.

With a June rate cut still on the table, investors should buy stocks immediately after the CPI drop, according to Fundstrat

-

According to Fundstrat, investors should take advantage of the inflation-induced market sell-off to buy stocks.

-

Fundstrat's Tom Lee says the March CPI report made real progress and suggests deflation will continue.

-

Lee also believes that, as far as possible Koon probability decline, but the Fed in June the possibility of rate cuts is very high.

Fundstrat's Tom Lee thinks investors should immediately buy into the stock market decline triggered by Wednesday's fiery March CPI report.

Lee said the inflation report was a smidge above economists' expectations, and that a deeper dive into the inflation report would show that deflation is continuing. Lee believes this suggests that the stock market's decline is another buyable decline, just as it was after the December, January and February CPI reports.

"Do you believe this is actually a very good CPI report? I think there's a chart that explains that," Lee said in a Wednesday message to clients." Believe it or not, this is actually a very good CPI report. I think that's why the stocks that are selling today will end up being bought."

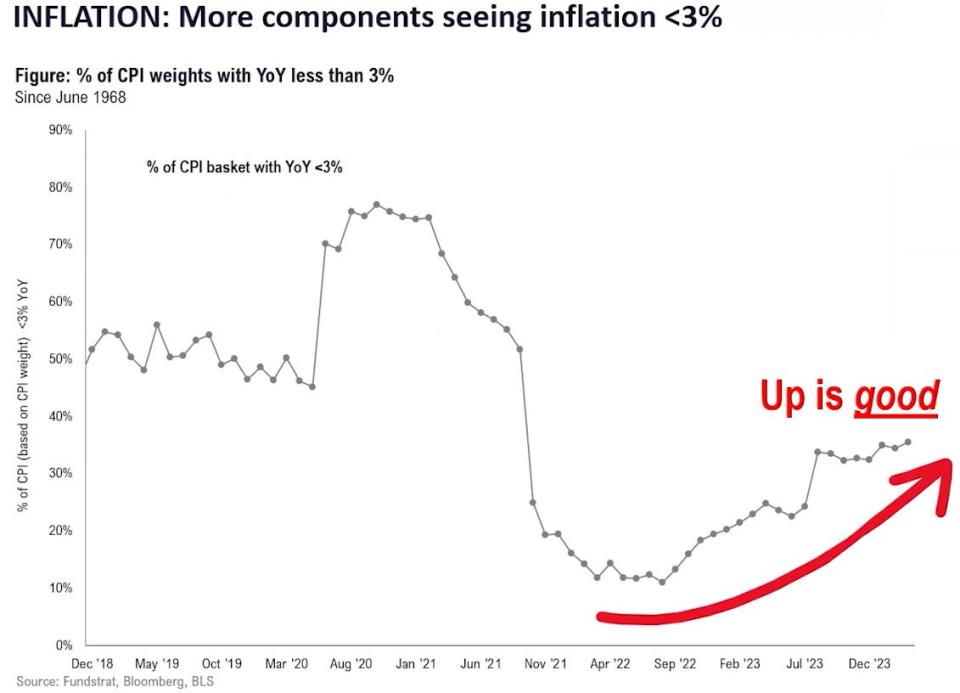

The chart below shows that the more fundamental components of the CPI report underline the longer-term trend of inflation beginning to return to below 3%.

"The forces of deflation are really strong because we have the highest proportion of components with year-on-year inflation below 3%, so in other words, there is more stuff growing closer to trend than less stuff," Lee explained.

In addition, Lee emphasized that the main driver of inflation in March was higher auto insurance prices, which followed several years of soaring car prices during the pandemic.

"The rise in the CPI is almost entirely due to auto insurance. So that just tells you that it's a timing issue, not a structural issue. In other words, there's no other factor that's causing the CPI to go up," Lee said.

Jeremy Siegel also emphasized this development in an interview with CNBC on Thursday.

"Home and motor vehicle insurance are two of the furthest behind of all the components of the Consumer Price Index," Siegel explained." It was verified that auto insurance premiums increased 12 to 15 months after used and new vehicle prices rose."

Lee also said the possibility of a Fed rate cut in June remains, even after the CPI report is released, with the futures market pricing in the possibility of a rate cut at around 20%.

"I don't think this completely rules out the possibility of a rate cut in June," Lee told CNBC on Wednesday, adding that the Fed also needs to digest three CPI reports before the June 12 rate decision, and if any of these CPI reports show that deflation is returning, the Fed may be more inclined to cut rates.

This is good news for the stock, according to market professionals.

Read the original article on Business Insider