.

1 Top Chip Stocks That Might Be Overlooked in the New AI Era

For the semiconductor industry, now is the time to build big, as construction is beginning on a number of ambitious chip manufacturing facilities, or "fabs".Taiwan Semiconductor ManufacturerCompany andIntelCompanies such as the U.S. Department of Commerce are receiving generous government assistance as countries strive to make their supply chains more resilient.

In particular, Intel wants to be the first to enter the "angstrom era," which is the process of shrinking the smallest features of a chip down to nanometers or more (an angstrom is 10 nanometers, 1,000 nanometers).ten thousand (A nanometer is equal to 1 centimeter.) A certainty.

Application Materials firms(A) Plied Materials ) (NASDAQ: AMAT)It's the best in the business. The chipmaker just had a glorious 2023, and a new round of growth could be just around the corner, making the company an overlooked buy as artificial intelligence (AI) systems place new demands on high-performance chips.

A slow and steady bet on AI?

Applied Materials develops, manufactures and sells a wide range of equipment for the manufacture of semiconductors. In fact, the company has one of the most extensive portfolios of chip manufacturing equipment, as well as an extensive software and service department, which is absolutely essential for a company engaged in the actual manufacture of chips.

Considering the temporary downturn in the chip manufacturing industry last year, the company finished FY2023 in top form. During this period, theNvidia) seems to be sucking up all the sales of computing infrastructure in data centers, while Applied Materials has switched to supplying equipment to chipmakers and selling parts for the still-booming electric car market.

But now that the demand for AI systems is rising, perhaps the data center market (excluding AI systems) will return. A new growth cycle for Applied Materials' state-of-the-art equipment is in the making.

The company recently announced more details about its Centura Sculpta machine, which is designed to expand the number ofASML Holding CompanyThe ability of expensive lithography to make advanced chips. Applied Materials says it is ready for the E-class era and beyond, and it is in contact with every leading logic chip maker as it further develops Sculpta's capabilities.

Applied Materials isn't exactly a high-growth AI company at this particular moment in time. The company's revenue was actually flat year-over-year in the most recent quarter. While Wall Street analysts on average are forecasting full-year revenue growth of 11% to nearly $30 billion in 2024, Koon has not provided specific revenue guidance. The reason for this is that Applied's management team is optimistic about customer demand over the next two years.

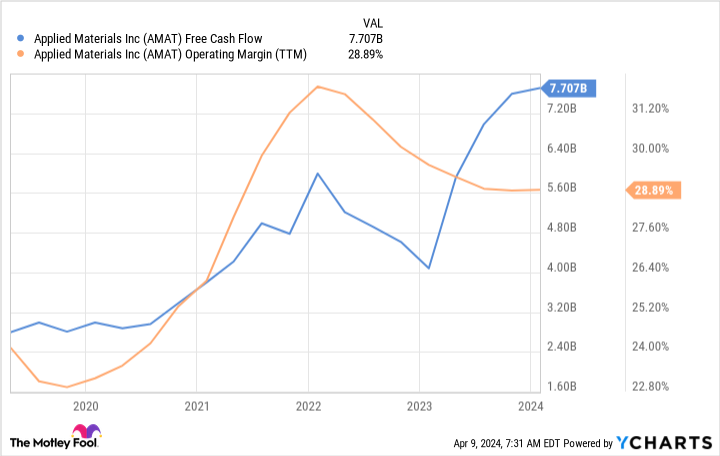

If analysts' forecasts are correct, 11% growth this year is not the fastest pace. But what Applied lacks in all-over growth potential, it makes up for in profitability. The company's free cash flow is booming as long-term R&D in artificial intelligence and other new semiconductor manufacturing needs begin to pay off.

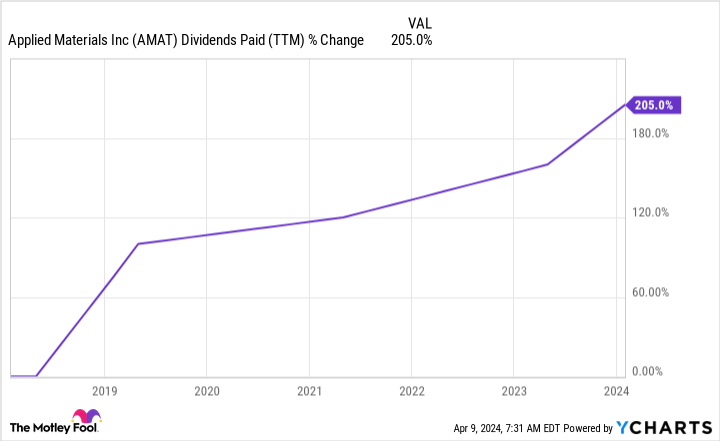

After hiking the quarterly dividend by 23% in 2023, management just announced another 25% increase on top of that in March 2024.The current annualized yield is just 0.8%, but that's an epic increase for investors looking for a cash payout from their stock. Over the past six years, Applied Materials' annual dividend payout ratio has increased by more than 200%.

This artificial intelligence stock could be really cheap.

Artificial intelligence will make it harder to manufacture advanced chips, and other long-term growth trends such as electric vehicles and industrial automation are far from over, so Applied Materials will remain a solid growth and dividend-paying investment for years to come. The company's balance sheet is excellent, with $7.5 billion in cash and short-term investments, another $2.9 billion in long-term investments, and just $5.5 billion in debt.

It's safe to say that this company has plenty of resources and can use them to stay on the right track. While Applied Materials shares may not be as cheap as they were in 2022 and 2023, when the chip industry was heavily traded, Applied Materials shares are certainly not expensive at this juncture.

Its shares trade at approximately 25 times current year's expected earnings. Applied Materials' consensus earnings estimates could rise over the next few years as customers such as TSMC and Intel retool their fabs with Applied Materials' equipment to realize next-generation advanced manufacturing technologies.

I'm happy to continue to hold a long-term position in Applied Materials as the new era driven by artificial intelligence arrives. I'll continue to do so later this year as the company provides more details on the pace of its next growth cycle.

Should you invest $1,000 in Applied Materials now?

Before buying shares of Applied Materials, consider the following:

Motley Fool Stock AdvisorA team of analysts has just named what they think is the best name for investors to buy right now.10Only ...... and Applied Materials were not included. The 10 stocks that made the list are likely to generate huge returns in the coming years.

Consider April 15, 2005NvidiaOn the list ...... If you invest $1,000 at the time of our recommendation, theYou will have $533,293.! * *The

Stock AdvisorProvides investors with an easy-to-follow blueprint for success, including guidance on building an investment team, regular updates from analysts and two new stock picks each month. Stock Advisor The rate of return for the service since 2002 has been the same as that for the S&P 500 index, but the rate of return for the service has been the same as that for the S&P 500 index.quadruple*.

View 10 Gift Certificates

*Stock Advisory Rates as of April 8, 2024

Nicholas Rossolillo and his clients own shares of ASML, Applied Materials, and Nvidia. the Motley Fool recommends ASML, Applied Materials, Nvidia, and Taiwan Semiconductor Manufacturing Company. the Motley Fool recommends Intel. The Motley Fool recommends Intel and also recommends the following options: Intel January 2023 $57.50 Call Options Long, Intel January 2025 $45 Call Options Long, and Intel May 2024 $47 Call Options Short. The Motley Fool has a disclosure policy.

1 Top Chip Stock That Could Be a Neglected Buy in the New AI Era was originally published by The Motley Fool.