.

Stocks Today: U.S. Futures Sink as Inflation Report Fires Up

U.S. stocks are set to open sharply lower on Wednesday after a key inflation report showed consumer prices unexpectedly rose last month.

Futures on the Dow Jones Industrial Average (^DJI) fell more than 11 TP3T, while futures on both the S&P 500 (^GSPC) and the tech-heavy Nasdaq Resonance 100 (^NDX) fell more than 1.251 TP3T.

Meanwhile, bond yields soared. 10-year Treasury yields (^TNX) rose as much as 14 basis points Wednesday morning, touching above 4.5% for the first time in 2024.

The Consumer Price Index (CPI) rose 0.41 TP3T in March from the previous month and 3.51 TP3T from a year ago, accelerating from the annual rate of 3.21 TP3T in February.

Both metrics were above economists' forecasts of 0.31 TP3T month-over-month growth and 3.41 TP3T year-over-year growth, according to Bloomberg.

The higher-than-expected data could spur investors to expect fewer Fed rate cuts this year. According to the CME FedWatch tool, there are currently about 75% bets that the Fed will leave rates unchanged in June. More than half of investors also expect the central bank to hold steady at its July meeting.

Wednesday will also see the release of the minutes of the Fed's March meeting, which are likely to be highly scrutinized for any hint of a collapse in policymakers' expectations for rate cuts.

First-quarter earnings season kicked off with Delta Air Lines (DAL), which has been the focal point of the airline industry's response to Boeing's (BA) continued struggles. Delta's shares jumped nearly 5% before rock bottom as earnings beat estimates.

That sets the stage for Friday's reports from the big Wall Street banks, which aren't expected to dazzle with profits even as Wall Street looks forward to a bumper season.

-

Josh Schafer

Inflation hotter than expected in March

The Consumer Price Index (CPI) rose 0.41 TP3T in March from a month earlier and 3.51 TP3T from a year earlier, accelerating from February's 3.21 TP3T annual rate of increase.

Both metrics were higher than economists' forecasts of a 0.3% monthly increase and a 3.4% annual increase, according to Bloomberg.

On this news, the three major stock index futures fell about 1%.

-

Brian Sozzi.

Brian Sozzi.If businesses cut back on spending before the election...

This tightening is not reflected in the travel budgets of Delta Air Lines (DAL), as shown by the company's performance announcement this morning.

Delta Air Lines said that first-quarter corporate Guru sales were up 14% year-over-year. The performance of "large" corporate customers was particularly strong, signaling that Delta's major carrier partner, American Express (AXP), will report in a couple of weeks.

"We're seeing some really strong demand," Ed Bastian, Delta's chief executive officer, told Yahoo Finance anchor Brad Smith." That momentum has been building internationally. Domestically, too. ...So far this year, we've seen the highest 11 days of sales in the company's history. This is a strong indication of a healthy spring and summer travel season.

-

Brian Sozzi.

