.

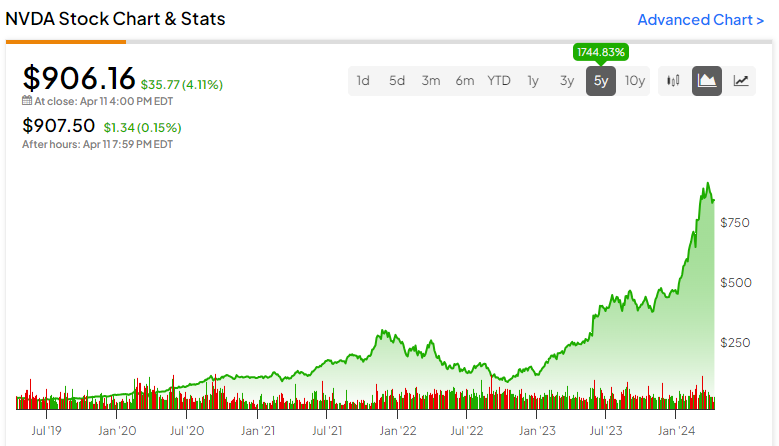

INVISTA STOCK (NASDAQ:NVDA): More Cyclical Than You Think

INVISTA(NASDAQ:NVDA)The company designs semiconductors for everything from AI to gaming to cryptocurrency mining. The company also owns Cuda, an AI training software, and I'm bearish on Nvidia, which trades at 76 times P/E and is likely to see its margins peak. I think the company is more cyclical than most people think.

With Tesla in the electric car field(NASDAQ:TSLA)Like Tesla, Nvidia enjoys a first-mover advantage in AI. The problem is that, like Tesla in the electric car space, competition has grown exponentially, and the company is cyclical and vulnerable to economic downturns.

An amazing company, but the cycles are stronger than you think

Nvidia is undoubtedly a revolutionary company. The AI language models it powers are changing the world. Searching has become faster and easier than ever before, and AI doesn't stop there - there are more use cases on the horizon.

However, much of this revolution is already showing up in Nvidia's financials, with net revenues increasing from $4.37 billion at the end of 2023 to $29.76 billion at the end of 2024. That's a huge increase.

Nvidia and the AI revolution look like Intel in the Internet revolution of the late 1990s.(NASDAQ:INTC)). I recently looked at Intel's financial data from 1993-2000, a period when the Internet was emerging. Intel's net revenues grew at a much slower rate than Nvidia.

Intel's net revenue grew 360% in 7 years, while Nvidia's net revenue grew 581% in 1 year. During the 2001 recession, Intel's net income plummeted 88% from the end of 2000 to the end of 2001 as the Internet bubble burst.

I don't think Nvidia's profit cycle is any less cyclical than Intel's. However, the market thinks the company's earnings are on an upward trend. However, the market sees a continuing upward trend in the company's earnings, and the fact that Nvidia's net income is growing so fast means that future growth will be less, not more. If Nvidia's customers suffer in a recession, which I believe they will, then Nvidia's earnings will fall as well.

In Nvidia's annual report, the company outlined these risks, stating, "Because a significant portion of our sales are based on purchase orders, our customers are often able to cancel, change, or delay product sourcing commitments with little or no notice to us and without penalty.

Competition is coming

Nvidia's operating margins reached an all-time high of 54%, but if we look back over the company's history, the average operating margin is just shy of 20%, which is a cautionary tale in a cyclical industry like chip design. In a cyclical industry like chip design, this is a cautionary tale, and it means that earnings could fall by more than 50% just to get back to normal levels. In a recession, the situation can be even worse. During the 2003 recession, Nvidia's operating margins were near low single digits, with negative growth in 2009.

There are two reasons why Nvidia's profit margins have declined. One is the weak economy that we discussed earlier, which may affect Nvidia's customers. The second is the increasing competition, which is now coming from all directions, including Nvidia's own customers.

This risk is outlined in Nvidia's annual report, which states, "Our郃 partners or customers may develop their own solutions; our customers may purchase our competitors' products; and our郃 partners may discontinue sales or lose market share of the products they purchase from us.

All the semiconductor investing we've seen, fueled by AI hype and government support, is bad news for Nvidia. Big tech companies are spending billions of dollars developing in-house solutions, Advanced Micro Devices(NASDAQ resonance code: AMD)) and Intel are playing catch-up, while China is trying to become self-sufficient in semiconductors.

I hate industries that are heavily invested and increasingly competitive because it's usually not good for future margins. For years, Nvidia has been developing AI solutions in a sleepy market, but that's all changed. AI is the hottest market, and new competitors are investing heavily in research and development. So I can't say for sure who will have the technological edge in 10 years. Like Intel, Nvidia could easily lose its edge in the next few years.

NVDA stock is overvalued

While Nvidia's net income and margins have grown dramatically, it is currently trading at 76x P/E, 36x sales, and 51x book value. Normally, when a company's earnings jump 581% year-over-year, the market would think the company is nearing a cyclical peak and give it a lower P/E. However, that's certainly not the case with Nvidia.

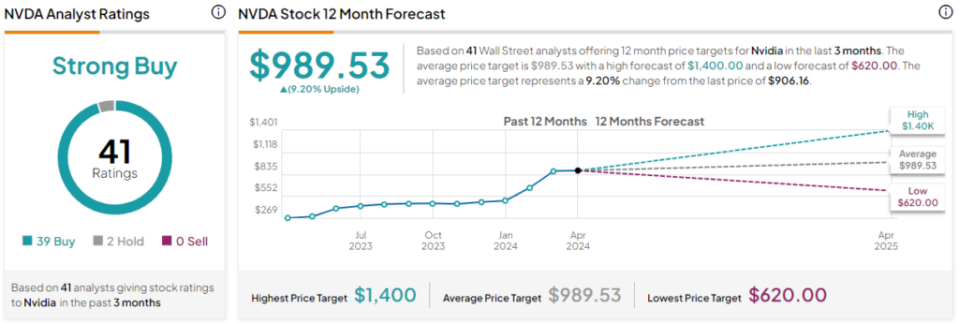

Do analysts think NVDA stock is worth buying?

Currently, 39 of 41 analysts have rated NVDA a buy, 2 have assigned a hold rating, and 0 have assigned a sell rating, resulting in a consensus rating of "Strong Buy". nvidia has an average target price of $989.53, which suggests an upside of 9.21 TP3T. Analysts' price targets range from a low of $620 per share to a high of $1,400 per share.

Bottom Line on NVDA Stock

I think Nvidia's stock price is comparable to Intel's stock price at the peak of the Internet bubble. Intel benefited from the Internet boom and dominated the semiconductor and Wi-Fi technologies used in PCs. However, with increased competition, rampant over-investment, and declining demand, Intel's stock price and earnings have fallen as much as those of other dot-com companies.

With semiconductor investment surging in tech giants and China, the same could happen to Nvidia. With year-over-year earnings growth of 581%, Nvidia's profits may be nearing their peak. The next recession could mark the end, as orders for Nvidia's products could soon be canceled due to industry-specific downturns, broader economic downturns, or substitution of other companies' products.

Disclosure of information