.

Is it too late to buy shares of Micron Technology?

Memory Chip ManufacturerMicron Technology Inc.firms(NASDAQ resonance code: MU)It's a hot commodity right now. Micron shares are near all-time highs, up 48% in 2024 and 93% over the past 52 weeks, where the Artificial Intelligence (AI) boom has added fuel to Micron's growth fire and pushed the stock's chart into the stratosphere. Modern AI systems use a lot of memory and solid-state storage. As a leading supplier of these chips, that's good news for Micron and its shareholders.

Long-term shareholders can celebrate some long-term returns that change the rules of gaming. Over the past ten years, the company's stock has risen byStandard & Poor's 500The index has more than doubled in value. But is this a good time to take a new position in Micron?

Let's take a look at how much room Micron currently has for further upside.

Are Micron's growth prospects measured in "microns" or "miles"?

Micron products are in high demand.

Training and running advanced AI systems requires a lot of number crunching, which requires a lot of short-term DRAM chips. These systems also require large amounts of long-term storage with fast read and write performance. The only logical choice for meeting this requirement is NAND chips, also known as flash memory or solid state devices (SSDs).

Micron is not only a leading manufacturer of memory chips, but also an innovator in the field with a current performance advantage. Micron's latest and greatest high-bandwidth memory solutions offer unrivaled performance per watt of power consumption, making them attractive to builders of very large systems.NvidiaThis memory type has also been selected as the standard internal DRAM for its next-generation AI gas pedal.

In 2024, the unit price of NAND chips remains stable, while the average spot price of mass-market DRAM chips has so far risen by 111 TP3 T. Building on this solid foundation, industry leader Samsung expects to raise NAND chip prices by 201 TP3 T in the next quarter, and Micron's technological advantage should allow it to raise prices even faster.

As a result, Micron's growth prospects look bright in the short term, and I don't expect things to change much in the next few years. Over time, Samsung and others may catch up to Micron's HBM advantage, but this is a long-term challenge.

Is Micron's stock valuation reasonable?

This is what makes people uncomfortable.

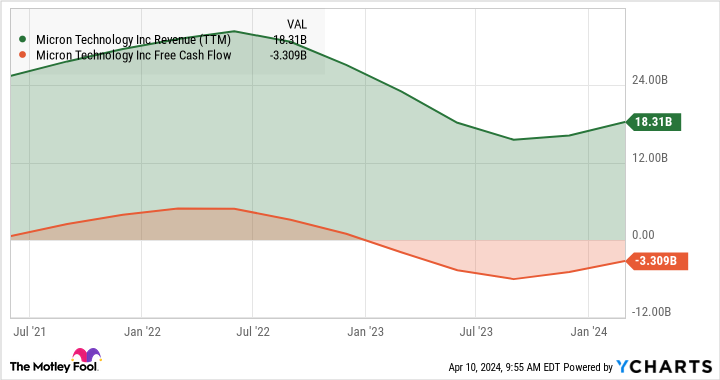

Yes, every market trend points to the rising sun. Unfortunately, the memory industry has recently rebounded from the bottom of a brutal downtrend. As a result, Micron's trailing sales are down 43% from the summer of 2022, and free cash flow is severely negative:

Profit-based valuation metrics are meaningless where earnings and cash flow are negative, but the ever-present price-to-sales ratio is at its highest since the dot-com bubble.

Final Verdict: You Should Probably Pick Another Artificial Intelligence Stock

I'm a longtime Micron shareholder, and the cyclical nature of the built-in industry is no longer surprising.

But this is a different kind of dramatic upgrade. Micron's valuation is only meaningful if you expect a structural change in the entire memory chip industry. Specifically, Micron needs to stay ahead of the curve as demand for its High-B耑 memory solutions continues to soar.

Even for me, this is a bit too much.

On that note, I'm seriously considering pulling some of my profits out of Micron and reinvesting them in less expensive growth stocks or stable index-tracking exchange-traded funds (ETFs). You may think differently, and there may be more rocket fuel in Micron's tank, but I'm just trying to sleep better at night because my investment in this highly valued stock is relatively modest.

Should you invest $1,000 in Micron now?

Consider this before buying shares of Micron Technology:

Motley Fool Stock AdvisorA team of analysts has just named what they think is the best name for investors to buy right now.10Only ...... Micron Technology was not included. These 10 stocks could generate huge returns in the years to come.

Consider April 15, 2005Nvidia) on the list at ...... If you invest $1,000 at the time of our recommendation, theYou will have $522,969.! *Stock Advisor provides easy-to-use stock investment tools for investors.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Stock Advisor The rate of return for the service since 2002 has been the same as that for the S&P 500 index, but the rate of return for the service has been the same as that for the S&P 500 index.quadruple*.

View 10 Gift Certificates

*Stock Advisory Rates as of April 8, 2024

Anders Bylund owns shares of Micron Technology and Nvidia.The Motley Fool holds a recommendation for Nvidia.The Motley Fool has a disclosure policy.

Is It Too Late to Buy Micron Technology Stock? This post was originally published by The Motley Fool.