.

How long before supercomputer stocks reach $1,500?

Supercomputer, Inc. (NASDAQ resonance code: SMCI)After soaring all the way to 2,16% in 2024, investors are splashing out on shares of this server maker to capitalize on its stellar growth momentum.

Supermicro's red-hot rally has brought its stock price to around $950. That's almost in line with the median 12-month price target of $949, according to 18 analysts covering the stock. The median price target suggests that Supermicro may not have much more upside. However, the stock has a maximum price target of $1,350, which would represent a 31% increase from its previous level.

However, in the long run, can Supermicro break these expectations and hit $1,500? And if so, how soon can investors expect that milestone to arrive? Let's try to find out the answers to these questions.

Supercomputers for More Upgrade Space

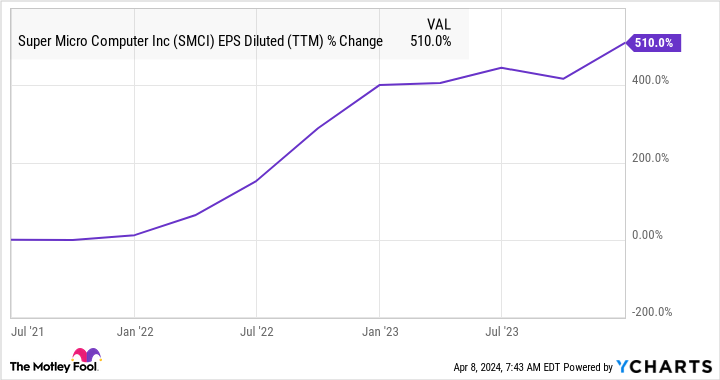

Supermicro's impressive 2024 rally explains why the stock is currently trading at almost 74 times trailing earnings. This is significantly higher than the company's five-year average P/E ratio of 16 times. However, as the chart below shows, Supermicro's bottom-line growth has taken off dramatically over the past few years, which explains the high earnings multiple it currently carries.

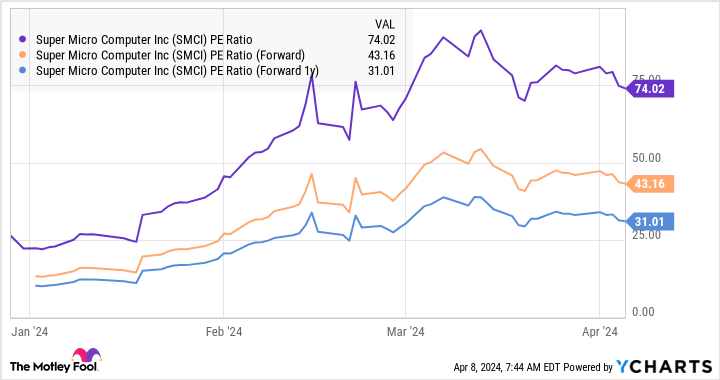

Even better, Supermicro's earnings growth potential is so solid that its forward earnings multiple is significantly lower than its trailing P/E.

Specifically, analysts expect the company's earnings to grow by 871 TP3T to $22.10 per share in the current fiscal year. For the next fiscal year, Supermicro's earnings are also expected to grow a whopping 39% to $30.82 per share. Forecasts for the next five years are also solid, with consensus estimates that Supermicro's earnings will grow at an annualized rate of 48%.

Supermicro reported adjusted earnings per share of $11.81 for its last fiscal year. Based on last year's earnings of $48%, the projected five-year annualized growth rate, SuperMicro's earnings per share will jump to just under $84 over the next five years.Nasdaq Resonance 100The index has a forward earnings multiple of 27, and assuming Super Micro trades at a similar multiple in five years (using the index as a proxy for tech stocks), its shares would trade at $2,268 over the next five years.

This is well above the $1,500 mark we are trying to find. However, if we go back one year and use the above inputs to calculate Supermicro's potential earnings four years from now, the bottom line could jump to more than $56 per share. Multiplying the estimated earnings in four years by the forward earnings multiple of $27 for Nasdaq Resonance yields a stock price of $1,512.

As a result, Supermicro's shares are on track to reach the $1,500 milestone within the next four years, assuming no stock split by management. But don't be surprised if that milestone comes sooner, as Supermicro is taking steps to capitalize on the fast-growing artificial intelligence (AI) server market, which will help it achieve faster earnings growth.

This major catalyst will drive its bottom-line growth.

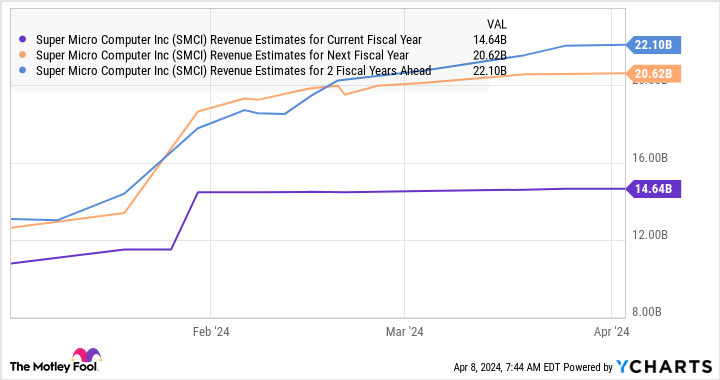

Analysts expect Supermicro's earnings to grow at a rate that may not take into account the company's expanding capacity, which should enable it to deliver stronger-than-expected growth. This is evidenced by the fact that the company's revenue is expected to jump to just over $22 billion in a couple of fiscal years.

However, Supermicro has expanded its capacity to support $25 billion in annual revenue. In the last quarter, Supermicro's fab utilization was 65%, and management notes that spare capacity is filling up fast, so it's not surprising that the company is selling out its full revenue capacity. But more importantly, Supermicro is taking steps to further increase its production capacity.

This is true considering that the artificial intelligence server market is likely to grow six-fold from 2023 to $150 billion by 2027. As a result, Supercomputer's growth is likely to be higher than analysts' forecasts, which is why this AI stock could realize its $1,500 price target sooner than the four-year timeframe mentioned above.

Should you invest $1,000 in SuperMicro now?

Consider the following before buying shares of Supercomputer, Inc:

Motley Fool Stock AdvisorThe analyst team has just named what they believe to be the best value for investors.10Only ...... and not Super Micro Computer. The 10 stocks that made the list could generate huge returns in the coming years.

Consider April 15, 2005NvidiaWhat it was like when it was on the list ...... If you invested $1,000 at the time of our recommendation.You will have $533,293.! *Stock Advisor provides easy-to-use stock investment tools for investors.

Stock AdvisorIt provides investors with an easy-to-learn blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Stock Advisor The service has contributed to the S&P 500 Index's return since 2002.translate twiceMuch*.

View 10 Gift Certificates

*Stock Advisory Rates as of April 8, 2024

Harsh Chauhan does not hold any of the above shares.The Motley Fool does not hold any of the above shares.The Motley Fool has a disclosure policy.

How Soon Will Supermicro Computer Stocks Reach $1,500? This article originally appeared in The Motley Fool.