Brian Sozzi.INVISTA's Weakness Continues

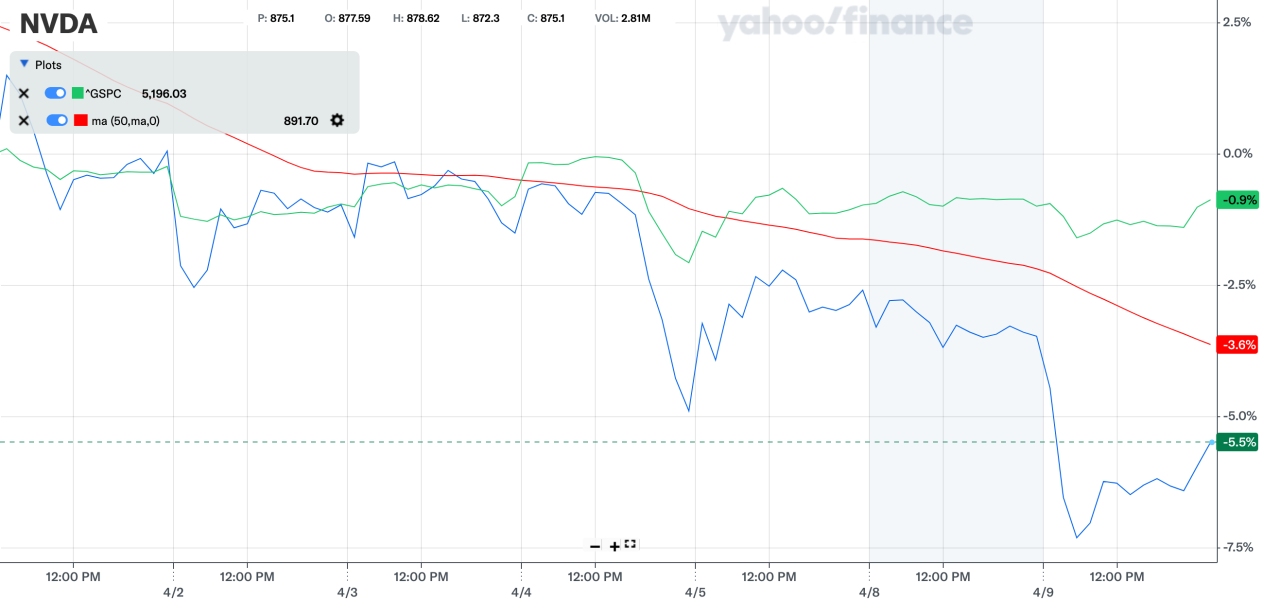

More people should be talking about the weakness of market leader NVDA.

The stock fell below its 50-day moving average earlier this month (see chart below) and has remained below this key momentum line ever since. the stock is down nearly 6% in April, while the S&P 500 is down slightly.

Is this a sign that the market is going to have a tough time this summer? Maybe. After all, this stock has been the leader of the bull market for over a year! So if it's no longer the leader, then there may be something to be concerned about from an investor's perspective.

Market leader Nvidia fell. (Yahoo!) -

Brian Sozzi.

