, have been impressive growth drivers for the company. In the most recent quarter, these OA medicines were instrumental in driving international sales growth of 13% in the Companion Animal Products division.

There is no doubt that dogs and cats are like family members in many homes. If only there was a cure for osteoarthritis, many pet owners would be just as willing to pay for it as they would for their own disease.

ZTS's forward P/E ratio of 32.6 times is well below the industry average of 41.3 times for specialty and learnt drug manufacturers.

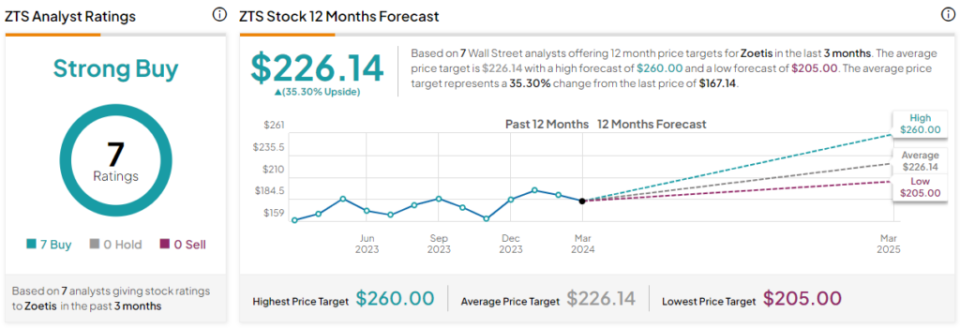

What is ZTS' target share price?

Analysts consider ZTS stock a "Strong Buy", with a consensus of 7 analysts rating the stock a "Buy" over the last three months. zts stock has an average price target of $226.14, implying a 35.3% upside potential.

Exact Sciences Corporation (NASDAQ: EXAS)

Exact Sciences is one of the most talked about innovators in the field of cancer diagnostics. It goes without saying that traditional cancer screening methods, such as colonoscopy for colorectal cancer, are far too invasive for many people. Not to mention, they can come with a much higher bill. As Exact Sciences continues to revolutionize the cancer screening market with impressive innovations, it's hard not to be optimistic.

There's no doubt that if the company hadn't been such an innovative disruptor, it probably wouldn't have a seat at Cathie Wood's ARK investment fund. The company's flagship product, Cologuard, saw record deliveries last year, helping the company complete more than 4 million tests. Looking ahead, I expect that number to stay hot as more people learn about the less invasive screener through the company's marketing campaigns.

EXAS shares rose at the end of March after the company revealed optimistic data on its oesophagus test Oncoguard to the public, and as the company continues to bet on the new test, it may only be a matter of time before EXAS shares come off the ledge. As the company continues to bet big on new tests, it may only be a matter of time before EXAS shares, which are down 53% from their highs, come off the sidelines. with a market capitalization of $13 billion, Exact may not be a big company, but it's a leader in cancer screening and diagnostics, and it's looking to expand its lead as it continues to ramp up its R&D efforts.

What is the target share price of EXAS stock?

Analysts consider EXAS stock a "Strong Buy", with 14 analysts unanimously rating EXAS stock a "Buy" over the last three months.The average price target for EXAS stock is $92.17, implying a 24.1% upside potential.

AstraZeneca (NASDAQ Resonance Symbol: AZN)

AstraZeneca shares have been flat for two years now, with the stock down a little more than 10% from its peak. With sales of the COVID-19 vaccine plummeting, the company definitely needs a hot new product to help keep growth strong. Despite declining demand for COVID-19, AstraZeneca still managed to achieve sales growth of 6% in 2023. With a strong lineup of oncology and rare disease treatments, I think analysts are right to remain bullish on AstraZeneca, as the company's stock itself is in need of a long breather.

Specifically, the company's oncology product line is promising. Just last week, the company received approval to use Enhertu for a specific first-in-class treatment. Earlier this year, the company also got the green light for Tagrisso, which will be used in conjunction with chemotherapy to treat specific forms of lung cancer.

With a forward P/E of just 16 times, AZN stock is undoubtedly the cheapest of the three.

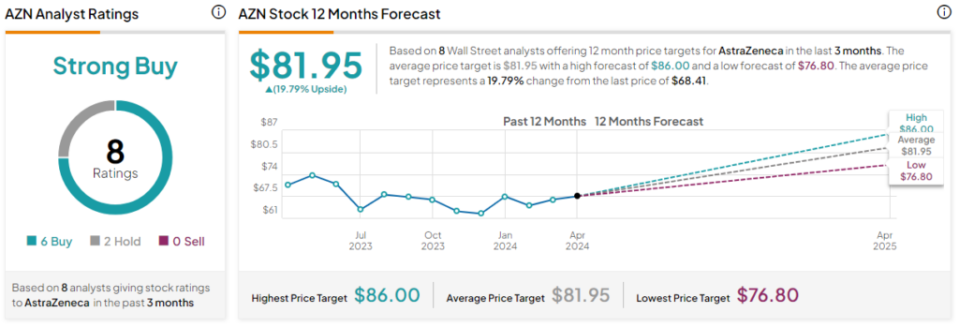

What is the target price for AZN stock?

Analysts consider AZN stock to be a "Strong Buy" stock, with six "Buys" and two "Holds" in the past three months.The average price target for AZN stock is 81.95, implying an upside potential of 19.8%.

enlightenment

All three of these companies have some relatively attractive (and unique) innovations under the hood that may be able to drive the type of growth that we investors desire. Of the three, analysts seem to think that ZTS stock has the most upside in the coming year.

Disclosure of information