.

Shopify Stock (NYSE:SHOP): Can High Growth Justify High Valuations?

Shopify Stock(NYSE:SHOP)) has risen about 66% in the past year, reflecting the company's continued success in maintaining superior growth metrics. As the leading platform for building e-commerce stores, Shopify has been driving strong GMV, revenue, and free cash flow growth, which has boosted investor confidence in the stock. However, Shopify's continued rally reminds me of one of the persistent questions surrounding the stock - its valuation. Importantly, Shopify stock's premium doesn't provide a margin of safety. As a result, I'm neutral on the stock.

Excellent growth of the whole noodle

Let me start with the positives of the Shopify investment case, which include the fact that the company has managed to maintain excellent growth across the board. I think this is a very impressive achievement, given that comparative data from previous years has been difficult, and the Fed's efforts to cool the economy have created additional headwinds.

Regarding the tough comparisons from previous years, note that Shopify's revenue growth rate of 26.1% in FY2023 is an acceleration from 21.4% in FY2022. At the same time, these figures follow FY2021 growth of 57.4% and FY2020 growth of 85.6%. It is truly remarkable that Shopify has been able to maintain such a strong growth rate even after the pandemic-induced explosion.

In terms of the Fed's efforts to slow economic growth, it's expected that rising interest rates will put pressure on consumer spending. That should translate directly into pressure on Shopify's revenues, as its merchants are also struggling. Instead, the economy has been resilient over the last year, and consumer spending has continued to grow. As a result, Shopify hasn't encountered any problems in continuing to thrive.

As seen in Shopify's recently released Q4 report, growth in consumer spending drove growth in gross merchandise volume (GMV) and GMV of merchandise transactions linked to Shopify payments. In turn, these catalysts contributed to strong revenue growth. In the fourth quarter, GMV was $75.1 billion, an increase of 23% year-over-year. This was the most significant quarterly GMV growth rate since the pandemic-induced growth rate in 2021.

In addition to the increase in same-store sales as a result of continued strong consumer spending, Koon noted that the growth in GMV came from a number of areas. This was driven by Shopify's expanding merchant base globally, a 40% increase in EMEA, and significant growth in offline sales. In particular, offline GMV grew by 28% in the fourth quarter.

The significant growth in GMV, coupled with the increasing number of merchants choosing Shopify Payments as their primary payment processor for seamless operations, also contributed to the growth in mass revenue. By Q4, Shopify Payments had increased its penetration among merchants to 60%, up from 56% last year, resulting in payment-related GMV growth of 45%. As the platform typically charges 2.9% + 30 cents per such transaction, Shopify Payments further drove revenue growth in Q4, which was up 24%. Shopify Payments further drove revenue growth in the fourth quarter, which grew by 24% to $2.1 billion.

It is worth noting that the revenue growth rate would have been 30% if Shopfiy's logistics business had been included, but that business was sold to Flexport last year. the company's accelerated revenue growth is all the more impressive in this context.

Free cash flow surges, but caution is needed

Shopify's strong revenue growth and efforts to rein in expenses have led to a surge in free cash flow in the fourth quarter and throughout fiscal 2023. However, I'm still cautious about Shopify's free cash flow numbers. Let me explain why.

For starters, in addition to the revenue growth that has allowed Shopify to expand its business margins over time, the company has improved profitability by controlling expenses. For example, research and development costs fell from $440 million last year to $311 million in the fourth quarter. As a result, Shopify's free cash flow margin more than quadrupled in the fourth quarter to 21%, up from 5% in the fourth quarter of 2022. As a result, free cash flow surged to a record $446 million for the quarter and a record $905 million for the year.

