.

Al Gore's hedge fund favors a $445 billion stock.

Former U.S. Vice President of Arbitronics Al Gore co-founded Generation Investment Co. in 2004. Today, the company manages nearly $50 billion in capital, all of which is invested in projects that the company believes will not damage the planet. It believes that sustainable investing has the potential to outperform the market over the long term.

There is some evidence for this belief.Morgan StanleyThe data shows that investment funds with a focus on sustainable investment have outperformed traditional funds in four of the last five years.

Where is Al Gore's investment firm investing its money today? One of the largest investments - a stake worth about $560 million - is in a company that almost everyone is familiar with:MasterCard (NYSE: MA)The

MasterCard is a rocket stock.

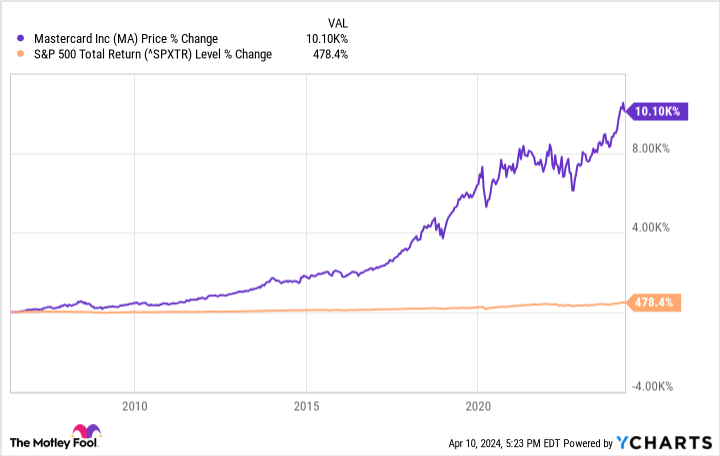

It's easy to see why long-term investors like Al Gore like MasterCard stock. All you have to do is pull up a chart of the company's stock price. Over the past two decades, MasterCard's stock price has risen by more than 10,000%. In comparison, the price ofStandard & Poor's 500 The rate of return for the same period is only 478%.

This performance was no fluke. MasterCard has also outperformed the S&P 500 over the past year, five years and 10 years. It's a rocket stock that keeps going up.

What investors are really interested in, however, is how MasterCard is performing.why?Keeps running to win over Daban.

Find successful stocks like this

In the last quarter of 2006, MasterCard processed $308 billion in transactions, and in 2010, the total amount of payments reached $427 billion. Five years later, total payments are approaching $600 billion. In the last quarter, the total volume of transactions exceeded US$1 trillion. The only years when MasterCard payments declined were during the 2009 recession and the 2020 pandemic. However, shortly after these events, MasterCard payment volumes returned to record levels.

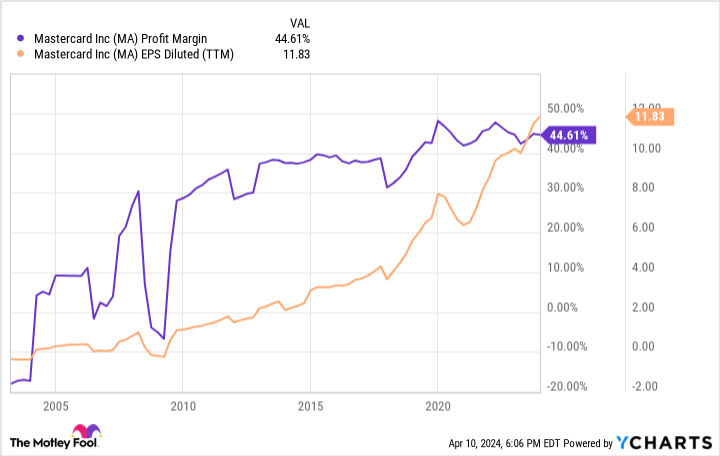

Since MasterCard's profits are largely dependent on the extent to which people use MasterCard, continued growth in payment volumes has led to continued growth in net income. MasterCard's earnings per share have reached record highs almost every year, and its margins have expanded to 40% to 50%. Collectively, MasterCard is a growing, profitable business that has weathered the recession with relative ease.

The high profitability is a result of the asset-light business model. The MasterCard payment network does not require extensive equipment or machinery to operate. It runs primarily on software, which can quickly adapt to growing business volumes with little additional capital expenditure. This naturally results in a sustainable business model. According toMorningstarMasterCard ranks in the top 15% of all publicly traded companies in the Sustainalytics rating system, which quantifies how environmentally friendly a company is. It's no wonder that Al Gore's company is investing heavily.

The asset-light business model has brought MasterCard high profit margins, but it is the network effect that has driven its growth for decades. The web experience describes how a business gains value as it expands. Think of all the credit card providers you know today, and chances are you can only name MasterCard,Visakha,American Express Cardrespond in singingDiscoveryCards. This is because these four companies virtually control the 100% market in the United States.

There is a reason for the name of the industry. The main reason is efficiency. The greater the scale of the payment network, the better it works. Therefore, the name of the industry is a natural feature of the payments industry. Bypassing these networks is possible, but it comes at the cost of access. Customers and merchants want to use a payment network that both can use and trust. There is no reason why dozens of redundant payment networks should provide the same service.

Therefore, MasterCard is the ultimate network player. MasterCard's network size is huge, second only to Visa, and this size can only lead to bigger size, making it more difficult for competitors to emerge. Also, because MasterCard is a light-asset business, the company has been able to scale up efficiently, which is one of the key reasons why margins have continued to rise.

Gore's firm began holding MasterCard shares in the second quarter of 2022. Don't be surprised if MasterCard is still in the portfolio years from now.

Should you invest $1,000 in a MasterCard now?

Before buying MasterCard stock, consider the following:

Motley Fool Stock AdvisorThe analyst team has just selected what they think is the best name for investors to buy now.10Only ...... MasterCard was excluded. The 10 stocks that made the list are expected to generate strong returns over the next few years.

Consider April 15, 2005NvidiaOn the list at ...... If you invest $1,000 at the time of our recommendation, theYou will have $533,293.! * *

Stock AdvisorIt provides investors with an easy-to-learn blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Stock Advisor The service has contributed to the S&P 500 Index's return since 2002.translate twiceMuch*.

View 10 Gift Certificates

*Stock Advisory Rates as of April 8, 2024

Discover Financial Services is an advertising partner of The Ascent, a Motley Fool company. American Express is an advertising郃 partner of The Ascent, a Motley Fool company. ryan Vanzo does not own any of the above mentioned shares. the Motley Fool holds recommended Mastercard and Visa. the Motley Fool recommends Discover Financial Services. The Motley Fool recommends Discover Financial Services and recommends the following options: Long Mastercard January 2025 $370 Calls and Short Mastercard January 2025 $380 Calls. The Motley Fool has a disclosure policy.

Al Gore's Hedge Fund Fancies This $445 Billion Stock was originally published by The Motley Fool.