.

Bought 3 high-yield bank stocks at discount price

Buying stocks when other investors are worried is not easy, but it is one of the surest ways to find discount stocks. You have to be careful and make sure you focus on buying good companies that can withstand the negative aspects of other investors' worries about the future.

Today.Canadian Imperial Bank of Commerce (Canadian) Imperial Bank of Commerce (NYSE: CM).),Nova ScotiaBanks (Bank of Nova Scotia) (NYSE stock code:BNS(math.) andToronto Dominion Bank (Toronto -Dominion Bank (NYSE: TD).) still seem to be trading at discounted button prices, and this is a long-term opportunity to buy them.

About Bank of Canada

The Canadian Imperial Bank of Commerce (CIBC), Scotiabank, and Toronto Dominion Bank (TD Bank) (often referred to as "TD Bank") all share one important characteristic. As Canadian banks, they are subject to much stricter regulation than most other countries, such as the United States.

Canada's largest banks (including the three listed here) are protected to some extent. This is because Canada does not seem to like banking carriers, so smaller competitors do not have a chance to get bigger, larger banks cannot join the giants, and even industry giants find it difficult to acquire smaller Canadian banks to expand their operations.

In addition, Canadian banking laws tend to cause banks to be conservative in their approach to business operations. This is true in both domestic and foreign markets (the banks in question have some exposure to non-Canadian markets as they seek to grow over the long term).

As a result, Canadian banks are a good choice for more conservative dividend investors. CIBC, Scotiabank, and TD Bank kept their dividends steady during the Great Recession, whereas many of the largest U.S. banks eventually cut their dividends.

Canadian Imperial Bank of Commerce

Canadian Imperial Bank of Commerce 70% A little more of its business comes from the domestic market. This is a higher percentage than the other two banks, which is a concern for investors today.

Canada's real estate market is going from strength to strength, but rising interest rates have Wall Street worried that loan defaults could become a problem. It's entirely possible, but CIBC's Tier 1 ratio is as high as 13% (the higher the better) and has long supported the dividend through thick and thin (e.g., it didn't cut the dividend during the Great Recession).

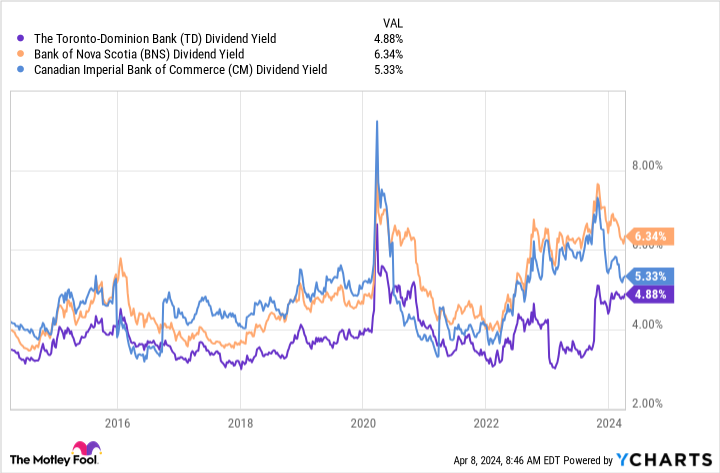

With CIBC's share price having risen a bit recently, the market's worries have eased. However, the negative brow has not completely disappeared and the dividend yield of 5.3% is still near the upper end of its 10-year yield range. If you're comfortable with short-term uncertainty, this Canadian-focused bank is worth a closer look.

Scotiabank is changing the status quo

Scotiabank's share price has also been rising recently, but its dividend yield of 6.2% also remains near the high end of its historical range. However, the situation is quite different from that of CIBC.

Scotiabank's most notable feature was its investment in South America. However, Scotiabank has not been able to translate this opportunity into financial growth. As a result, investor concerns have caused Scotiabank to outperform its peers in terms of yield.

Koon's management is changing its mindset to try to improve its lagging financial performance, including such indicators as earnings growth and return on equity. Part of the strategy is to exit the less desirable South American markets and focus on more attractive markets such as Mexico.

The crux of the story is that the dividend payout ratio is above the company's target range, but management has no objection to this in the short term. The company expects that, over time, improved performance as a result of the business transformation will bring the dividend payout ratio back into the expected range.

If you can sleep through a corporate reorganization, then this high-yield stock will look safer and safer over time.

Toronto TD Bank walks the wrong way

Toronto Dominion Bank's stock price has been falling, leading to an uptick in yield, while most of its peers' stock prices are rising and yields are falling. The bank's dividend yield of about 5% is near its highest level in recent history. Using this as a rough valuation metric, TD Bank is probably the most discounted stock.

There are two sides to the story. One side is the risk in the Canadian real estate market. But TD Bank also suffered a major setback in its U.S. development plans.

Concerned about the bank's money-laundering controls, the US regulator canceled an acquisition. This means that TD Bank may not be able to make acquisitions in the United States for some time (although TD Bank will still be able to open new outlets in an organized manner). In addition, there may be fines involved.

But TD Bank's Tier 1 ratio of 13.91 TP3T is the third highest in North America, so it appears to be well-prepared for any struggles. Growth may be slowing, but it's not stopping.

It's a good time to get in on this North American banking giant as it navigates its way through a difficult time. Once the U.S. market resumes its acquisition-driven growth, investors are likely to place a higher valuation on the stock. In the meantime, you'll get a nice dividend yield while you wait for that to happen.

Get high yield while you can

Investors have good reason to worry about CIBC, Scotiabank and TD Bank. However, these conservative Canadian banks have weathered difficult times and continue to reward investors with great returns. If you're thinking long-term, like a contrarian, now is the time to consider these Canadian banks and their historically attractive dividend yields.

Should you invest $1,000 in Toronto Dominion Resonance Bank now?

Before buying shares of Toronto Dominion Bank, consider the following:

Motley Fool Stock AdvisorA team of analysts have just named what they think are the best values for investors.10Only ...... and Toronto Dominion Resonance Bank were not among them. These 10 stocks could generate huge returns in the years to come.

Consider April 15, 2005Nvidia) on the list at ...... If you invest $1,000 at the time of our recommendation, theYou will have 533,869dollar! * *The

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Stock Advisor The rate of return for the service since 2002 has been the same as that for the S&P 500 index, but the rate of return for the service has been the same as that for the S&P 500 index.quadruple*.

View 10 Gift Certificates

*Stock Advisory Rates as of April 8, 2024

Reuben Gregg Brewer holds shares of Bank Of Nova Scotia and Toronto-Dominion Bank.The Motley Fool recommends Scotiabank.The Motley Fool has a disclosure policy.

3 High-Yield Bank Stocks to Buy at Snapback Prices was originally published by The Motley Fool.