.

2 Backdoor Stocks to Capitalize on the Artificial Intelligence Revolution

There are many ways to invest in artificial intelligence (AI). Choosing to directly invest in a company that launches or carries an AI product may be more attractive, but there are also many opportunities for companies that provide key components.

That's exactly what it is.ASML (NASDAQ resonance code: ASML)respond in singingTaiwan Semiconductor Manufacturer firms(New York Stock Exchange: TSM)The strengths of these two companies lie in their products. The products of these two companies are critical to the technology; without them, AI would not be what it is today. Let's see if these two stocks are suitable additions to your portfolio now.

Taiwan Semi-Conductor

Taiwan Semiconductor (or TSMC) is the world's largest manufacturer of郃 chips. This means that it produces chips for companies that want to design their own microchips but do not have the equipment to do so. This makes TSMC theApple,Nvidia respond in singingAMDIt is the preferred partner of companies such as Carbide, because it possesses some of the most powerful technologies.

TSMC's 3-nanometer chips represent its most advanced technology and are a significant improvement over previous generations by reducing power consumption and increasing computing power. The company is also developing a 2-nanometer chip, which it plans to launch in 2025.

The company continues to push the boundaries to provide customers with the ability to develop more powerful, high-performance products. It is an important part of the AI value chain.

TSMC is also a solid investment, and in 2023, it had seen many customers cut back on orders due to an oversupply of chips, but that has not been the case so far in 2024. So far in 2024, however, that has not been the case. in January and February, the company's revenues grew 8% and 11% year-on-year, respectively. Wall Street analysts expect this growth momentum to continue over the next two years, with revenues projected to grow at a rate of 21% and 20% in 2024 and 2025, respectively.

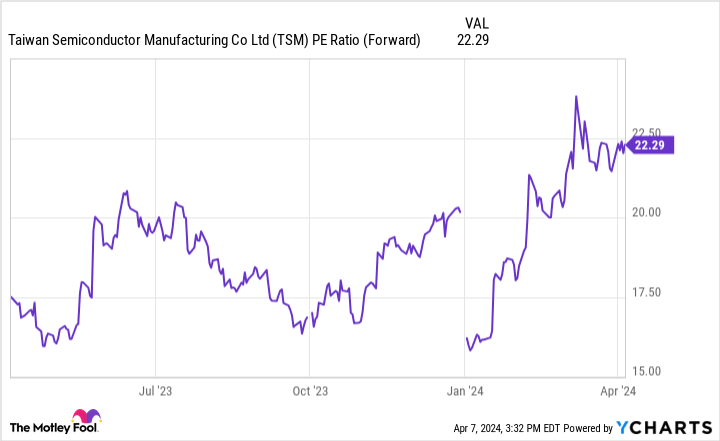

The company is trading at 22x this year's expected earnings and the shares are a strong investment in the AI space.

ASML

TSMC is recognized for its advanced chip manufacturing capabilities, and ASML is the company that has helped make this possible. 3nm or 2nm refers to the distance between the conductive traces on a chip (the smaller the number the better). To achieve such a small space requires specialized equipment that only ASML can manufacture.

ASML's extreme ultraviolet lithography equipment requires advanced technology, and it is the only company in the world that produces it. As a result, it has a virtual monopoly on the technology.

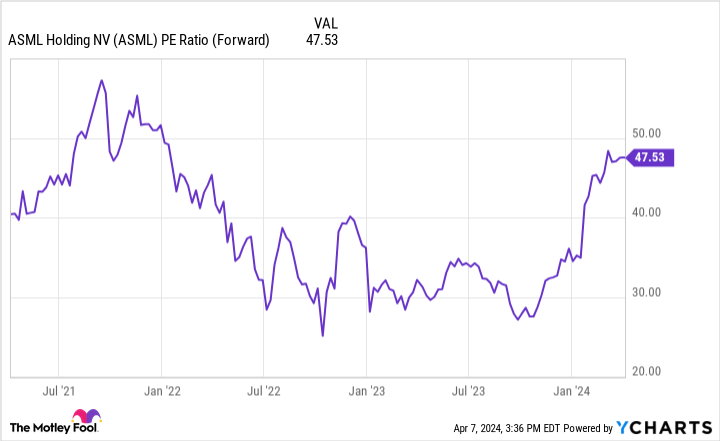

ASML is a very expensive stock at nearly 48 times forward earnings. It's at such a premium because many investors know that TSMC or other companies like ASML have a lot of money to spend on the stock.IntelChip makers like ASML need to increase the production of High-B耑 chips. This will require ASML's machines, so investors expect a lot of growth in the future.

This effect is not immediately apparent because of the long time it takes to manufacture the machines. in 2024, analysts expect revenue growth to be only 2%, but by 2025, this forecast will jump to 27%.

If you're going to invest in ASML, you should be looking at the long term, because if you don't sell a machine or two by the end of the quarter, your business could be very unstable. For example, in the fourth quarter, the company sold 113 new machines and 11 old machines.

However, if there is a downturn in chip production (e.g. in 2023), then the need for increased capacity may not be as great the following year. This is the impact that ASML is currently feeling, but it is not expected to last long.

ASML's technology monopoly is the number one reason to invest in the stock, but you have to have the right mindset to hold the stock for the long term. If you can do that, it could be a great AI investment.

Should you invest $1,000 in Semiconductor Manufacturing Corporation now?

Please consider the following before purchasing shares of Taiwan Semiconductor Manufacturing Co:

Motley Fool Stock AdvisorThe analyst team has just selected what they believe is the current trend of-est (superlative suffix)Worth investing in10Taiwan Semiconductor Manufacturing Corporation is not one of the 10 stocks listed on ....... These 10 stocks could generate huge returns in the years to come.

Stock AdvisorIt provides investors with an easy-to-learn blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 8, 2024

Keithen Drury has a position in Taiwan Semiconductor Manufacturing Company.The Motley Fool recommends ASML and Taiwan Semiconductor Manufacturing Company.The Motley Fool has a disclosure policy.

Two Backdoor Stocks to Capitalize on the AI Revolution was originally published by The Motley Fool.