.

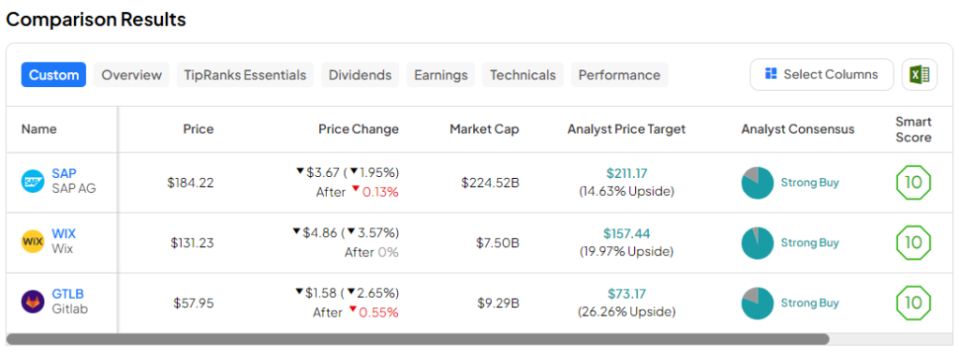

SAP, WIX, GTLB: Which "Strong Buy" Tech Stock Is Best?

It's not just the "Magnificent Seven" tech stocks that are benefiting from the ongoing artificial intelligence (AI) revolution. There is plenty of growth potential elsewhere as well. So, in this post, we'll use TipRanks' comparison tool to compare SAP, WIX and GTLB, three lesser-known tech companies whose AI momentum deserves more attention from investors.

There's a reason each company has received a "Strong Buy" rating from analysts: they're all AI GARPs (i.e., AI growth at a reasonable price), and look just as impressive as wealthy megacorporations that leave no stone unturned on the AI investment side of the equation.

SAP (NYSE: SAP)

SAP is a German enterprise software company that many U.S. investors may have written off in recent years. The company's stock was hit hard in the 2022 sell-off, eventually losing more than $50% in value from its 2020 highs to its 2022 lows. Since bottoming out in September 2022, SAP shares have been on a tear.

Its impressive cloud computing comeback and improved profitability (Q4 2023 earnings jumped 44%) are the main reasons why the stock was able to break out of its multi-year resistance ceiling and reach new highs. Although the stock has fallen back a bit in recent weeks, I'm inclined to stay bullish as bargain hunters look for better entry points.

In the company's most recent quarterly earnings report, Koon also mentioned Business AI as something that will help SAP realize long-term growth. With a reorganization plan to lay off 8,000 employees in place, SAP seems to be borrowing from the "year of example" approach of most other companies.

SAP is making strategic investments in a variety of emerging AI companies, including resonant Lloyd's((Claude-maker Anthropic) and Cohere Corporation of Canada, in partnership with NVIDIA Corporation.(NASDAQ:NVDA)) has established a partnership to accelerate the adoption of artificial intelligence in the enterprise. As the AI advantage expands, SAP will be a potential beneficiary of several of the most influential companies in the "Big Seven".

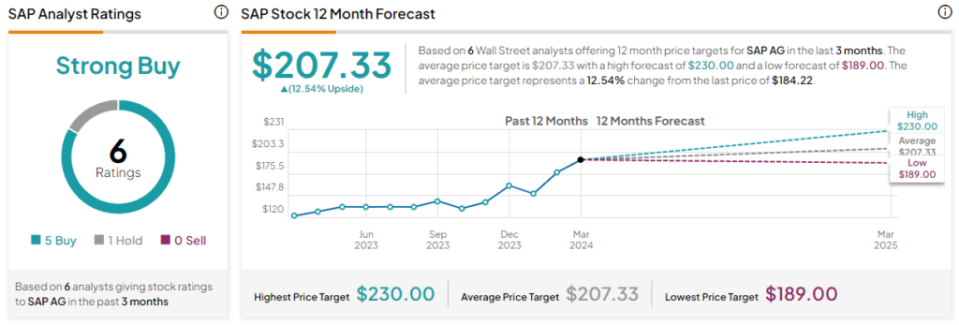

What is the target share price for SAP stock?

Analysts consider SAP stock a "Strong Buy" (Strong Buy) stock, with five "Buys" (Buys) and one "Hold" in the past three months. "The average price target for SAP stock is $207.33, implying an upside of 12.5%.

Wix (NASDAQ: WIX)

Wix, an e-commerce company based in Israel, is poised to gain as Israel eases restrictions on AI spending. The company behind its intuitive (and now AI-enabled) web builder has long been touted as a pioneer in AI-assisted web development. As Wix continues to make its web builder smarter and easier to use, I have to remain bullish on this stock, even though recent momentum has sent it up 15% year-to-date.

Bank of America(NYSE:BAC)One analyst at the company called Wix "the TurboTax of web development" late last year. It's an interesting comparison, but one that shouldn't be taken lightly since TurboTax is practically synonymous with tax preparation software. Bank of America also says that Wix is headed for the "profit crunch point" as the company continues to grow.

