.

Better AI Stocks: NVIDIA and AMD

The chip market has exploded over the last year as the demand for more powerful hardware has surged in tandem with the artificial intelligence (AI) boom. Increased interest in AI services has meant increased demand for graphics processing units (GPUs), the chips necessary to train and run AI models.

As a result, since April last year, the technology at the forefront of this technology has become more and more advanced.INVISTACompany (Nvidia NASDAQ Resonancestock (market)(Code: NVDA)respond in singingAdvanced Micro Devicesfirms( Advanced Micro Devices(math.) genusNasdaq Resonance Symbol: AMD) shares are up 222% and 84%, respectively. thanks to their successful chip businesses, these companies have an exciting long-term future in artificial intelligence, and they could profit from the market tailwinds within a few years.

Last year, the AI market was close to $200 billion and is projected to grow at a compound annual growth rate of 37% by 2030. based on this trajectory, the AI market will reach nearly $2 trillion by 2030.

So while shares of Nvidia and AMD have had a banner year, both companies may still present more investment opportunities for new investors in the long run. Let's take a closer look at these two chipmakers to see whether Nvidia or AMD is the better AI stock this April.

INVISTA

Over the past year, it's been hard to avoid coverage of Nvidia, which has come to represent the AI boom. 2023 saw the company capture the AI chip market, with an estimated 90% of GPUs, which has led to a straight line increase in revenue.

In the fourth quarter of 2024 (which ended in January), the company's revenues rose 2,65% year-over-year to $22 billion. Operating income jumped 9,831 TP3T to nearly $14 billion. The impressive growth was largely driven by a 4,09% increase in data center revenues, reflecting a surge in artificial intelligence.

Last year, the company's free cash flow grew 4,30% to more than $27 billion, suggesting that it has enough money to continue investing in AI and maintain its market dominance.

As a leading chip maker, INVISTA has a strong position. In addition to AI hardware, the company's chips are used in a wide range of applications, including cloud platforms, gaming machines, laptops, customized PCs, and more.

As such, the company is one of the best choices for investing in technology, especially for those looking to profit from the future of artificial intelligence.

Advanced Micro Devices, Inc.

AMD is late to the game in the AI space, having been beaten to the market lead by Nvidia. However, AMD is investing heavily in the industry and has established some lucrative郃 partnerships that could take it far in the coming years.

Last December, AMD announced the MI300X GPU for artificial intelligence, a chip designed to compete directly with Nvidia that has already attractedMicrosoft respond in singingMeta Platforms The company has signed on as a client with some of the most prestigious companies in the technology industry.

AMD is diversifying into the artificial intelligence-driven personal computer (PC) space. According to research firm IDC, PC shipments will see a big boost this year, with artificial intelligence as a key catalyst.A Canalys report predicts that 60% of PCs shipped in 2027 will support AI.

AMD's earnings haven't yet reflected its heavy investment in artificial intelligence, but the company's most recent quarterly report suggests it's headed in the right direction. in Q4 2023, the company's revenue grew 10% year-over-year to $6 billion, beating analysts' expectations by about $60 million. The company's AI-focused data center division delivered $38% in revenue growth.

Is Nvidia or AMD a better AI stock?

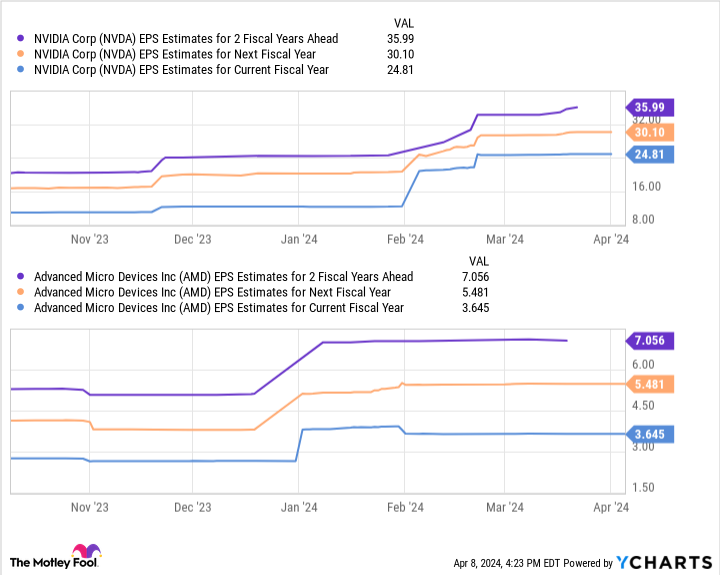

Nvidia and AMD are poised to profit from the growth of artificial intelligence for decades. Over the long term, both stocks are likely to enhance any investment portfolio. But earnings per share (EPS) estimates suggest that AMD may have more room to grow in the next two years.

These charts show that by fiscal 2026, Nvidia's earnings per share could reach $36, while AMD's could be just over $7. But multiply those figures by the forward P/E ratios of the two companies (35 for Nvidia and 47 for AMD), and Nvidia's shares trade at $1,260 and AMD's at $329.

Based on their recent prices, Nvidia's stock price is set to rise 44% over the next two fiscal years, while AMD's is set to rise 93%, a significant difference that underscores the fact that AMD is at an earlier stage in the AI space, and may have more room for growth in the near term. As a result, AMD is now a better buy than Nvidia.

Should you invest $1,000 in Nvidia now?

Before buying Nvidia stock, consider the following:

Motley Fool Stock AdvisorA team of analysts have just selected what they believe to be the most popular analysts in the world at the moment.-est (superlative suffix)Worth investing in10Nvidia is not one of the 10 stocks listed on ....... The 10 stocks that made the list are poised to generate huge returns over the next few years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View these 10 stocks

*Stock Advisor's Circular as of April 8, 2024

Randi Zuckerberg, the former Facebook Market Development Mass Director and spokeswoman, and sister of Meta Platforms CEO Mark Zuckerberg, is now a member of The Motley Fool's Board of Directors. Dani Cook has no position in any of the stocks mentioned above. The Motley Fool has recommended Advanced Micro Devices, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: Long Microsoft January 2026 $395 Call Options and Short Microsoft January 2026 $405 Call Options. The Motley Fool has a disclosure policy.

Better AI Stocks: Nvidia vs. AMD was originally published by The Motley Fool.