Brian Sozzi.Save the Date for Cryptocurrency Investment Fans

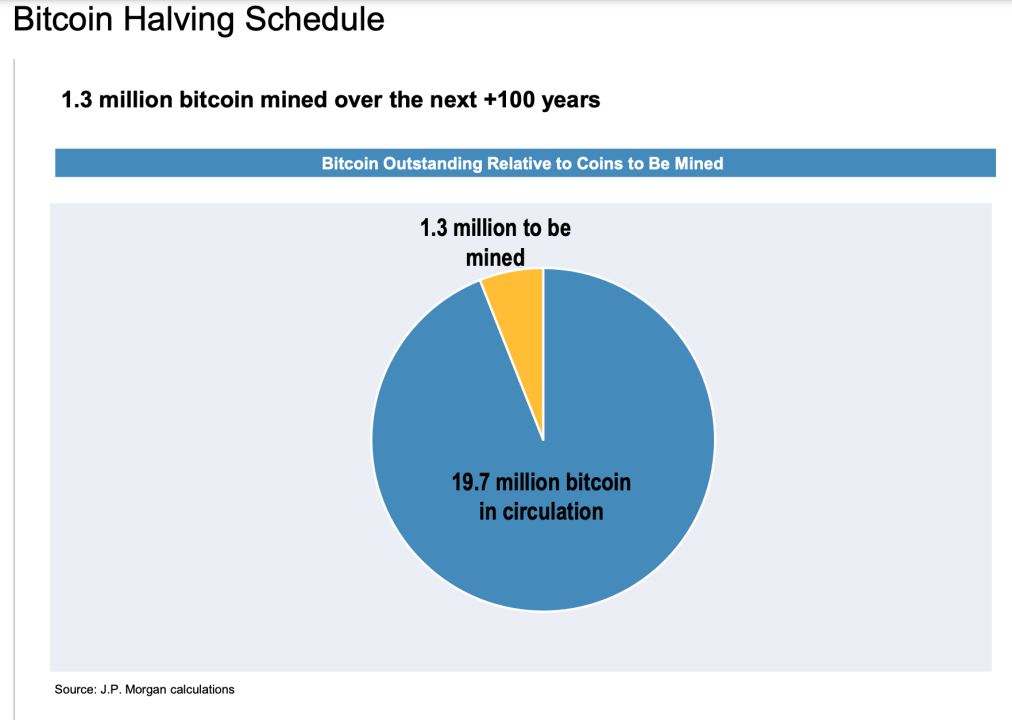

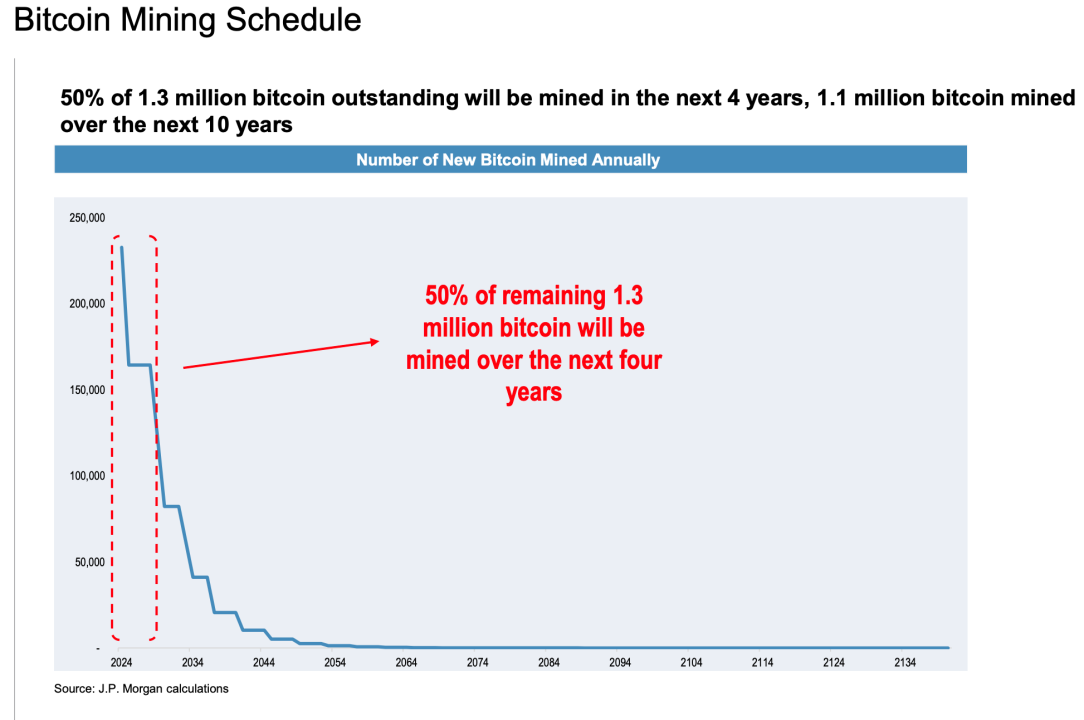

The next Bitcoin halving will happen on April 16, strategists at JP Morgan said this morning.

In case you forgot, Yahoo Finance anchor Brad Smith explains in detail what a Bitcoin halving is and what it means for cryptocurrencies.

The JPMorgan team has also provided a couple of good charts to get you thinking about the prospects for Bitcoin mining, a process that has the potential to be a catalyst for Bitcoin's price rise.

More Bitcoin halving events are on the horizon. (JP Morgan)

Near-term Bitcoin mining outlook. (JP Morgan) -

Brian Sozzi.

Brian Sozzi.Here's a market statistic to get your day off to a good start!

Remember how the market went up almost every day in March?

So far, April has been anything but, with losses starting to pile up.

Deutsche Bank's strategy team noted this morning that the S&P 500 has gone seven consecutive sessions without a new record. This is the longest stretch without a new all-time high since the S&P 500 broke above its 2022 peak in January.

The next record to be broken is ...... The S&P 500 has now risen for five consecutive months, dating back to November.