In total, website building and artificial intelligence seem to be a match made in heaven. We've heard a lot about AI-assisted coders (or Copilots) lately, but not much about AI web tools that don't require designers to touch any HTML or CSS. wix has been in the web production game for a long time. With AI on board, the company may be able to further widen its moat.

In addition, with the increasing popularity of spatial computing community noodle designs, I see AI tools as a solution to help people build the absolute best image of their spatial network without having to relearn the skills to use the next-generation network.

"AI is a natural extension of what we do, and the better the AI algorithms, the better Wix will be," said Avishai Abrahami, Founder and Premier Executive Officer of Wix Heel. I couldn't agree more, Mr. Abrahami and his team are way ahead of the curve in the AI race.

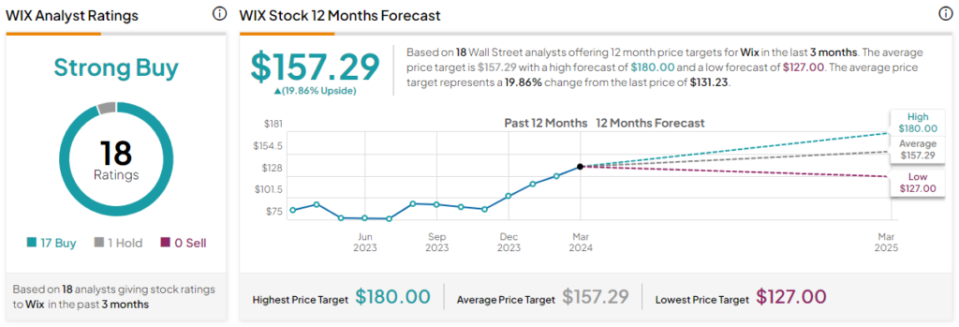

What is the target share price for WIX stock?

Analysts consider WIX stock a "strong buy" with 17 "buys" and 1 "hold" in the last three months.WIX stock has an average target price of 157.29, implying an upside potential of 19.9%.

GitLab (NASDAQ resonance stock code: GTLB)

GitLab, a provider of DevOps (development and operations) and DevSecOps (including security) solutions, has had a relatively rocky few years since its IPO. Since peaking on its first day of trading, the company's stock price has fallen about 48%.

As the $9.2 billion market cap tech company looks to add to its AI toolkit, its stock could once again top its all-time high of $137 per share. With Koon's emphasis on generative AI that is "grounded in privacy, security and transparency," I can't help but remain bullish on this mid-sized company as it gears up for compounding.

With GitLab Duo (help code), the company seems to be building a fairly robust AI ecosystem for DevSecOps developers. From AI-enabled code suggestions to vulnerability detection and decodability (Amazon(NASDAQ:AMZN)With this impressive feature also touted by the new CodeWhisperer, GitLab Duo could be a secret weapon in the fight against the bigger competitors in the曏 industry.

Wells Fargo Bank(NYSE:WFC)(NYSE: GTLB) recently assigned a Buy rating to GTLB and set its price target at $70.00. Wells Fargo describes the Duo Pro product as a gas pedal of DevSecOps productivity.

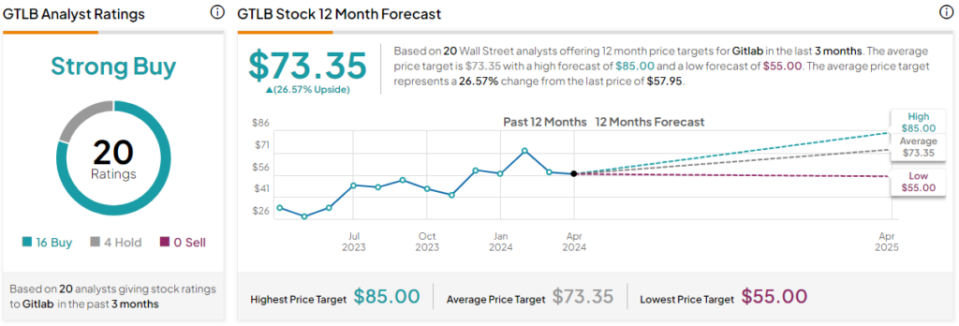

What is the target share price for GTLB shares?

GTLB's stock has a "Strong Buy" rating from analysts, with 16 "Buys" (Buys) and 4 "Holds" (Holds) in the last three months. "GTLB stock has an average price target of $73.35, suggesting an upside potential of 26.6%.

Conclusion

As the number of AI winners begins to grow, including some forgotten legacy companies and relatively unknown small-pan stocks that are poised to make a splash, investors should consider expanding their screen. This expansion should include more than just seven (or fewer) stocks. Of those three, analysts expect GTLB stock to see the biggest gains next year (about 26.61 TP3T).

Disclosure of information