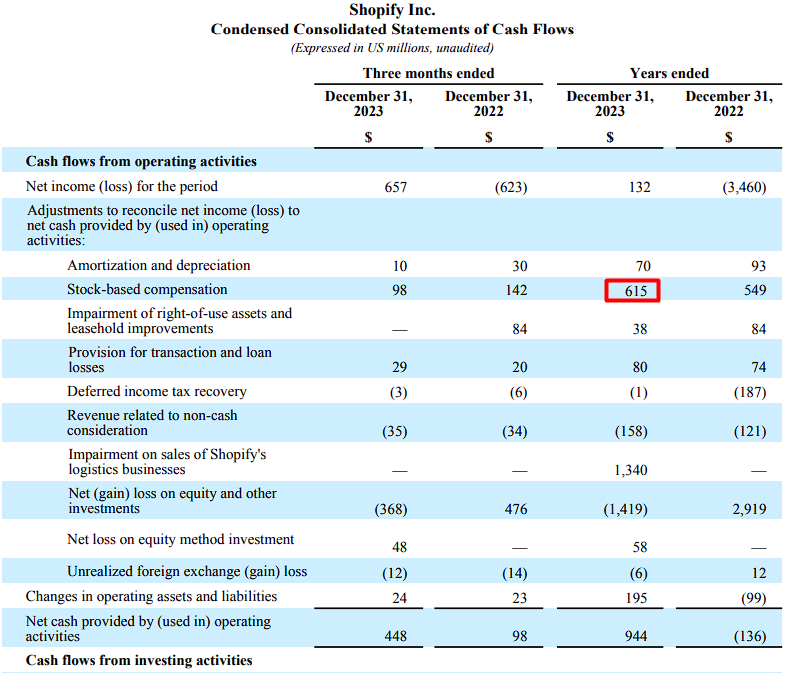

That said, I would advise investors to take these numbers with a grain of salt, especially considering Shopify's rich stock payout. To explain, the $905 million annual figure includes $615 million in SBCs, which is a very real expense due to its dilutive nature, and one that many investors tend to overlook. See the chart below.

Valuation concerns remain, free cash flow expected to be strong

Wall Street expects Shopify's free cash flow growth momentum to continue. That said, I still think the stock's valuation will continue to be a problem. The numbers speak for themselves.

Based on consensus estimates, Shopify is expected to generate free cash flow of $1.19 billion and $1.67 billion in FY2024 and FY2025, respectively. However, this means that the stock is currently trading at 81x and 58x the expected free cash flow for this year and next year, respectively. From a P/E perspective, Shopify is trading at around 73x and 56x expected earnings for this year and next year, respectively.

Whatever your expectations for Shopify's future earnings and free cash flow growth, these multiples are incredibly high. But even if Shopify's future growth somehow justifies paying such a high price, if Shopify's performance falls below Wall Street's expectations, there's little margin of safety for investors who have been there before.

Do analysts think SHOP stock is worth buying?

Despite SHOP's significant rebound, Wall Street remains bullish on the stock. Over the past three months, the stock has received 12 "Buy", 14 "Hold" and 3 "Sell" consensus ratings. shopify has an average target price of 82.84 USD, implying an upside of 15.1%.

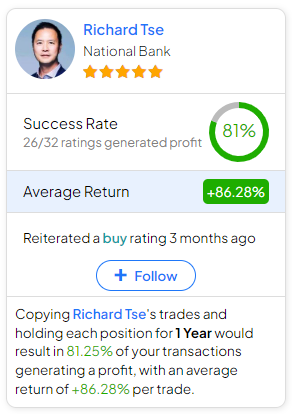

If you want to know which analysts to follow if you want to buy or sell SHOP stock, then the most profitable analyst covering the stock (in a one-year time frame) is National Bank(TSE:NA)Richard Tse of the University of California, Berkeley.)The average return rate per rating is 86.281 TP3T and the success rate is 811 TP3T. Click on the chart below to learn more.

Mass Arbitration

In aggregate, Shopify's GMV expansion and revenue growth remain impressive in the face of tough market competition and a hawkish Fed, but valuation concerns linger. Granted, free cash flow growth expectations seem promising, but even under those assumptions, the stock seems to be trading at a very high multiple. In my view, this raises red flags, which is why I have chosen to remain on the sidelines on the stock.

Disclosure of information