.

Look at my holdings this year translate nearly doubled the growth of the stock!

For the second year in a row, the bull market has gone wild on Wall Street. While most investors love bull markets, they can also make finding good deals more challenging.

As of the close of business on April 10.Standard & Poor's 500 The Index's Simpler P/E ratio (also known as Cyclically Adjusted Price/Earnings Ratio or CAPE Ratio) hit one of its highest values in more than 150 years.

Unlike the traditional P/E ratio, which takes into account returns over the past 12 months, the Simpler P/E ratio is based on the average inflation-adjusted returns over the past 10 years. In other words, it removes the one-off events from the equation, thus providing an all-encompassing perspective of stock valuation. The Simler P/E closed at 34.26 on April 10, twice the average since 1871, which is an ominous warning of a sharp correction based on historical experience.

Despite warnings that a stock market correction or even a bear market might be in the near future, I continued to look for value in growth stocks. While the pickings were slim, one growth stock ticked all the boxes, prompting me to pull the trigger and nearly double my holdings.

Investors of all ages can go with Bubbles Edge Calculators.Fastly (NYSE: FSLY)Greetings. The company is best known for its Content Delivery Network (CDN), which is tasked with quickly and securely transporting data from the edge of the cloud to the end-user.

How Fastly lost its edge

No matter how much an investor likes a particular stock, it is important to recognize that headwinds can be a problem.from beginning to endThere is. There isn't a public company that doesn't face some sort of competitive or macro challenge. For Fastly, the company has retreated about 90% from its mid-period high of $136.50 set in October 2020 for a couple of obvious reasons.

First, Fastly went through an emotional roller coaster during the COVID-19 pandemic and became one of the investment superstars during the pandemic-induced lockdown. The idea was that if people were sleepy at home, more content would be distributed through Fastly's CDN. That emotional investment excitement waned as soon as the COVID-19 vaccine hit the drugstore shelves and people's lives returned to some semblance of normalcy.

Another issue for the company is its failure to deliver recurring earnings. While investors rarely considered stock valuation during the COVID-19 pandemic, the 2022 bear market has brought traditional fundamental valuation metrics back into focus. Significant expenses, including the continued expansion of Fastly's CDN network in international markets, caused the company to lose more money than the Wall Street analyst consensus expected.

Additionally, former mat executive Joshua Bixby allowed the stock-based compensation (SBC) to spiral out of control, and in 2020, when Bixby took over, the SBC more than quintupled to $64 million, and in 2021, it more than doubled again to approximately $140 million. While the SBC can be a good incentive for employees, it tends to dilute existing shareholders.

As Fastly continues to lose money, the company has a lot to prove to Wall Street and its shareholders.

Here's why I almost doubled my position in Fastly stock in March!

The good news is that we are starting to see significant improvements in many of Fastly's Key Performance Indicators (KPIs). What prompted me to nearly double my position in March was Fastly's steady improvement in key areas, much-needed management adjustments, and attractive long-term potential.

Arguably Fastly's biggest catalyst was the August 2022 hiring of Todd Nightingale (born September 1, 2022) as its first mat executive. Nightingale comes fromCisco SystemsHe is a former director of the company's Enterprise Networking and Cloud Computing divisions. While Nightingale understands what Fastly can do to capitalize on growth, his biggest contribution is what he can take away.

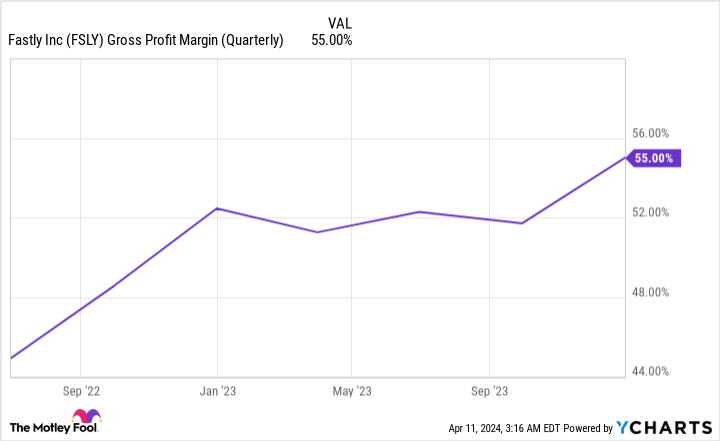

Under Nightingale's leadership, Fastly's SBC has shrunk for the first time in the company's history, while R&D and G&G costs have remained relatively flat. For a company that continues to see double-digit sales growth, the stagnation in costs has been matched by steady growth in adjusted gross margins. Since taking over, Nightingale has improved its GAAP gross margin by 640 basis points to 55%.

In addition to the dramatic improvement in gross margins, most of the company's KPIs point to a high level of satisfaction with its CDN services. fastly continues to achieve record highs in total enterprise customers and average spend per enterprise customer. At the same time, its Annual Revenue Retention (ARR) rose 30 basis points to 99.2% in 2023. an ARR above 99% clearly indicates that the company's customer base is growing.

Most importantly, Fastly's dollar-based net survival rate (DBNER) has remained between 1,18% and 1,23% over the past eight quarters (ending December 31, 2023). DBNER indicates that average spending by existing customers has increased by 18% to 23% year-over-year. Since Fastly is primarily a mobile platform, the company's KPIs indicate that existing customers like the platform enough to continue to increase spending by double digits.

From a macro perspective, Fastly is well-positioned to benefit from the continued migration of data to the web and the cloud. As the demand for online content grows, the amount of data traveling through the Fastly CDN should grow as well.

While Fastly's operating results won't be immediate, the company has laid the groundwork for recurring profitability by 2025 or even later this year. If Fastly can deliver on the Wall Street consensus of 30% of annualized earnings growth by 2028, then the stock I added to my holdings in March will have been worth every penny.

Should you invest $1,000 in Fastly now?

Before buying Fastly stock, consider the following:

Motley Fool Equity AdvisorThe analyst team has just selected what they think is the best name for investors to buy now.10Only ...... and Fastly are not among them. The 10 stocks that made the list could generate huge returns in the coming years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 8, 2024

Sean Williams owns shares of Fastly. the Motley Fool owns shares of Recommended Cisco Systems, Inc. and Fastly. the Motley Fool has a disclosure policy.

Meet the Growth Stocks I've Translated This Year was originally published by The Motley Fool.